Leading global banks anticipate that gold prices will remain elevated throughout 2025, potentially reaching the $3,000 mark, reports Reuters.

The geopolitical uncertainties continue to shape investor sentiment, the report claims citing the global banks.

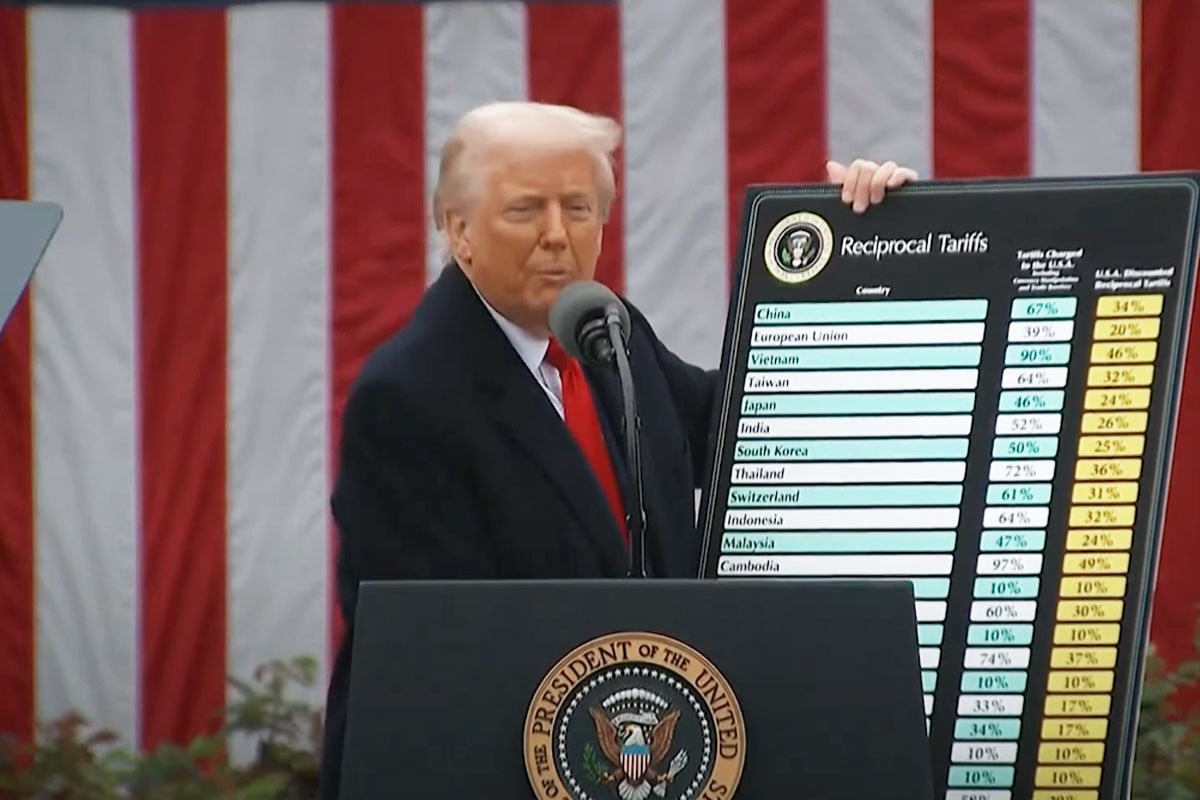

Among the key drivers of this rally are US President Donald Trump’s aggressive trade policies, including fresh tariffs on major partners like Canada, Mexico, and China, which have triggered retaliatory measures from these nations.

Citi bank responded to these developments by revising its near-term (0-3 months) price target for gold up to $3,000 per ounce from $2,800, while maintaining its 6-12 month forecast at $3,000, unchanged from the previous forecast. The bank also upgraded its 2025 average price outlook from $2,800 to $2,900 per ounce.

“The gold bull market looks set to continue under Trump 2.0 with trade wars and geopolitical tensions reinforcing the reserve diversification/de-dollarization trend and supporting EM official sector gold demand, and with global growth concerns (tariff and cycle related) set to raise ETF and OTC investment demand,” Citi stated in a note.

“We expect gold to continue to rise as a hedge against growth and other risks, including actual and perceived rising growth risks, including trade wars, still-high interest rates weighing on growth, continued deterioration in the U.S. labor market, ex-US currency devaluation risks, and potential US equity drawdown risks,” the bank noted.

Meanwhile data from the World Gold Council showed global gold demand rose 1% to a record 4,974.5 metric tons in 2024, driven by higher investment and increased central bank purchases in the fourth quarter.

“While growth should remain robust over the first half of 2025, the outlook beyond that will to a large degree depend on the timing and magnitude of fiscal, trade and immigration policies in the U.S., and the degree of tariff retaliation,” Macquarie said in a December 5 note.

Gold continued its upward momentum, reaching a new all-time high of $2,882.16 on Wednesday. The five-session winning streak was driven by rising trade tensions between major economies, increasing concerns about economic growth, and uncertainty over the Federal Reserve’s interest rate path.

Bd-Pratidin English/ AM