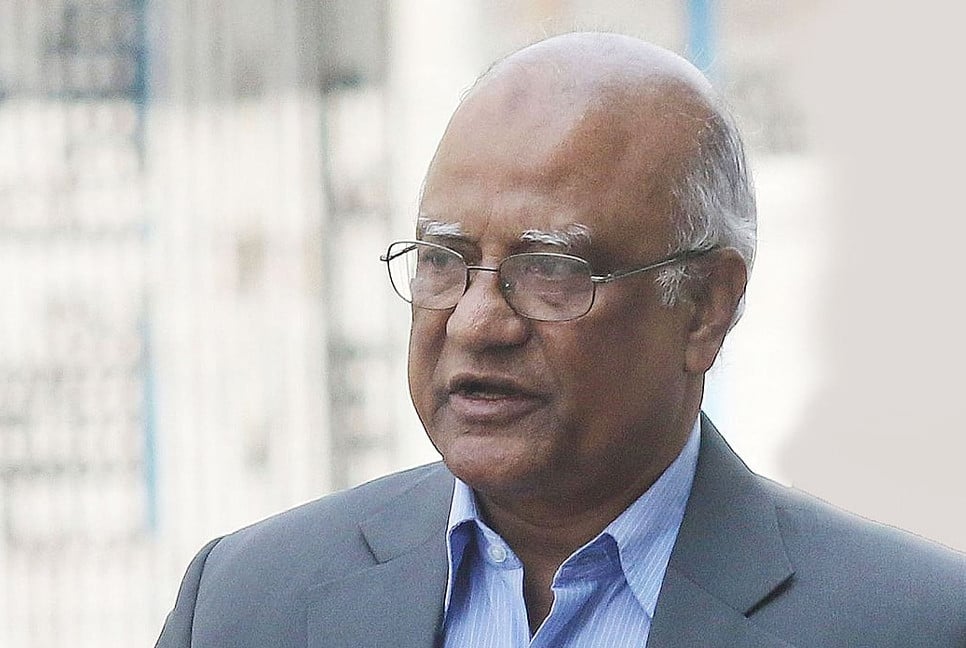

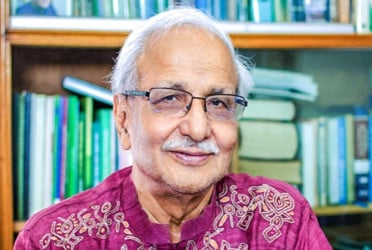

Former governor of Bangladesh Bank (BB) Dr. Salehuddin Ahmed on Monday said that not repaying bank loans has emerged as a new business model specific to the Bangladesh economy, reports UNB.

He said this while speaking in a discussion meeting titled 'Economic Pattern and Proposed Budget 2024-25' organized by the Editors Council and Newspaper Owners’ Association of Bangladesh (NOAB) on Monday.

"You will take a loan for your business from the bank and not pay it back. This model of defaulted loans is now the business model.”

Commenting that there is no innovation in the proposed budget to mitigate the ongoing macroeconomic instability, Dr. Salehuddin said, "The budget comes at a challenging time, but I don't see anything new in it that seeks to face these challenges.”

"The figures of the previous budget have only been adjusted here. It is being said that the budget is contractionary, but seeing the budget deficit, it does not seem contractionary," he said.

Reliance on bank loans to meet the budget deficit has increased and this will have a negative impact on the private sector, said Salehuddin.

He said, “If the government takes more loans, how will the private sector get loans? And if the private sector does not get loans to expand enterprise, how will there be employment?"

The former BB governor thinks that the small and medium industries (SME) sector will also be affected due to the proposed budget.

Criticising the 1,285 new projects that have been taken up in the proposed budget, Dr. Salehuddin said that if it is halved, the government's debt dependence and budget deficit will be reduced. No solid steps are seen in the policy strategy and philosophy of the budget, which very essential in this crisis time.

The budget should be performance-based. Some organizations must be closed if necessary. And some companies have to reduce their manpower. There is no use in just throwing around the budget figures, he pointed out.

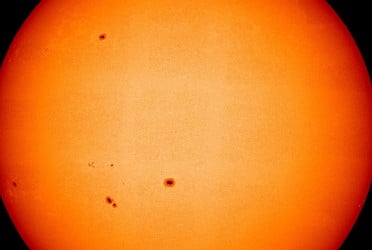

“Tough steps have to be taken to resolve the crisis that should be transparent like sunlight, other than, the problem would not be overcome,” he added.

Dr. Salehuddin believes that inflation cannot be brought under control with the advice of the International Monetary Fund (IMF) by increasing the interest rate and the market-based dollar exchange rate and contractionary monetary policy.

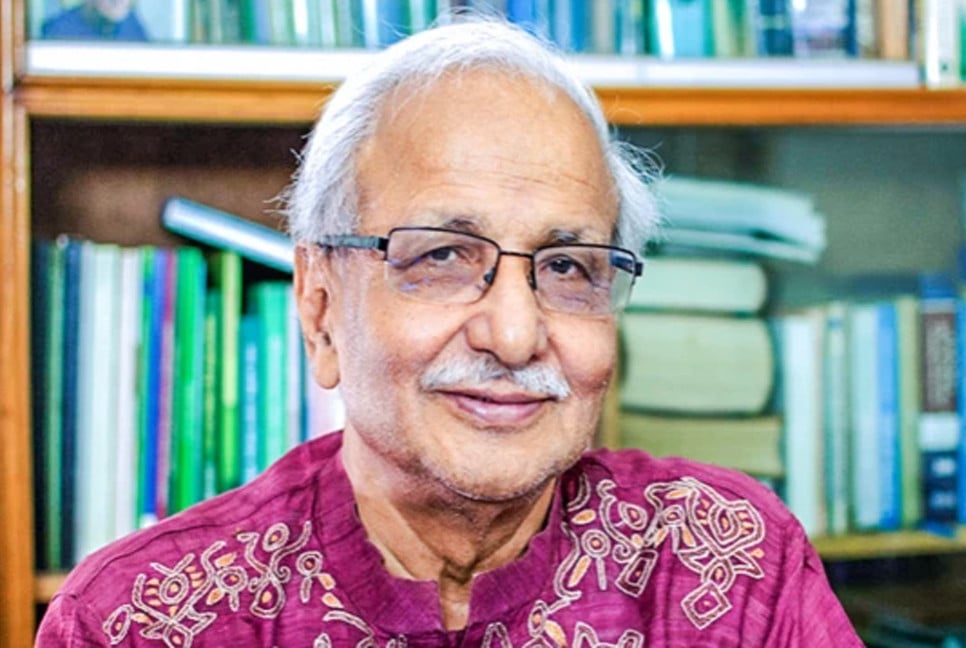

Former adviser of the caretaker government Dr. Wahiduddin Mahmud, Comptroller and Auditor General Mohammad Muslim Chowdhury, and CPD Executive Director Dr. Fahmida Khatun, among others, spoke at the program.

Bd-pratidin English/Tanvir Raihan