Hundi transaction in the country has become reckless through a payment service provider ‘TallyPay.’ As their transaction has increased thrice, Bangladesh Bank is looking into the matter. According to the central bank officers, Bangla QR system has been introduced to enhance the digital payment transactions. However, its illegal use has been started, which is creating big risk in the ecosystem of digital transactions. Some MFS agents is engaged in non-permitted transaction through Bangla QR by using e-wallet TallyPay owned by Payment Service Provider organization ‘Pragoti Systems Limited.’

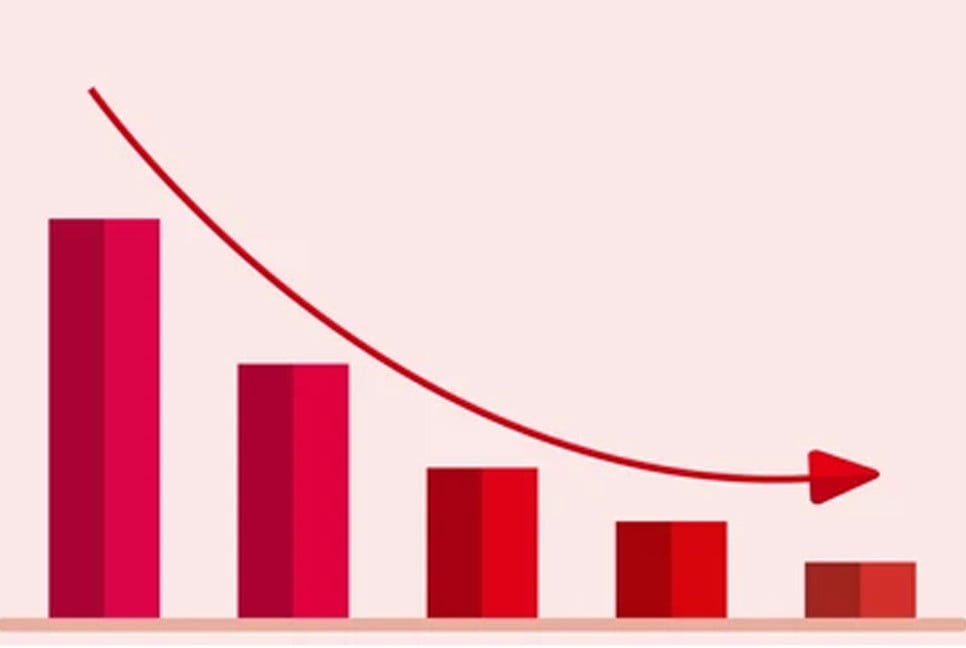

Customers who come to cashout (withdraw money) at these MFS agent points are asked to pay through TallyPay Bangla QR code instead of cashout. That is, large sums of digital money are being converted into cash through payment without buying any product or service, which are encouraging illegal transactions. As a result, agents are making illegal money by accepting payments instead of providing traditional cashout services. On the other hand Pragati Systems Limited is earning fixed fees against fake payments. Converting digital money into cash in this manner is in violation of MFS regulations and poses serious risks of money laundering and terrorist financing as the transaction is illegal. At the same time, unauthorized transactions through Bangla QR codes are also spoiling the reputation of the MFS sector. TallyPay’s suspicious transactions were discussed in detail in the latest meeting of Bangladesh Bank's Payment Systems Department. Bangladesh Bank decided to look into the unusual transaction besides sending show cause notice to Talipay. It is reported that even though the daily limit of MFS cashout is Tk 25 thousand, digital money is being converted into cash through large amount of payments using TallyPay Bangla QR. Sometimes the same person is withdrawing huge amount of cash beyond the limit through transactions of large amount (30 thousand, 50 thousand or 1 lakh taka).

Stakeholders say that such transactions by avoiding the cashout limit set by Bangladesh Bank are harming the important cashout services of MFS, destroying the business environment as well as creating risk of money laundering and financing of terrorism as MFS institutions are constantly monitoring transactions and reporting any suspicious transactions to Bangladesh Bank. Cash withdrawals through TallyPay’s Bangla QR in the name of digital payments remain unmonitored and there is no evidence of large withdrawals, which could disrupt the digital transaction ecosystem. It has been seen from the market that the Bangla Merchant QR has been placed at the MFS agent points in TallayPay to facilitate questionable transactions. Such unauthorized transactions were found from field investigation. Perfect telecom is operating near the entrance of Kadirabad housing in Katasur area of Mohammadpur. In this shop, cash withdrawal is going on by accepting unauthorized payments using TallyPay’s Bangla QR. Even without selling any product or service, the shop takes huge amount of money as payment throughout the day and gives it to the customer as cash. The same scenario was seen at Majumdar Store near Mohammadia Housing in Mohammadpur. Not only are these two shops, many agent points across the country also running unauthorized cashout business using TallyPay's Bangla QR. The issue of unusual transactions through TallyPay’s Bangla QR has also come up in the meeting of Bangladesh Bank's Payment Service Department (PSD) and TallyPay. In the meeting, Bangladesh Bank demanded an explanation about the increase in the amount of transactions almost three times. At that time, MFS agents are only involved in cash in and out operations. They are directed not to be on boarded as merchants of TallyPay and close the on boarded merchant accounts and inform Bangladesh Bank. In addition, micro merchants who have been irregularly converted into 'Regular Merchants' and issued Business Identification Number (BIN) are asked to provide the micro merchant BIN. The issue of TallyPay’s claim of Super QR without following the guidelines regarding Bangla QR logo also came up in the discussion. In the meeting, TallyPay was instructed to comply with all circulars and license conditions of Bangladesh Bank. Later, Bangladesh Bank also issued a warning letter to TallyPay in this regard.

Pragati Systems Ltd. has provided mobile banking services with a license as a Payment System Operator (PSO) and a number of commercial banks also introduced such services including a service named 'Sure Cash' before launching in TallyPay. "Sure Cash" suddenly decided to stop operations, as a result of which the contracted institutions were suddenly in trouble.

(Translated by Lutful Hoque)