Mexico’s state oil company Pemex is in talks with potential buyers in Asia and Europe, including China, as it looks for alternative markets following US President Donald Trump’s 25 per cent tariffs on Mexican crude, a senior government official said.

Last year, 57 per cent of Pemex’s 8,06,000 barrels per day (bpd) of crude exports went to the US. In January, exports dropped 44 per cent year-on-year to 5,32,404 bpd, the lowest in decades. While Mexico already exports crude to India and South Korea, the US remains its primary buyer.

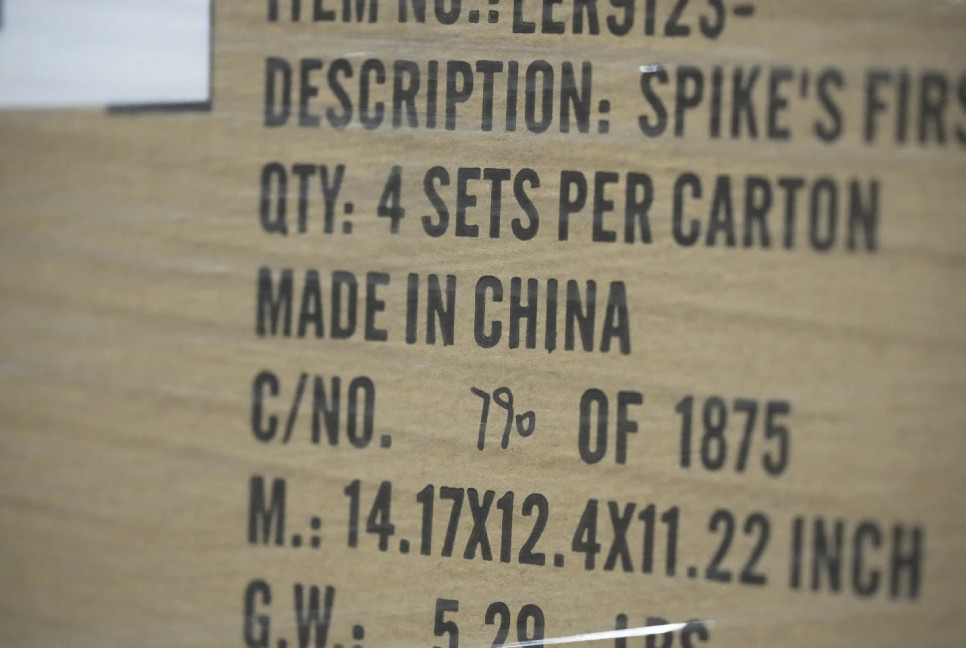

Pemex is now exploring new deals in China, India, South Korea, and Japan, despite higher shipping costs. A source at PMI Comercio Internacional, Pemex’s trading arm, said Asian refineries are better equipped to process Mexico’s heavy sour Maya crude.

Government officials confirmed that no discounts will be offered to retain US buyers. Once current contracts expire this month, shipments will likely shift to Asia and Europe.

Mexico faces declining oil production, with output from its aging Gulf fields at a 40-year low. Meanwhile, delays at the Olmeca refinery in Dos Bocas have left the country dependent on fuel imports from the US.

Without major investments in exploration and production, Mexico may even have to import crude in the future to sustain its refinery expansion—an unexpected shift for the oil-rich nation.

Bd-pratidin English/FNC