The industrial sector continues to face significant challenges as capital equipment imports decline sharply, signalling broader issues for manufacturing and infrastructure development – both crucial for economic growth.

According to Bangladesh Bank data, in the first seven months (July-January) of the current fiscal 2024-25, the opening of letters of credit (LCs) for capital machinery imports dropped by 33.68 percent compared to the same period in FY24. Similarly, LC settlements fell by 27.33 percent during the same period.

Experts attribute this decline to multiple factors, including economic instability, supply chain disruptions, and inflationary pressures, which have made it increasingly difficult for businesses to afford essential machinery. Regulatory hurdles and geopolitical tensions have further discouraged foreign investment and trade.

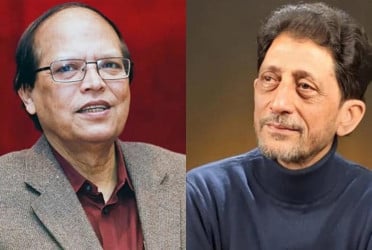

Mohammad Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), told the media, “Instability in industries and factories has created severe challenges, and they are going through an extremely tough time. A zero-tolerance policy should be enforced to improve the law and order situation.”

He also highlighted the rise of “case trades”, where individuals exploit legal loopholes to file cases against traders over personal disputes or disagreements. He urged authorities to halt cases unrelated to criminal activities.

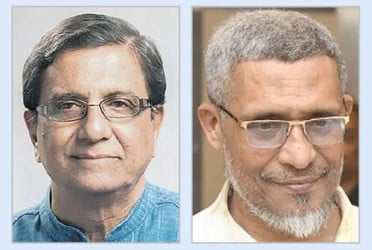

Dr Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development and former Director General of the Bangladesh Institute of Development Studies, stressed the need for decisive government action.

“The market-disrupting syndicates must be dismantled. Public and private investment must increase, and small and medium enterprises (SMEs) need to be revitalised. Without a boost in production, inflation will persist,” he warned.

Dr Zahid Hussain, former lead economist at the World Bank’s Dhaka office, echoed similar concerns.

“To address this crisis, governments and industry stakeholders must create a more stable and conducive environment for trade, investment, and technology transfer. Unless these structural issues are tackled, industrial recovery will remain sluggish, undermining long-term economic prospects,” he said.

Bangladesh Bank data further reveals a sharp decline in capital machinery imports. The total value of LCs opened for machinery imports during July-January stood at $1 billion, down from $1.52 billion in the same period of FY24. Similarly, LC settlements dropped to $1.24 billion from $1.71 billion.

The import of intermediate goods also saw a decline, with LC openings falling by 4.49 percent and settlements by 12.79 percent. During this period, the total value of intermediate goods imports dropped to $2.49 billion from $2.6 billion last fiscal year, while LC settlements declined to $2.6 billion from nearly $3 billion.

Conversely, LC openings for industrial raw materials showed slight growth, increasing by 10.07 percent. However, LC settlements declined by 15.90 percent, highlighting continued instability in the sector.

Courtesy: Daily Sun.

Bd-pratidin English/Tanvir Raihan