The people involved in money laundering have been changing the destinations of money due to lack of confidentiality in existing destinations. They have been transferring their deposits from Swiss Banks to countries like Singapore, Malaysia, Dubai, UK, USA, Canada, Cayman Island, Luxemberg, and Bermuda.

In the report published by central bank of Switzerland, it was revealed that the Bangladeshi depositors had withdrawn their money in bulk. The Bangladeshis had withdrawn Swiss Franc equivalent to Tk 10, 537 crore in just 2022. In 2021, their amount of deposits in Swiss banks were 87 crore 11 lakh Franc.

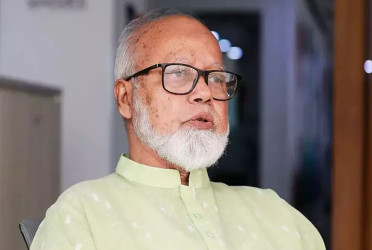

According to Iftekharuzzaman, executive director of Transparency International Bangladesh, as the demand of dollar is high due to election year and economic crisis, the launderers are transferring money from Switzerland to more lucrative destinations. Even, they might return this money to Bangladesh.

He told this while talking to The Bangladesh Pratidin on Friday. Iftekharuzzaman said, "The money being siphoned off isn’t limited to just one destinations; rather it’s siphoned off to many countries other than Switzerland. Some of these destinations include UK, USA, Singapore, Malaysia, Canada etc. Now, Dubai of UAE has become new destinations of money laundering.”

According to reliable sources, each year from Bangladesh, money equivalent to 1,200 crore dollars is getting siphoned off to various countries. This amount would remain in the country if government was successful in preventing money laundering. In addition, they didn’t have to take loan from IMF. So, its essential to increase activity to control money laundering and take step to return money being siphoned off. If the government is cordial, then they can return this money through authorities concerned.

The former governor of Bangladesh Bank, Salehuddin Ahmed on Friday told The Bangladesh Pratidin, “The Bangladeshis took the money from the Swiss bank and sent it to other countries. The law enforcement agencies of our country are asking various questions about money laundering. As a result, many people think that if they contact the Swiss bank, they will get information about money laundering. Thinking that, they took money from the Swiss bank and sent it to another country.”

Dr. Salehuddin Ahmed said, “Especially countries like Dubai, Cayman Islands, Luxembourg, Bermuda have become new destinations of money laundering. Many people send money to Switzerland to bring it back to the country. Sending money there can be a problem as the hundi is a bit tougher amid the ongoing dollar crisis.

He also said the government may initiate an investigation to take legal action against those whose accounts have been depleted in Swiss banks and can get information about going to a new country. An investigation may be conducted to take action against money launderers. It can also be a positive aspect for the government to catch money launderers.

Ahsan H. Mansoor, executive director of Policy Research Institute, said, “Swiss banks cannot keep the information of money launderers a secret. If the government of a country wants, the Swiss bank is giving information of money launderers to the home country.”

He said these things while talking to The Bangladesh Pratidin. Ahsan H Mansoor said, “Money launderers changed destinations due to have the advantage of non-disclosure of information. However, money laundering has not stopped. People are now stopping depositing money in Swiss banks.”

He also said that information of money laundering is provided by Swiss banks when the government makes request. The government can collect data on money launderers in its country from Swiss banks if it wants. That's why they are no longer depositing money in Swiss banks. There are many safer places than Swiss banks for the money launderers. Dubai is currently one of these places. Apart from this, the money of our country is being siphoned off to countries like Singapore, USA, Canada, UK.

@The report was published in Bengali on print and online versions of The Bangladesh Pratidin on June 24 and rewritten in English by Lutful Hoque