According to an industry leader, the trade tension across the world is shifting the wind, and Bangladesh may rather take advantage of it.

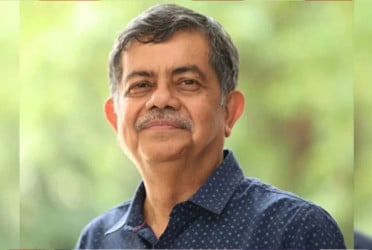

Faruque Hassan, Director of the International Apparel Federation (IAF), emphasized that attention should also be directed towards investments in the country's backward linkages, according to an analysis shared with the media on Tuesday, reports UNB.

He shared a detailed analysis of the European Union's (EU) apparel import for the period from January to December 2024.

This data provides insights into the performance of various countries in the global apparel market and Bangladesh's position within it.

This data reflects the EU's imports from Bangladesh between January and December 2024, indicating goods that entered through EU ports during this timeframe.

The global apparel market has experienced a modest growth, with the total import value increasing by 1.53% from US$91.17 billion in 2023 to US$92.57 billion in 2024.

Bangladesh has also managed to achieve a growth of 4.86%, with export values rising from US$18.86 billion to US$19.77 billion, Hassan said.

China, the EU's largest supplier, has experienced a 2.61% year-on-year growth, with exports rising from US$25.41 billion to US$26.07 billion.

Notably, Cambodia and Pakistan have exhibited impressive performances, with growth rates of 20.73% and 12.41% respectively, which is significantly higher than Bangladesh.

Vietnam and India grew by 4.21% and 1.97% respectively. Turkey experienced a 6.64% decline during the mentioned period of time.

In terms of quantity, EU’s global import increased by 8.98%, with Bangladesh showing a commendable growth of 10.18% in the same period, while China surged higher than Bangladesh by 12.05%.

However, the analysis said, on a unit price basis, Bangladesh has seen a decrease of 4.84%, which is a point of concern.

In fact the unit price of EU’s global apparel import has gone down by 6.83%, significantly influenced by the 8.43% price slash by China.

The price cuts by Vietnam and Cambodia are also noticeable.

This may be noted that the EU-Vietnam Free Trade Agreement (FTA) has been in effect since 2021, granting Vietnam the preferential benefit of a gradual removal of tariffs by the EU.

However, taking a closer look at the European Union market, we can observe the comparative shares of various suppliers.

The share of Bangladesh in EU’s apparel was 21.37% of the EU's total apparel imports in dollar value, which was 20.69% in 2023.

China, being the leading supplier, accounted for about 28.12% in 2024, which was 27.87% in 2023.

Other notable suppliers include Vietnam with 4.66%, and India with 4.89%.

The analysis underscores the need for Bangladesh to focus on strategic initiatives to enhance competitiveness, said Hassan who served as the President of Bangladesh Garments Manufacturers and Exporters Association (BGMEA).

While the growth in export volume is encouraging, the decline in unit prices is a challenge.

"It is crucial that we explore opportunities to add value, improve operational efficiency, and tap into diversified markets to sustain growth," Hassan said.

Bd-pratidin English/ Afia