In 1976, four years after the Liberation War, Bangladesh remained mired in poverty. Signs of despair were visible everywhere. The hopes that had ignited the struggle for independence were slowly dimming. Crushed under the weight of hardship, the people seemed to be living out the dire predictions of Henry Kissinger and American economists. After independence, these economists had proclaimed, “Bangladesh will be a model of poverty.” They had warned, “Bangladesh will become a symbol of famine.”

In 1974, Bangladesh experienced a devastating famine. The wounds of that famine had yet to heal. The country seemed like a map of hopeless, destitute people. More than 70% of the population lived below the poverty line. Debates raged—would Bangladesh survive? Would it become a model of extreme poverty or ultimately fail as a state and disappear from the world map?

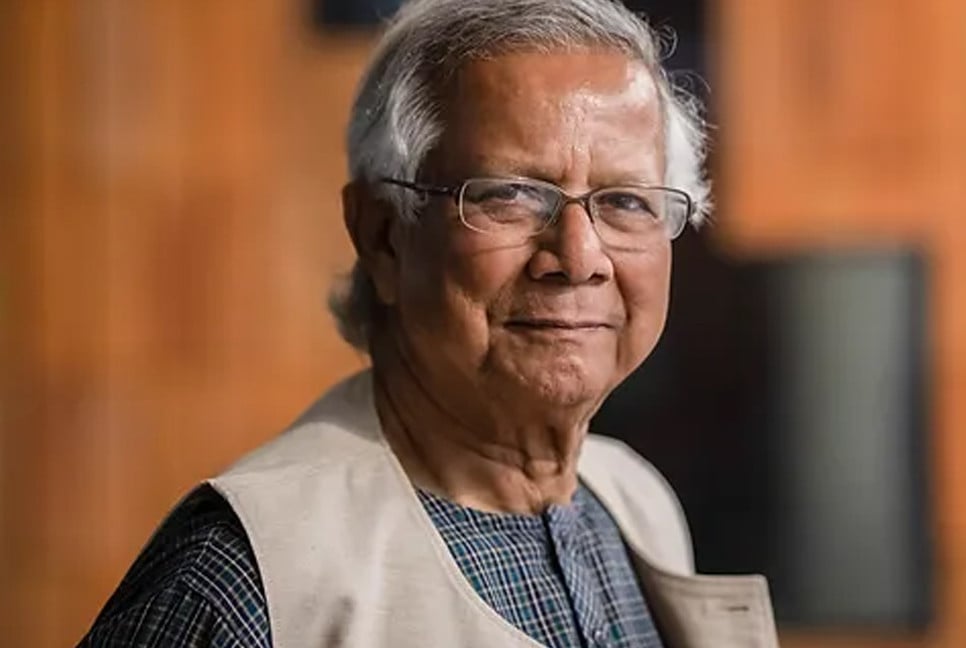

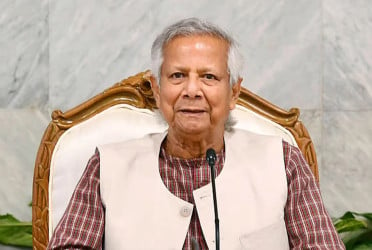

At this critical moment, a young and ambitious teacher from Chittagong University envisioned transforming rural economics. His initiative was small, but his dream was vast.

In 1976, Dr. Muhammad Yunus, along with some colleagues and students, traveled to the remote village of Jobra in Chittagong for a research project. He sought to understand the root causes of rural poverty and explore ways to overcome them. His question was simple: Could banking services be extended to the poor? If given loans, would they use the money productively or merely for food and clothing?

In traditional banking systems, obtaining a loan was extremely difficult. Banks required collateral, something the poor simply did not have. All they possessed was an abundance of energy, courage, and determination. No one had ever considered using the poor’s work ethic and creativity as collateral for loans. But Dr. Yunus introduced a revolutionary concept—collateral-free microcredit.

His research yielded promising results. Not only was he inspired, but so were his students and the villagers. He discovered that, given even a small amount of financial assistance, the poor could change their own destinies. Moreover, they were far more diligent in repaying loans than wealthier individuals.

Thus began Dr. Yunus’s journey to transform rural Bangladesh.

Bangladesh, once deemed a model of poverty and famine, would go on to achieve unprecedented success in poverty alleviation. The mastermind behind this transformation was Dr. Muhammad Yunus.

The Birth of Grameen Bank

Following his 1976 research, Dr. Yunus conceptualized Grameen Bank to serve the rural poor. He presented his findings to the government, but the idea of collateral-free loans was met with skepticism. Many considered it unrealistic and financially unsafe.

However, Dr. Yunus was undeterred. His relentless efforts paid off when, on September 4, 1983, the government officially enacted the "Grameen Bank Ordinance." Thus, Grameen Bank was born, starting with a modest capital of 30 million taka (3 crore). The government contributed 18 million taka, while borrowers themselves provided 12 million taka.

Grameen Bank did more than just provide collateral-free microloans—it became a global model for poverty alleviation. A key feature of the bank was its focus on women, as membership was primarily granted to women, promoting female empowerment and financial independence.

By 1984, Grameen Bank had become the driving force behind Bangladesh’s fight against poverty. And Dr. Yunus was its visionary leader.

As Grameen Bank expanded, Dr. Yunus realized that eradicating poverty required more than just loans. Education, healthcare, employment opportunities, and skill development were equally essential.

Thus, he established 28 different institutions dedicated to rural development. These included:

Grameen Telecom (to provide rural communities access to mobile technology)

Grameen Distribution Limited

Grameen Education

Grameen IT Park

Grameen Danone Foods (to address child malnutrition)

Grameen Health Services

Grameen Knitwear Limited

Grameen Agriculture Foundation (to support farmers and agricultural innovation)

Each of these organizations had one ultimate goal: Zero Poverty.

Through Grameen Telecom, Dr. Yunus facilitated a digital revolution in rural Bangladesh. A partnership with Norway’s Telenor led to the creation of Grameenphone, which played a crucial role in connecting rural entrepreneurs, particularly women, with the wider economy.

Recognizing the importance of education, he launched Grameen Education projects to provide schooling for underprivileged children.

Observing the natural textile skills of rural workers, he established Grameen Knitwear Limited to create sustainable employment in garment production.

To improve nutrition, he founded Grameen Danone Foods, ensuring affordable, nutritious food for children.

Through Grameen Health Services, he addressed rural healthcare needs, ensuring access to medical care for those who had none.

To promote sustainable agriculture, he launched the Grameen Agriculture Foundation, which introduced modern farming techniques and livestock management.

Over the past 49 years, Bangladesh has undergone an incredible transformation. The vision and determination of Dr. Muhammad Yunus have reshaped the nation. The once impoverished, famine-stricken villages have now become hubs of entrepreneurship and self-sufficiency.

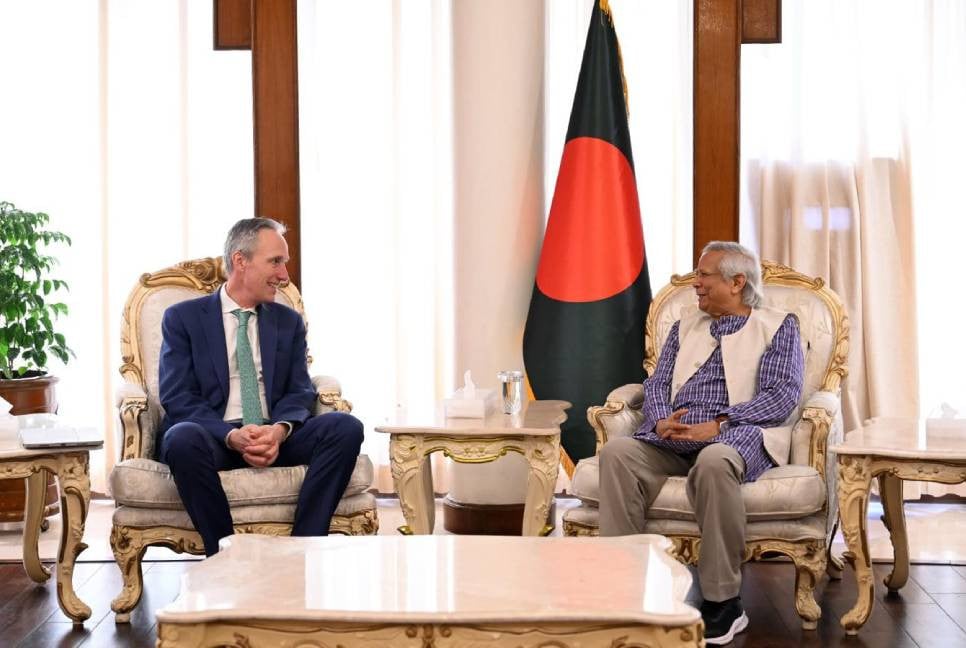

His ideas have extended far beyond Bangladesh. Today, 64 countries have adopted the Grameen Bank model. From his microcredit experiments, the concept of social business has emerged, influencing global economic policies and offering sustainable solutions for poverty alleviation worldwide.

Dr. Yunus is not just an economist—he is a visionary, a leader, and a warrior against poverty.

He didn’t just improve rural economies; he transformed millions of lives.

Through his relentless dedication, Bangladesh has become a beacon of hope in the fight against poverty, setting an example for the world.

His work has proven that poverty is not an inevitable fate—it can be eradicated. And at the heart of this transformation stands one man: Dr. Muhammad Yunus, the architect of poverty alleviation.

Bd-Pratidin English/ARK