The committee for “White Paper on State of the Bangladesh Economy” submitted its findings to the chief adviser Professor Muhammad Yunus on Sunday. The “White Paper” reveals the dark side of ousted prime minister Sheikh Hasina regime.

According to the data of the White Paper, at least 1.75 lakh crore of taka has been looted in the last 15 years. With the bad loans or Non-Performing Assets (NPAs) created in the banking sector, it was possible to make 24 Padma Bridges.

Banking sector was the most affected sector during the Awami League led government’s tenure.

There have been incidents such as taking out loans anonymously, laundering money, and changing the ownership of banks at gunpoint. Hence, the good governance and best practice in the banking has dropped to zero, and now the whole country, including the banking sector is paying price for this.

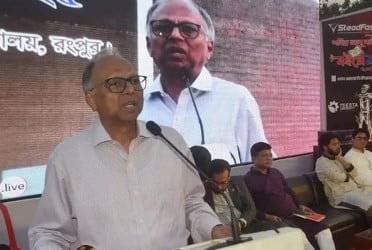

Committee led by Dr Debapriya Bhattacharya placed the report before the chief adviser at his Tejgaon office that will be revealed to media Monday.

The committee report says: “During the previous government, political influences were evident in loan approval that deepened the crisis in the banking sector. The amount of bad or distressed loans during this period is equivalent to the cost of constructing 14 Metrorail Projects, or 24 Padma Bridge Projects.”

The report continued: “The continuous loan defaults and high-profile scandals have destroyed financial stability and diverted the capital away from productive sectors.”

“The recruiting agencies have transacted 13.4 lakh crore taka for visas in the last 10 years that is equivalent to the construction cost of 4 MRT6 projects, it furthered, adding: “Due to syndicates and this exploitative recruitment, migrant workers have been deprived of fair employment, resulting in a decrease in the amount of remittances.”

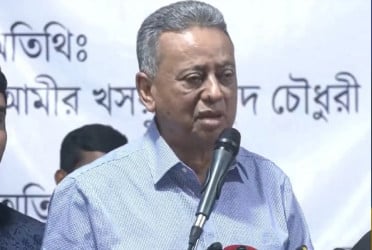

During the report handover program, Bangladesh Bank governor said they are checking the “health” of financial sectors of the country.

He fears that the defaulted loan will increase by 12.5 to 17.5 percent in coming days, making defaulted 25-30 percent defaulted loan. He said: “It will reach 15 percent in the next month, then 17 percent, and gradually will reach to 30 percent.”

He added that the loans were sanctioned during the previous government, and now these amounts are coming to account. The defaults have already occurred.

He said: “We have started working to reduce it.”

Translated by Bangladesh Pratidin English/ Afsar Munna