Over the past two years, the average interest rate on loans in the country has surged by nearly 5 percentage points, raising serious concerns among entrepreneurs and business owners.

The rising cost of borrowing is significantly impacting business expansion and investment decisions, with many firms hesitant to take out loans due to the financial strain.

The trend has contributed to a sharp decline in private sector credit growth, now at its lowest in a decade.

According to data obtained from Bangladesh Bank, the weighted average interest rate on loans stood at 7.24% in January 2023. By January 2024, it had increased to 9.75%, and by January 2025, the rate had surged further to 11.89%, reflecting a 4.65 percentage point rise over two years.

As a result, credit flow to private firms in January 2025 grew by only 7.15%, the lowest since at least 2015, according to Bangladesh Bank statistics.

Experts warn that higher interest rates are making it increasingly difficult for businesses to secure capital for expansion, new projects, and daily operations. The increased borrowing costs discourage long-term investments and new initiatives, as entrepreneurs fear the rising expenses could erode profits and hinder growth.

This slowdown in business activity could have broader economic repercussions, stifling innovation and development, they added. Industry insiders highlight that small and medium-sized enterprises (SMEs) are particularly vulnerable, as higher loan repayments strain their already tight cash flow.

Many businesses are now reconsidering their financing strategies, with some delaying or cancelling planned investments or seeking alternative funding sources such as equity financing or internal reserves, which are not always readily available.

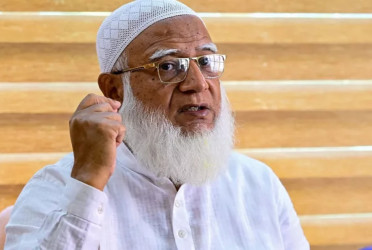

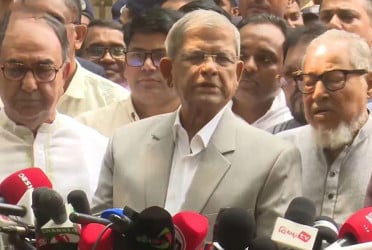

Mohammad Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), told the Daily Sun, “Many companies are operating at a loss, and production is being hindered by a severe gas shortage. If this situation continues, businesses will only be able to service loan instalments, leaving the principal amounts unpaid. Given the current economic climate, loan defaults are likely to rise, and new employment opportunities will shrink.”

Shams Mahmud, president of the Bangladesh Thai Chamber of Commerce and Industry, echoed these concerns, stating that the high interest rates and overall economic challenges have deterred many entrepreneurs from investing in new factories.

“The rise in interest rates is already negatively impacting new investments and business expansion. As we transition towards becoming a developing country, we must prepare for the challenges ahead. For that, proper financing is essential. If interest rates remain high, no company will take out loans,” he said.

Interest rates rising at an alarming pace

Bangladesh Bank data shows that the average lending rate in the banking sector surpassed 11.89% in January 2025. In January 2024, it stood at 9.75%, but by February, it had crossed into double digits at 10.05%. The upward trend continued in subsequent months: March (10.36%), April (10.53%), May (11.28%), June (11.52%), July and August (11.57%), September (11.70%), October (11.77%), and November and December (11.84%).

In April 2020, Bangladesh Bank capped bank loan interest rates at 9%. However, economic disruptions caused by the COVID-19 pandemic and geopolitical conflicts led the central bank to introduce the SMART rate in June 2023, linking loan interest rates to the six-month average yield of 182-day treasury bills. Since its implementation, interest rates have steadily risen.

In May 2024, the regulator abandoned the SMART rate formula and returned to a market-driven system, granting banks the authority to set lending rates based on bank-client relationships, loan demand, and the availability of funds.

Private sector credit growth at a decade-low

Private sector credit growth in January 2025 dropped to 7.15%, the lowest in a decade, compared to 9.84% in January 2024. This figure was 2.65 percentage points below Bangladesh Bank’s target of 9.80% for the second half of the 2024-25 fiscal year.

As of January 2025, total outstanding private sector credit stood at Tk1,680,110 crore, up from Tk1,567,943 crore in January 2024.

The slowdown reflects banks’ cautious lending approach amid economic uncertainties and businesses’ reduced appetite for investment.

Source: Daily Sun

Bd-pratidin English/ Afia