The Centre for Policy Dialogue (CPD), a think tank, in its traditional post-budget review on Friday said the proposed budget projected ambitious targets for both GDP growth and inflation, without putting forth any realistic measures to achieve them in light of global and domestic crises, reports UNB.

The CPD said budget focused on increasing tax-GDP ratio, but the revenue growth target is not realistic, so the volume of deficit financing will ultimately widen.

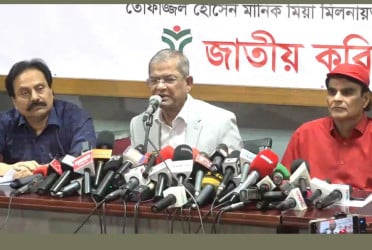

CPD Executive Director Dr Fahmida Khatun led the post-budget review, held at a hotel in Gulshan, and televised live on some tv channels.

She said the budget has been placed at a time when the macroeconomic stability of Bangladesh has weakened significantly.

“The macroeconomic stress is visible on lowering growth of revenue mobilisation and shrinking of fiscal space of current fiscal year (FY 2022-23), soaring borrowing from banks, higher price of daily essentials and decreasing foreign exchange reserve,” she added.

The private credit growth projected to 15 per cent in FY 2023-24 that was 14.1 per cent in 2022-23. As of April 2023, private sector credit growth was 11.3 per cent, she said.

Replying to a query, CPD’s distinguished fellow professor Dr Mustafizur Rahman said the revenue growth projection in 2023-24, compared with actual revenue achievement of FY2022-23, wpi;d be a massive 39 per cent, which is "absolutely ambitious" - perhaps even overambitious.

The budget’s growth projection occurred based on a wrong concept, so multi sectoral problems would arrive in the implementing stage of the proposed budget.

Mustafiz expected a monetary policy reflecting fiscal policy in light of the budget and controlling measures of higher inflation.

Khondaker Golam Moazzem, research director of CPD said the budget technically avoided the capital market development policy, which is very essential for such a developing economy.

“Without establishing a realistic and sustainable capital market, investment financing cannot grow, the government incentive based capital market cannot play a role in new investment in the capital market,” he added.

Towfiqul Islam Khan, Senior Research Fellow in CPD said curiously, no mention was found regarding the accumulation of external payments arrears or new forex reserve.

Details about critical reforms, including shifting towards market-based dollar exchange rate and interest rate and adoption of periodic formula-based petroleum product prices, have not been explained in the budget speech, he said.

The CPD projection said the budget of FY 2023-24 targets 15.5 per cent growth will be around 39.7 per cent growth target compared to the current budget achievement and Tk1.42 lakh crore is needed to be mobilized.

Bd-pratidin English/Tanvir Raihan