The country’s businesses are under pressure as Bangladesh Bank (BB) removed the interest rate cap to reduce the ongoing inflation in the country.

The central bank fixed the interest rate cap at 9 per cent demanded by the businessmen in April 2020. But in the new monetary policy for the next months, BB removed the interest cap rate. As a result, the overall interest rate will increase. The interest rate will increase for small loans compared to big loans. Businessmen apprehended that the operational cost of the business will increase due to the removal of the interest rate cap.

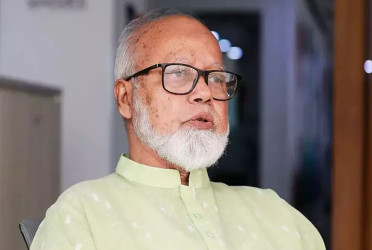

Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) President Md Jashim Uddin told Bangladesh Pratidin that the government gave various incentive packages to businessmen during the Covid-19 period. But the current situation is worse due to the Russian invasion of Ukraine. There is no incentive package this time. The central bank removed the interest cap rate for IMF, some local organisations and critics. Small businesses will be affected by this decision. It was not a good decision. Big industrialization will also be affected. From now on, banks will take separate interest rates which the central bank won’t control.

Bangladesh Chamber of Industries (BCI) President Anwar-ul Alam Chowdhury Parvez said the removal of a 9 per cent interest rate cap will create trouble for small businessmen.

“I think the interest rate will increase by 1.5-2 per cent. The rate will be more for small businesses which will increase the production cost. As a result, many mill factories will fall into deep crisis. Many employees will lose jobs.”

Besides, the new monetary policy has prioritized the implementation of the Annual Development Program (ADP). Financing will also decrease in the private sector for this reason, he added.

According to the information, BB has removed the interest rate cap of 6-9 per cent and replaced it with a market-driven reference rate to be regulated by the average treasury bills rate.

As per the new rate formula, the reference rate will be calculated as the six-month moving average rate of treasury bills with a 3 per cent margin for banks and a 5 per cent margin for non-bank financial institutions.

The central bank has also increased the policy rate, also known as the repo rate, by 50 basis points to 6.50 per cent, and the reverse repo rate by 25 basis points to 4.50 per cent.

Bangladesh Garment Manufacturers and Exporters Association (BGMEA) President Faruque Hassan said the withdrawal of a single-digit interest rate will create new pressure and challenge among businessmen. Businesses can’t get gas and electricity properly despite giving extra prices. The buy order is decreasing day by day. Removal of the interest cap will add to the business cost. There will be very tough to sustain in the business competition. It will also hit the new investment and employment in the country. The environment of business will also be limited.

Dhaka Chamber of Commerce and Industry (DCCI) President Barrister Sameer Sattar said the loan interest rate might be double-digit due to the removal of the interest rate cap which will create obstacles the businesses in the global economic perspective. Besides it will increase the operational cost of small and medium enterprises.

He also suggested the government should decrease taking loans from the banks and increase the amount of tax collection as it (govt) can ease banks’ dependency.

The DCCI chief also thinks the reduction of defaulted loans will be possible by ensuring transparency and accountability in the financial sector.

@ The article was published on print and online versions of The Bangladesh Pratidin on June 20, 2023 and has been rewritten in English by Golam Rosul.