Bangladesh's capital market has been in a downward spiral since the Awami League assumed power in 2009. Despite a brief surge following the historic student-led movement in 2024, the market's recovery has been short-lived. The situation has deteriorated significantly, with the index recently breaking its four-year low, further eroding investor confidence.

A prolonged bear market has persisted for over 60 days. Last week, the Dhaka Stock Exchange (DSE) index plummeted by 250 points. In response to this decline, concerned investors staged a protest in front of the DSE headquarters. They demanded the resignation of the Bangladesh Securities and Exchange Commission (BSEC) chairman and its commissioners.

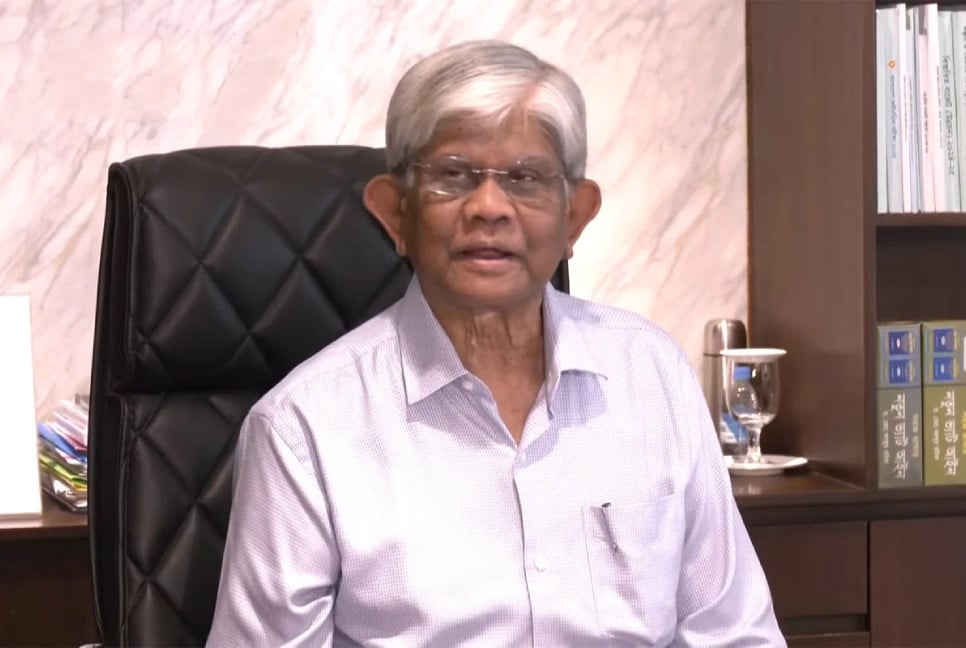

Following a record-breaking market decline, government’s Finance Advisor Dr. Saleh Uddin Ahmed convened a meeting with BSEC officials. While the market subsequently attempted to recover, critics argue that this was a short-lived rebound. They contend that long-term planning alone is insufficient to revitalize the capital market. Instead, they advocate for timely decision-making by relevant authorities in consultation with various market stakeholders.

During the 12 weeks since the interim government assumed power, the market price index has exhibited a predominantly bearish trend. Only two weeks saw a bullish market, while the remaining ten weeks were characterized by a downward trajectory.

Following Sheikh Hasina's departure, the market index surged to a high as expected. However, a period of volatility ensued; prices fell steadily for two weeks, rebounded in the third week, and declined again in the fourth. Over the next seven weeks (from weeks 5 to 11), stock prices experienced a prolonged downturn, with the DSE index losing over 1,000 points. This drop brought the index down from 6,015 points to 4,900 points.

Last week, the DSEX, DSE’s prime index, gained 84.80 points, marking a 1.66% increase. Despite this recent rise, DSEX has lost a total of 725 points in the 12 weeks since the interim government took power. Prior to this period, the index had dropped by 143.38 points (2.73%) and shed 809 points over the preceding 10 weeks.

After emerging from a bearish trend, the stock market demonstrated a bullish uptick. Investors witnessed a modest price increase across most stocks over the past three trading days. As a result, the market capitalization of the DSE expanded by 80 billion Taka, and the index climbed by 100 points. Trading volume also saw a notable increase during this period.

Over the past five trading days, the stock market witnessed a positive trend. A total of 279 companies were listed as gainers, while 101 companies were listed as losers. Additionally, 15 companies remained unchanged.

As a result of this market movement, the total market capitalization closed at 6,65,332 crore Taka on the last trading day. This represents a 1.29% increase, or 8,464 crore Taka, compared to the previous week's closing market capitalization of 6,65,846 crore Taka.

Former DSE Director Minhaz Mannan expressed disappointment that the anticipated transformation of the stock market following a change in the country's ruling framework has not materialized. Despite hopes for a corruption-free, disciplined, and forgery-free market, mismanagement and indiscipline persist.

Mannan argues that simple reshuffling of officials is insufficient to address the deep-rooted issues. He suggests that weaknesses in policy and loopholes in the law have contributed to investor distrust. To restore confidence, a comprehensive overhaul is necessary, addressing not only the recent actions of individual chairmen but also the systemic problems that have plagued the market for years.

Mr. Mannan stated that after the new commission was formed, they requested the commission to take immediate action by engaging with stakeholders. However, their response was inadequate. The commission has outlined long-term roadmaps, but the efficacy of these plans remains uncertain. As the market continues to decline, urgent solutions are imperative to prevent its complete collapse.

He also said that the National Revenue Board (NBR)'s recent imposition of taxes on stock market profit-taking has raised concerns among investors. Despite significant losses incurred by many, the implementation of these taxes has been met with criticism. Such a decision may erode investor confidence and hinder the market's growth. A more collaborative approach, involving input from market stakeholders, could lead to policies that balance revenue generation with market stability.

bd-pratidin/Jisan