Bangladesh’s apparel sector has thrived largely due to duty-free market access in developed countries and cheap labour. These factors attracted Western buyers to place their orders in this South Asian country.

However, that competitive benefit is now narrowing. Global trade dynamics shifted in the wake of US countervailing tariffs. Industry insiders believe India and Pakistan will gain a better edge in apparel exports to the US since the counter-tariffs imposed on these two countries are lower than Bangladesh.

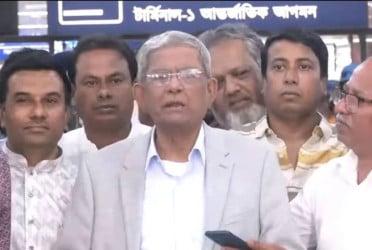

Additionally, BKMEA President Mohammad Hatem noted that during the political unrest in July 2024, some factories had to shut down, prompting buyers to shift orders to neighbouring countries.

Moreover, after the July-August uprising, labour unrest also led to further factory closures. Just as Bangladesh was beginning to recover export momentum in the current year, the US counter-tariff measures changed the equation entirely.

Already, some buyers are asking to hold off on their orders. Given the lower tariff rates in India and Pakistan, a portion of future orders may be diverted to these countries.

According to the latest data from the World Trade Organization (WTO), China is the world’s top apparel exporter. Bangladesh ranks second globally, followed by Vietnam, Turkey, and India in third, fourth, and fifth positions, respectively. These five countries lead the global apparel export market.

In the US market, the top apparel exporters are China, Vietnam, Bangladesh, Indonesia, India, Mexico, Honduras, Cambodia, Pakistan, and South Korea. Among these, except for China and Vietnam, the rest are behind Bangladesh.

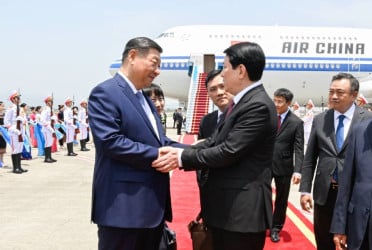

However, following the counter-tariff imposed by US President Donald Trump on April 2, India and Pakistan have emerged as significant threats to Bangladesh.

BKMEA Executive President Fazlee Shamim Ehsan explained, “The US President has imposed a 37 per cent counter-tariff on Bangladeshi goods, while for India and Pakistan, the rates are 26 per cent and 29 per cent, respectively. As a result, these two countries will enjoy a relative advantage over Bangladesh.”

According to the Office of Textiles and Apparel (OTEXA) under the US Department of Commerce, the United States imported $7.20 billion worth of apparel globally in January, a 19.46 per cent increase from the same period last year.

Among all competing nations, Bangladesh saw the highest growth – approximately 46 per cent – in apparel exports to the US. This growth outpaced even top exporters like China, Vietnam, Indonesia, and India.

During this time, China’s apparel exports rose by 13.72 per cent, Vietnam's by 19.90 per cent, India’s by 33.64 per cent, and Pakistan’s by 17.5 per cent.

Industry experts noted a potential shift in US apparel imports. They stressed that countries facing higher tariffs are likely to fall behind, while those with lower tariffs will advance in exports. Given the comparatively lower countervailing tariffs on India and Pakistan, their exports to the US may see further growth in the coming months.

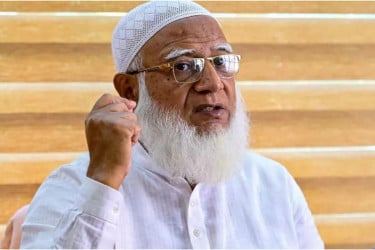

However, China and Vietnam remain Bangladesh’s real competitors in apparel exports. Since both these countries are imposed with higher countervailing tariffs than Bangladesh. Bangladesh might benefit from this relative advantage.

Ehsan pointed out that Vietnam is facing a 46 per cent counter-tariff, while the total tariff on Chinese goods, including countervailing duties, stands at 54 per cent. As these two countries are Bangladesh’s main competitors in the apparel sector, the higher tariffs on them may offer Bangladesh some relief.

Translated & edited by Fariha Nowshin Chinika