Efforts to restore business confidence and revitalise trade and investment remain incomplete, even after six months of the interim government.

Industry insiders said that they are grappling with multiple challenges including LC delays, currency fluctuations, high loan interest rates, VAT-related harassment, rising taxes, costly trade licence renewals, worsening law and order, and severe traffic congestions.

Besides, the flow of foreign direct investment (FDI) in Bangladesh also came down to a six-year low of $104.33 million in the July-September quarter of the current fiscal year 2024-25 owing to an unfavourable business environment.

Economists said the uncertainty intensified among businessmen and investors in the last six months amid the crisis in macro-economy which has been prevailing for the last few years.

They highlighted that investors may wait for an elected government to get back their confidence fully for making investments in the country.

Manufacturing industry’s woes

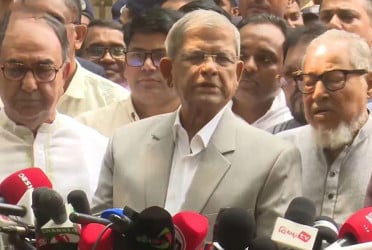

Talking to the media, former president of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) Mir Nasir Hossain said, “Following the regime change, we expected a more business-friendly environment. However, significant problems remain in the country.”

A mass uprising led to the removal of the fascist Sheikh Hasina on 5 August 2024. Subsequently, Nobel Laureate Professor Muhammad Yunus assumed the role of interim government head on 8 August 2024.

“The interim government faces enormous challenges in addressing the irregularities and corruption of the previous administration. The former government destabilised the banking sector. While the current administration is striving to rectify this, success remains limited. Access to finance has decreased, while bank interest rates have surged,” he added.

Nasir, also managing director of Mir Akhter Hossain Ltd, pointed out that law and order have not significantly improved in the past six months, as the police force has yet to become fully effective. As a result, business confidence remains low.

“However, we need a consistent supply of gas and electricity at reasonable prices for the manufacturing sector. The government should consult with the business community before setting energy prices. An uninterrupted gas supply is essential,” he added.

Bangladesh Chamber of Industries (BCI) President Anwar-Ul-Alam Chowdhury Parvez said, “At present, we are struggling with rising energy costs, high inflation, and prolonged supply chain disruptions. The government should introduce business-friendly policies after consultations with stakeholders to mitigate these issues.”

He stressed the need for government support to protect industries, generate employment, boost the economy, and attract foreign direct investment (FDI).

Former director of the BGMEA Mohiuddin Rubel said, “Businesses are struggling with multiple challenges. The interim government must take decisive action to ensure security and eliminate corruption at all levels to improve the business climate.”

He added, “New investments are not coming in due to high bank interest rates, a lack of security, and rising inflation. The situation remains unstable. Business owners require security to operate. Thus, instability and extortion must be curbed to enable smooth business operations.”

Economic outlook and investor sentiment

Speaking to the media, Policy Exchange Bangladesh Chairman Dr M Masrur Reaz said the economy and business environment remain in a precarious state following the mass uprising, with the macroeconomic crisis persisting for several years.

He noted that new concerns and challenges have compounded the economic turmoil over the past six months.

“The government has taken a number of positive, pro-people decisions regarding governance and regulations to address these challenges. However, economic stability has not yet been achieved. This is primarily due to the extensive corruption and financial mismanagement of the previous administration,” he added.

Dr Masrur explained that the economy has not fully recovered from the challenges prevailing since 2022. The banking sector remains fragile, as the former government destabilised financial institutions through corruption and mismanagement. Furthermore, there was a lack of people-centric policy decisions before the mass uprising of 5 August 2024.

“To control inflation, the government has had to tighten monetary policy, leading to increased interest rates and decreased domestic demand. However, the interim government has made some positive moves, such as halting the depletion of foreign reserves. Nevertheless, the current reserves of $19-$20 billion remain insufficient, making it difficult to tackle ongoing economic challenges. As a result, imports must be restricted,” he said.

He further noted that the government has yet to fully address issues within the banking sector, leaving some institutions vulnerable. Additionally, frequent industrial unrest and protests by various stakeholders have further eroded business and investor confidence.

“The establishment of reform commissions was a positive step, but the lack of immediate short-term reforms has prolonged existing issues. Law and order must now be restored. Foreign investors seek stability and confidence before committing to new investments. Many are waiting for an elected government before making long-term commitments,” he opined.

Plummeting FDI

Bangladesh received FDI of $104.33 million in the July-September quarter of FY 2024-25, down from $156.67 million in the same period of FY 2019-20. The total FDI inflow in FY24 was $1.4 billion, compared to $1.6 billion in FY23 and $1.7 billion in FY22, according to Bangladesh Bank data.

President of the Foreign Investors’ Chamber of Commerce & Industry (FICCI), Zaved Akhtar, told the media that the past six months have been particularly challenging for businesses and FDI. He noted that the regime change and installation of the interim government had a significant impact on investor sentiment.

“At present, law and order and energy security remain the biggest concerns for existing investors. Unless these issues are effectively addressed, investors will remain cautious. Existing investors act as ambassadors for potential new investors, and their confidence has a major influence on incoming investment decisions,” he stated.

Zaved, who is also Chairman and Managing Director of Unilever Bangladesh, explained that Bangladesh has experienced economic mismanagement over the past few years, eroding investor confidence and discouraging new investments.

“The July-September period was particularly challenging, with significant instability further denting investor confidence. Many investors chose to adopt a ‘wait and watch’ strategy rather than committing to new projects. For long-term growth, continuity, stability, and a favourable government policy towards investment and industry are essential,” he added.

Pressure on SMEs

Dhaka Chamber of Commerce & Industry (DCCI) President Taskeen Ahmed highlighted the pressing economic challenges facing Bangladesh’s private sector, which threaten growth and stability.

He suggested that streamlining trade and customs processes, simplifying business registration, and improving credit access for cottage, micro, small, and medium enterprises (CMSMEs) would enhance efficiency and attract investment.

Courtesy: Daily Sun.

Bd-pratidin English/Tanvir