Thailand is fast-tracking a strategic plan for its semiconductor sector, aiming to complete an initial draft within 90 days as it seeks to attract fresh investment amid U.S. President Donald Trump’s renewed trade war with China, reports Reuters.

The country’s national semiconductor board will hire a consultancy to develop an industry roadmap, according to Narit Therdsteerasukdi, secretary-general of the Thailand Board of Investment (BOI). Narit, who reports to the prime minister, is also planning investment roadshows in the United States and Japan to court semiconductor firms.

The global chip industry has been upended in recent years as the U.S. and China vie for tech dominance, shifting parts of the supply chain to Southeast Asia. With further disruption expected in Trump’s second term, his administration has announced a 10% tariff on Chinese imports as part of a broader effort to improve the U.S. trade balance.

Thailand, Southeast Asia’s second-largest economy after Indonesia, saw inbound investment applications surge 35% last year to a decade-high of 1.14 trillion baht ($33.5 billion).

“I expect this year’s applications to exceed last year’s, driven by investment in electronics and digital industries,” Narit said.

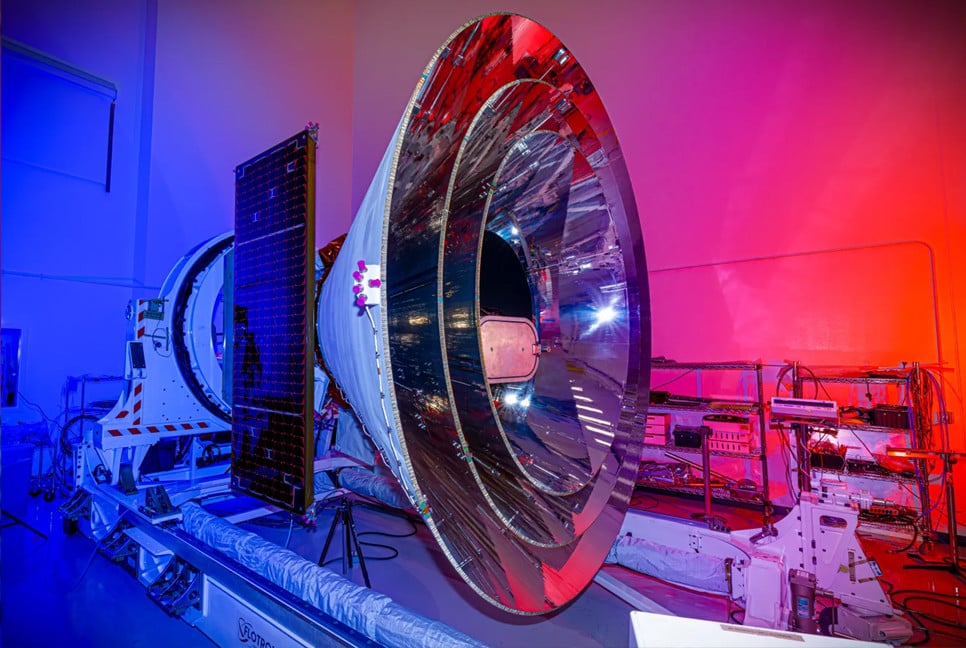

A 2024 report by consulting firm Kearney ranked Thailand second behind India among emerging economies for semiconductor manufacturing. The country is targeting 500 billion baht in new semiconductor investments by 2029, with a focus on power electronics—chips used in electric vehicles, data centers, and energy storage systems.

Massachusetts-based Analog Devices, Japan’s Sony and Toshiba, Germany’s Infineon, and a subsidiary of Taiwan’s Foxsemicon Integrated Technology are among the firms with chip-related operations in Thailand. Investments in printed circuit board production, a key component in devices from smartphones to EVs, have also risen sharply since 2023, according to the BOI.

“The trade war is a key factor,” Narit said. “One reason investors choose Thailand is our position as a neutral country.”

However, Thailand faces stiff competition from Malaysia, which accounts for 13% of global chip testing and packaging and is targeting over $100 billion in semiconductor investment.

Bd-pratidin English/ Jisan