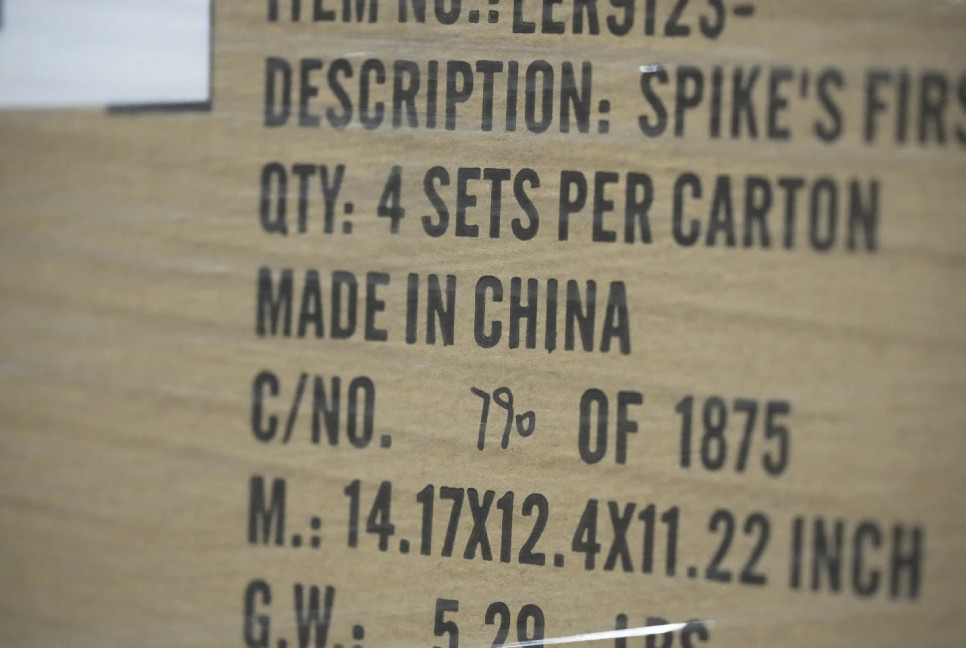

Chinese manufacturers of plastic Christmas trees and other festive goods say they haven’t received any orders from their U.S. buyers so far—and they fear they may not get any at all, according to Reuters.

The delay comes amid soaring US import tariffs, with US President Donald Trump ramping up levies on Chinese goods by 104% this year alone.

Manufacturers across China have expressed concerns as international clients lower, pause, or even cancel orders.

“By mid-April all the orders are normally finalised,” said Qun Ying, who runs a Christmas tree factory in Jinhua, eastern China. He was quoted as saying to Reuters, “But right now ... it's hard to know if any orders are coming. Maybe American customers won’t buy anything this year.”

Across the festive supply chain, manufacturers are reporting a standstill. Jessica Guo, also based in Jinhua, said one of her major American buyers has just paused a 3 million yuan ($408,191) order after spending 400,000 yuan on materials.

“I expect that order will soon be cancelled,” she told Reuters. “My peers and I rely on U.S. orders to survive. This will inevitably affect a lot of people. No one can escape.”

Guo noted that domestic demand for Christmas decorations in China is negligible. “Losing the U.S. market will definitely impact many people’s jobs,” she said.

Her 10,800-square metre factory usually employs 140 people, with the workforce swelling to 200 during the summer peak. This year, she doesn’t expect to hire extra staff.

US retailers source 87% of their Christmas decorations from China, amounting to roughly $4 billion annually. Meanwhile, Chinese factories sell about half of their stock to the US market. This dependency on each other is now being tested by the escalating trade war.

Now that tariffs have been slapped on countries like Cambodia — which supplies just 5.5% of America's Christmas decorations — shoppers in the US could be left with emptier shelves and higher prices.

“If Americans want new Christmas decorations this year, they will have to pay a lot more for them — if they can find them on the shelves at all,” one exporter told Reuters.

In the Chinese city of Shaoxing, factory owner Liu Song is attempting to adapt by shifting his focus away from the US.

“We are worried that U.S. orders will come down,” he said. “But we will definitely win this trade war.”

Song is now targeting markets in Russia, Europe and Southeast Asia, which already take in 75% of his products.

Economists predict the trade war will shave 1–2 percentage points off China’s economic growth this year. As Chinese exporters lose US orders, they’re likely to slash prices to stay competitive elsewhere — squeezing already-thin profit margins and threatening jobs at home.

Source: Times of India

Bd-pratidin English/ Afia