This week, a major announcement by former President Donald Trump about a $500 billion private-sector investment to build AI data centers has spotlighted the emerging role of nimble cloud computing startups. These smaller firms are carving out a niche in an industry long dominated by tech giants, reports Reuters.

Trump revealed that companies including OpenAI, SoftBank, and Oracle would join forces in a project designed to establish AI-focused data centers, generating over 100,000 U.S. jobs. The initiative aims to keep the U.S. ahead in the global AI race, particularly against China.

Notably absent from Trump’s announcement was San Francisco-based Crusoe, a startup tapped by Oracle to develop the first data center for the initiative, codenamed Stargate, according to sources familiar with the matter. Oracle contracted Crusoe to expedite construction and cut costs, subsequently engaging OpenAI as a potential customer, one source said. Oracle declined to comment on the matter.

Crusoe is part of a wave of “neocloud” companies—specialized cloud providers designed to meet the unique demands of AI firms. Others in this group include CoreWeave, Nebius Group, and Lambda. These startups focus on assembling vast networks of Nvidia chips to handle AI workloads, differentiating themselves from cloud giants like Amazon Web Services, Microsoft Azure, and Google Cloud, which also cater to broader corporate needs and use proprietary chips that compete with Nvidia.

“Smaller companies can move faster,” said Robert Brooks IV, vice president of revenue at Lambda, referring to the Stargate project. “When AWS or Google Cloud builds a data center, they consider other aspects unrelated to AI, slowing them down.”

Unlike tech giants, neocloud firms collaborate closely with Nvidia instead of developing competing chips, presenting a growth opportunity for Nvidia as demand for its AI chips rises. “It feels like Nvidia just gained another big buyer,” said Stacy Rasgon, a semiconductor analyst at Bernstein.

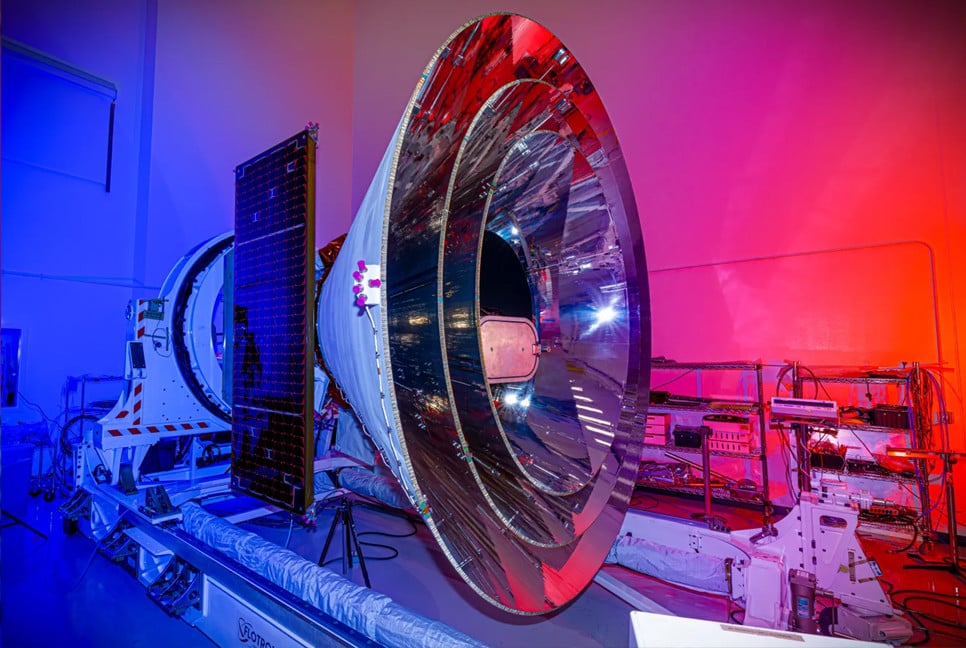

However, neocloud firms face challenges of their own. Crusoe is building its Abilene, Texas, data center to accommodate 100,000 AI chips per building and accelerate timelines by employing pre-fabricated components, which CEO Chase Lochmiller likened to modular home construction. Other neoclouds rely on leasing existing space or partnering with specialists like Equinix or Compass for rapid development.

Crusoe handed over the first building for tenant improvements within six months—a process that typically takes years. Meanwhile, CoreWeave, another prominent neocloud, is eyeing an IPO this year, reportedly targeting a $35 billion valuation.

Despite these successes, the scale of the AI data center initiative raises questions about funding. Elon Musk recently expressed doubts about whether SoftBank and OpenAI could finance the project, with reports suggesting a mix of debt financing and contributions of $19 billion from each partner.

Jason Hardy, Chief Technology Officer for AI at Hitachi Vantara, called the project a “huge undertaking” with the potential to create significant job opportunities. However, he cautioned that it is too early to predict its overall impact.

As the AI race intensifies, the rise of neocloud companies highlights the shifting dynamics of the tech industry. These startups are not just competing with tech behemoths but are also proving that speed and specialization can redefine the cloud computing landscape.

Bd-pratidin English/ Jisan