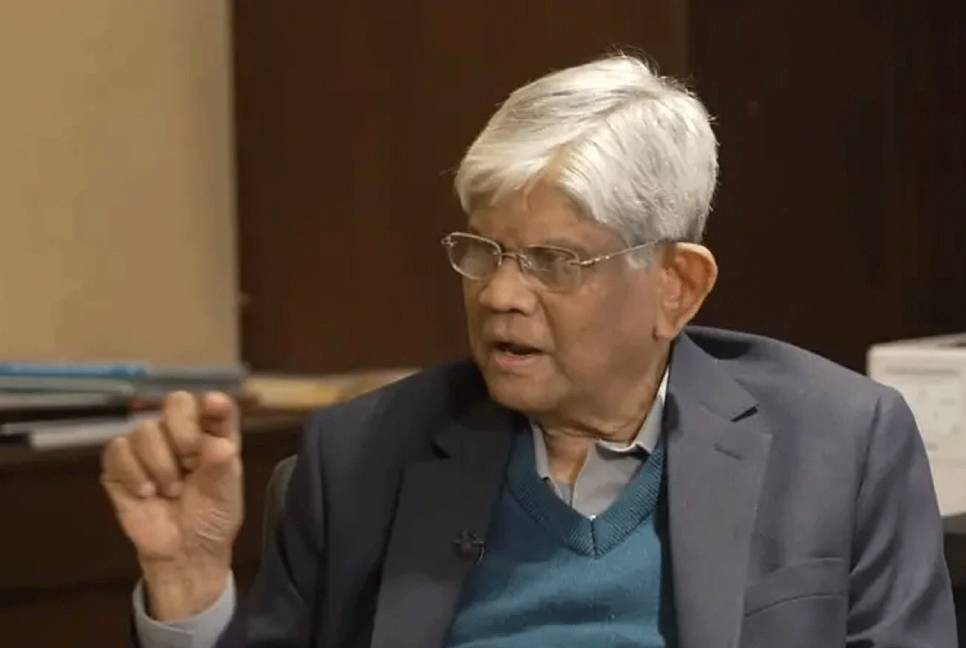

Finance Adviser Salehuddin Ahmed has cited extortion as a major reason for the interim government's failure to curb high inflation.

He said apart from previous extortionists, those who are trying to secure positions in politics, are also engaged in extortion. Extortionists at the local level are also active.

Salehuddin opined that addressing this issue completely before an elected government is difficult.

The finance adviser came up with the observation at an interview with BBC Bangla.

In the interview, the adviser discussed various issues including the budget, banking, income tax, and the stock market.

BBC Bangla: The interim government has been in office for six months. You have taken the charge of the Finance Ministry. How is your experience in these six months?

Finance Adviser: When we assumed office, there were various types of problems in the economic sector. Firstly, the irregularities in the banking sector, no other country in the world has faced such a crisis in the banking sector. Money was stolen and there were numerous loan defaulters. Corruption, money laundering, and violations of banking regulations happened in this sector. There have also been irregularities at the Bangladesh Bank over the past 15 years.

BBC Bangla: Over the past six months, one major issue has repeatedly come into the spotlight and this is inflation. Even in the last three months, inflation has remained between 10 to 11 percent. Why can't you (the interim government) bring this high inflation under control?

Finance Adviser: Inflation here is a legacy problem. This inflation has not happened in the last two or three years. There is a lot of money printed and a lot of money floating around. The big mega projects of crores of Taka. The problem with mega projects is that their returns and output don’t come quickly. A bridge may be built, but it doesn’t immediately impact the supply chain. At the same time, remittances have significantly fallen.

It doesn’t mean that we haven’t controlled inflation at all. We have managed it slightly. Food inflation has slightly increased. On the other hand, non-food inflation has decreased slightly. Overall, the inflation has risen. We are trying to maintain the supply chain as much as possible.

The supply chain is broken. There are too many middlemen. For example, if a truck travels from Mahasthangarh to Dhaka, the rent should be Tk 5,000. However, due to extortion, the actual cost stands at Tk 12,000. The extortion has not decreased.

BBC Bangla: It is your responsibility to curb extortion

Finance Adviser: We are an interim government. We can’t just forcibly detain the people. Previously, extortion was less because the political government had an advantage. They had political arms. But we don’t have that. You know the limitations.

The Consumer Rights Protection Act and a few magistrates cannot control extortionists. Currently, three major parties are involved in extortion. First, those who were already engaged in it before (from the Awami League); second, those who are now politically emerging and active at the grassroots level are also engaging in extortion; and third, the locals. Controlling all of them is becoming difficult for us.

BBC Bangla: You told me that the police alone cannot control extortion. You also spoke about political parties. Does it mean extortion won’t be controlled until a political government takes over? Why would political parties bring it under control?

Finance Adviser: Political parties are always focused on elections. They want to come to power. Big political parties have activists at the grassroots level. The interim government is struggling to manage them.

Secondly, there is also the issue of natural disasters. For example, there was flooding in Comilla and excessive rainfall in Sherpur and Mymensingh. We have faced additional challenges due to these natural calamities. That’s why inflation is still very high.

BBC Bangla: Does this mean that this problem won’t be solved until an elected government takes over?

Finance Adviser: We are trying. We hope to bring inflation below 8 percent by June. However, bringing it down to 5-6-4 percent is impossible. A 5 percent inflation rate is an ideal situation.

BBC Bangla: Syndicates were always blamed for rising commodity prices during the previous government. You also mentioned middlemen. There has also been talk about oligarchs controlling the supply chain. Earlier, you have spoken about these issues. But it seems that you (the government) haven’t been able to break this chain. What is the reason behind this?

Finance Adviser: We are trying to break the chain. We have to rely on a few government agencies, which are not sufficient. The controlling market cannot be effectively managed through TCB cards or by deploying deputy commissioners and UNOs. They go once and then leave. The main issue is that the public needs to be more aware.

I am collecting data—from Mahasthangarh to Kangshanagar in Comilla—on how much cauliflower is being sold. In some places, it's sold for Tk10, and sometimes even at Tk 2-3. But in Dhaka, people are buying it for Tk20. We raise prices (at the grassroots level), and the farmers are suffering.

It is also true that the police are not as active as before. We can’t utilize them as easily for certain tasks, like sending them to the markets to detain the price manipulators.

BBC Bangla: Before you took office, Non-Performing Loans (NPLs) were a massive issue in Bangladesh’s banking sector. On one hand, large amounts of loans have defaulted, while on the other hand, small entrepreneurs can’t get credit. But so far, the government hasn’t taken significant initiatives to recover these defaulted loans.

Finance Adviser: This is a problem. Due to these bad loans, many large defaulters have fled the country, and they can’t be caught. Moreover, they don’t have many assets left. Just yesterday, I held a meeting regarding Beximco Group, and altogether, we found assets worth around Tk 4,500 crore.

They took Tk 23,000 crore from Janata Bank alone. Overall, they have taken at least Tk 50,000 crore. Now, I have a question for the bank, how were they given so much money without any proper evaluation?

Bangladesh Bank is trying to identify loans that have no chance of being recovered. Those loans may be set aside. While for others-especially the large ones-special committees have been formed to deal with defaulters who are still in the country.

Suppose, they are now defaulter for a house or two. Bangladesh Bank is offering regulatory adjustments under regulatory 4-B. If a company has four units, but only two are flagged in the Credit Information Bureau (CIB), we are telling them to continue making loan payments to resolve the issue.

For this, money, funds are needed now. Where will the money come from? So far, we have provided Tk 22,000 crore in financial support to six banks to return depositors' money and partly to inject liquidity into the system.

So what are we doing now? There are some well-performing banks (private). The World Bank will provide these banks with a $1 billion guarantee.

BBC Bangla: Will weak banks receive any support?

Finance Adviser: No, they won’t get it. The funding will go to banks like HSBC, Citibank N.A., etc.

BBC Bangla: But these banks don’t have any issues.

Finance Adviser: They have a positive outlook on Islami Bank. Despite its massive portfolio, some parts of it are still performing comparatively well. For the small banks, we are providing them with some funds. Through this, we are utilizing the resources to some extent.

BBC Bangla: During the Awami League government, large-scale loan approvals were given, and even before that, similar actions took place, which sparked heavy criticism. At the same time, there has also been criticism about printing Taka to keep banks afloat. Now, Tk 22,000 crore has been injected into banks in a similar way. Why did you do this?

Finance Adviser: I had to provide the funds. But this was not simply printed money. It has been neutralized. This is not printed hard cash. This is basically in terms of Treasury Bills and Treasury Bonds. It is not 100 percent cash. It’s not like printing Tk 100 suddenly turns into Tk 500.

At present, the government is not taking large loans from the banking sector. Previously, out of the Tk 60,000 crore, the majority was borrowed by the government. However, this Tk 22,000 crore was not given to the government. It was provided to the private sector. And they are producing something. So, that is not completely money creation. What we are doing is sterilization—meaning that while we are injecting money, we are also controlling liquidity in other ways.

BBC Bangla: Let’s return to the issue of inflation. Prices are already high, yet your government has decided to impose new VAT on some goods. Why was this decision made? Won’t it increase people’s expenses?

Finance Adviser: The VAT we have imposed won’t immediately impact inflation for most goods—except for a few specific products. Just because the budget was announced doesn’t mean inflation will instantly rise.

BBC Bangla: Prices of many items have hiked. For example, fruit prices have gone up, and bakery goods have also become more expensive.

Finance Advisor: For example, if the price of a pound of biscuits in Bangladesh exceeds Tk 200… But Yusuf Bakery’s biscuits don’t cost Tk 200. You spend Tk 40-50.

My argument is that Bangladesh is a most least-taxed country in the world compared to Bhutan. So, we can’t simply avoid increasing taxes based on income tax rates alone.

This is just the beginning. The VAT increase is only for TK 12,000 crore whereas the overall revenue target is several lakh crore Taka. That’s why we need to rationalize VAT. No country in the world has VAT rates as low as 2.4 percent, 5 percent, 7 percent, or 7.5 percent.

In most countries, the minimum VAT rate is 15 percent. We were considering increasing the 5 percent rate to 10 percent or 10.5 percent. Some products already have such adjustments. So, we aimed to rationalize the VAT structure slightly. Additionally, I will try to reduce depending on VAT in the budget. Since VAT affects ordinary people and essential goods the most, I will focus more on income tax instead.

BBC Bangla: You were talking about income tax collection. A major problem in Bangladesh is that the number of taxpayers is very low. You mentioned that the proportion is extremely small. On the other hand, another issue is that those who pay taxes regularly and correctly have been burdened more and more every year, especially salaried employees.

For example, last year, the highest income tax rate was increased from 25 percent to 30 percent. This shows that the burden on salaried taxpayers is increasing. But the number of taxpayers is not. Will you take any measures to address this? Will you consider reducing this burden, or will you increase it further?

Finance Adviser: We will definitely expand the tax net. First, tax leakage is a big issue—many people who should be paying taxes, and in the amount they should, don’t pay the full amount. Because they settle it under the table. This is a major weakness in our tax collection system. The actual tax collected is far less than what we estimate should be collected. We are working on digitizing the NBR. This year, we received 1.2 million tax returns online.

We have already digitized personal income tax filings, but corporate tax filings are yet to be digitized. This will take more time because corporate taxation is complex. Once this is implemented, taxpayers won’t need to visit officials in person, which will reduce corruption.

Another sensitive issue is that many taxpayers pay excess tax but don’t get returns. In other countries, when someone pays more tax, they receive a return or an adjustment in future tax filings.

Here, only authorized VAT payers receive returns, but others do not. That’s why even small businesses like sweet shops hesitate to pay taxes. For example, flour and wheat-based products should have been taxed before reaching small retailers, but in reality, they are taxed at the final sale point. This is a problem.

It has already been decided in the Cabinet that I am separating tax policy and tax administration. NBR will only collect taxes. And policy is you will be done by a different body, independent.

In 2008, a decision was made to separate tax policy from administration. But it was never implemented because NBR officials opposed it. They said, “We will make our own policy.”

If I make a policy myself, I will do it according to my wish. I will impose a tax on someone. This is adjudicated and I will do it, right or wrong. That doesn't happen. Policymakers will decide.

This will benefit businesses, too. Currently, businesses have to lobby NBR officials to reduce their tax burden. In the new system, they will simply follow a predefined tax policy, and tax officials won’t have discretionary power to make changes. This is the policy, this is the rate.

BBC Bangla: So, you were saying that you will expand the tax net, meaning the number of taxpayers will increase.

Finance Adviser: Yes, we will increase the number of taxpayers. At the same time, we are changing the system. Digitization plus administration and tax collection will be different jobs.

BBC Bangla: Can it be said with certainty that tax collection will increase?

Finance Adviser: Yes, it will increase.

BBC Bangla: Will the amount collected from taxpayers increase? Are you considering raising it beyond the current 25-30 percent?

Finance Adviser: I am not thinking about that. I am focusing on increasing the tax-to-GDP ratio.

BBC Bangla: A large portion of the budget's operational expenses goes towards the government's operations. There's been a lot of criticism and discussion about this. Will you focus on this and try to reduce the government's operational expenses, or is that not possible?

Finance Adviser: We will definitely try. Government operational expenses include salaries and allowances. We have already started making changes. For instance, buying new cars, building new buildings, and large infrastructure projects are all now stopped. We are allowing purchases only when necessary. For example, 300 police cars were damaged, so we are permitting their replacement.

The Ministry of Foreign Affairs said we need cars for ambassadors. I said no. We will rationalize things. In the revised budget, I am already taking care of that. In the next budget, I will focus on how much we can reduce.

Secondly, we plan to avoid large mega-projects. We are continuing with those already in the pipeline, like the Matarbari and Mongla projects.

We will focus on projects that develop local and regional infrastructure, markets, and production facilities. We are looking at boosting the local economy and creating employment opportunities.

BBC Bangla: Since the fall of the Awami League government in August and your assumption of office, many demands have been raised for increased salaries, nationalization, etc. In some areas, you've promised to take action. How will you manage the additional expenses that will arise from these promises? These are long-term costs that will be incurred.

Finance Adviser: Political government didn't address these issues. What we are giving now is very minimal, and these people were completely deprived before. We are not touching the pay commission right now, nor are we planning to increase pay. This is not our job. When the political government comes in, they will form a pay commission. The last one was in 2015.

BBC Bangla: So, there won’t be any salary increases for government employees?

Finance Adviser: (Shakes head to indicate no) Only things like overtime for school and college teachers, and some other aspects we will consider if possible. But this will remain within a set framework, and we will not change the pay scale.

However, I will not reduce allocations in the social sector. We have commitments in education, IT, health, and social welfare, and we will not cut allocations for these sectors. Even our financial donors have told us, “You can undertake infrastructure projects and take budgetary support from us, but do not cut allocations for these sectors.”

BBC Bangla: Let’s talk about the budget. The Chief Advisor has hinted that elections could take place at the end of this year or early next year. That means the budget you announce this year will have to be implemented by the next elected government. In this context, do you plan to consult with political parties?

Finance Adviser: We will prepare the budget for a full year. Budgets are not made for six months. If the next government decides to revise it after six months, they can do so—just like we make revised budgets.

I will present the budget in June, but discussions will start in March or April. First, I will consult with chambers of commerce and business representatives. Then, I will also speak with other stakeholders, as the chamber body does not fully represent small-scale businesses.

I want to discuss different types of business bodies. That means talking to people from all sectors. Especially business people.

BBC Bangla: What will be the budget process, as there is no parliament now? How will it be done?

Finance Adviser: There has been a budget before during the caretaker government. It has been announced through the media. I will talk to the Advisory Council. If they say that they will talk to the political parties on a large scale, then we can share it as it’s the most expensive one.

Ultimately it will be an administered budget. We will announce it, and then implement it, as long as we are here.

BBC Bangla: For the last few years, we have been observing the currency depreciation. Will this trend continue this year?

Finance Adviser: The foreign reserves are very stable. It was decreasing and coming down a lot. I came to the duty and saw that there was a debt of about 500 million dollars due to LC. It is now decreasing and coming down to 500 million. Now the dollar rate is between Tk 120 to Tk 123, and it is crawling.

BBC Bangla: Do you think it will be under control? Can you handle it?

Finance Adviser: We are observing for now. If we leave it at all, as it went to Tk 400 in Sri Lanka, as it happened in Pakistan, then we will not be able to make an effort. It will remain within the crawling corridor. It will remain fairly stable. We’re observing it...It will be kept within that corridor.

BBC Bangla: If we talk about domestic investment, there is a slow pace in investment. At the same time, there has been an increase in interest rates - which the businessmen talk about. Along with that, they talk about law and order. How will you handle these issues?

Finance Adviser: This is also a major concern for us. If we do not stimulate business, then we will not be able to collect taxes. Employment... that too... The main issue is that interest rates are high now. But the issue is to reduce corruption... If transportation costs are reduced a little if waiting costs are reduced... Earlier, the interest rate was nine percent, even then the businessmen would complain. Overall, reducing the business costs is the point... If we don't provide small funds to small business owners, they won't be able to create employment.

The key for business owners is confidence, and consistency of policy; then business will be a little better.

BBC Bangla: Domestic investment has slowed, and foreign investment has dropped significantly—by 71 percent in the first quarter since you took office. What steps will you take to address this?

Finance Adviser: Initially, the situation was unstable, with regulatory inequities and uncertainty. Investors were unsure of what to expect.

Take the Korean EPZ, for example. They faced land plot issues for 15 years, uncertain about whether they would receive the land or not. Now, with the land registry resolved, they are smiling. We are working to simplify land and contract processes. Once that happens, investors will come.

BBC Bangla: When do you expect foreign investor confidence to return?

Finance Adviser: After the revised budget is finalized, we will have a clearer picture. As the budget discussions start around March-April, we will be able to outline our policies.

BBC Bangla: Repeated manipulations in the capital market have eroded public trust. How do you plan to restore investor trust?

Finance Adviser: The Securities and Exchange Commission has already taken steps by fixing the floor price for certain stocks affected by previous irregularities. Z-category stocks, which were causing instability, have been restricted.

We are working to eliminate corruption from the market. Investors have witnessed sharp price fluctuations—prices rise, then suddenly drop. Cases like the Sukuk bond, where Beximco took Tk 3,000 crore from the ICB Mutual Fund, have left lasting impacts. We are addressing such issues and bringing in new IPOs to improve market stability.

BBC Bangla: Is the capital market currently a secure place for investors?

Finance Adviser: We have several good stocks. However, small investors often lack proper guidance. The key is to invest wisely.

BBC Bangla: The new US administration’s monetary policies naturally influence global markets. Do you think the Trump administration's conservative economic and trade stance will affect your country?

Finance Adviser: The impact will be minimal. The US already has policies in place regarding our exports, and conditions are unlikely to worsen further. The aid we receive from the US is purely bilateral.

I recently spoke with Gap representatives, and they assured me they are committed to Bangladesh. If they consider relocating, their alternative is a "China Plus One" strategy. They remain confident in the Bangladesh market.

BBC Bangla: One of the main themes of the July uprising was eliminating inequality. Over the past few decades, wealth inequality in Bangladesh has become severe, with a significant share concentrated in the hands of a few—often acquired through corruption. How optimistic are you about addressing this?

Finance Adviser: It must be addressed. The reality is that while our economy has grown, the benefits have not reached everyone. Income inequality is a concern, but wealth inequality is even worse. Some individuals own 50 apartments-houses—both domestically and abroad. This must stop.

We are not expecting extremely high growth rates of eight or nine percent. We estimate growth at around 5.52 percent. The goal is for the benefits to reach farmers, women workers, and small traders—not necessarily equally, but equitably.

I envision a welfare-oriented state, where people’s well-being is not just measured in food security but also in healthcare and overall quality of life. That is possible, and we must work toward it.