The Businessmen in Bangladesh are grappling with the increasing crisis with defaulted loans, and the Bangladesh Bank (BB) contemplates classifying long-term loans or classified loans as per International Monetary Fund (IMF) terms by reducing the overdue period from six months to three.

Businessmen voice their concerns over the mounting burden of loan repayment, exacerbated by the adverse impact of the COVID-19 pandemic and the ongoing Russia-Ukraine conflict, leaving them vulnerable amidst prevailing economic challenges.

As part of the agreement to receive budgetary support of $4.7 billion from the IMF, the BB is considering listing long-term loans as classified loans with an overdue period of three months instead of six. This proposed measure has raised apprehensions within the business community, as it may significantly escalate the volume of non-performing loans and amplify the challenges faced by businesses and industrial establishments, exacerbating the already vulnerable economic situation in the country.

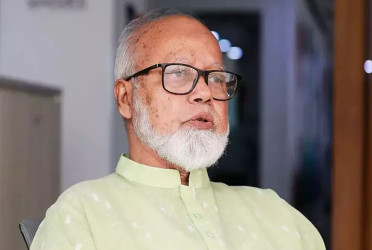

Md Amin Helaly, senior vice-president of Bangladesh Chambers of Commerce and Industry (FBCCI) told Bangladesh Pratidin, has concerns about the potential ramifications of classifying overdue loans within three months, instead of six. He pointed out that such a move would inevitably lead to a rise in non-performing loans, exerting immense pressure on businesses and industries. Furthermore, it might also impact private investments and make it challenging for businessmen to sustain their business operations. He stressed the need for the banking sector to adopt more efficient and expeditious loan recovery procedures to reduce non-performing loans effectively.

Md Sameer Sattar, president of the Dhaka Chamber of Commerce and Industry (DCCI) told Bangladesh Pratidin, BB’s decision to reduce the loan classification period from six months to three months may further increase defaulted or non-performing loans. Although ostensibly this decision is meant to reduce defaulted loans, it may actually increase defaulted loans. This decision will have a negative impact on the traders at a time when traders are struggling in the current volatile economic situation, where private investment is somewhat subdued. Such a decision would also deter private investment when businessmen are already facing difficulties in the volatile global economy and trade during the Russia-Ukraine war period before the transition from LDC. I think that rather than taking this decision, it is necessary to strengthen the process of recovering the amount of money that the bank already has as default or NPL with efficiency and speed.

According to BB sources, BB is planning to reduce the overdue period from six months to three months for listing long-term loans as classified as per their guidelines to get the International Monetary Fund's (IMF) $4.7 billion budget support. This measure is being planned to reduce irregularities and defaulted loans in the banking sector.

Due to covid-19 businessmen were freed from default without paying any kind of loan. In 2021, they were freed from default by repaying only 15 percent of the loan. At the beginning of 2022, the central bank could not stick to this decision even though it removed this special loan repayment concession. Due to the Russia-Ukraine war that started in February of that year, the country's top businessmen applied to the central bank for loan repayment concessions considering the unusual loss of business activities.

In view of the demands of the businessmen, the central bank has given concessions in the repayment of industrial loans, agricultural loans, and CMSME loans from April to December 2022.

Again, in view of the same demand of traders, the central bank gave a special concession that 50 percent of all current capital and term loans will not be defaulted from April to June this year. Although this facility has been withdrawn from July this year. Currently, there is no special facility for the repayment of the loan.

According to BB's current rules, a term loan is classified as 'substandard' after an overdue period of six months and after nine months the loan is classified as 'bad or loss-making'. An inspection by the central bank last year revealed that the banks have hidden about 10,000 crores worth of defaulted loans.

In the first three months of this year (January-March), defaulted loans in the country's banking sector increased by Tk 11 thousand crores. In the month of March, the total amount of defaulted loans in the banking sector stood at 1 lakh 31 thousand 620 crores, which is 8.80 percent of the total outstanding loans.

According to the circular of BB, for any overdue loan or installment, 1.5 percent penal interest will be levied on the full outstanding loan in case of a running or demand loan and on the overdue installment in case of a term loan. BB introduced a new rule on July 27. According to this rule, banks can charge a maximum of 1.5 percent penalty interest on overdue and classified loans.

Syed Mahbubur Rahman, Managing Director and CEO of Mutual Trust Bank Limited told Bangladesh Pratidin, the central bank could take such action under the IMF's terms, but it would greatly increase the amount of classified debt. Most of the country's debt is term debt. The economic situation is bad because of the Russia-Ukraine war. If the loan is classified after three months, the defaulted loan will increase significantly.

@The report was published in Bengali on print and online versions of The Bangladesh Pratidin on August 6 and rewritten in English by Tanvir Raihan.