The United States State Department has expressed interest in understanding the trajectory of public-private partnerships in Bangladesh's economic development and the ongoing recovery process.

The U.S. government is poised to offer policy support to bolster this sector, while the World Bank has also pledged assistance for the growth of the private sector.

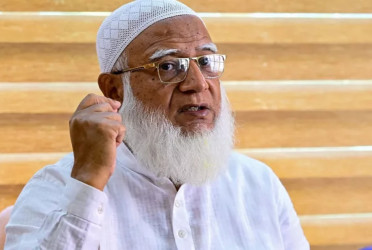

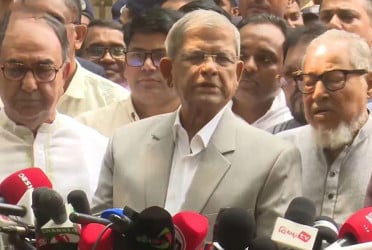

These insights were shared by Bangladesh Bank Governor Ahsan H. Mansur following a meeting with various professionals at the Bangladesh Embassy in the U.S. on Thursday.

Earlier, Mansur participated in several bilateral discussions with representatives from the State Department and the World Bank during the ongoing annual meetings of the World Bank and IMF in Washington, D.C.

Post-meeting, Governor Mansur said that both the World Bank and the U.S. have agreed to provide policy support for advancing public-private partnerships in Bangladesh, a request initiated by Bangladesh.

Mansur underscored that individuals who have embezzled funds and laundered money abroad will not evade accountability.

Bangladesh Bank is committed to identifying and recovering such assets, ensuring that misappropriated funds are returned, whether they are located domestically or internationally.

Ten foreign firms have been selected for asset valuation, with one firm to be appointed for this critical task.

In the face of a severe liquidity crisis, Mansur commended bank customers for their patience, emphasizing that they refrained from violent actions against institutions during this challenging period, which he considers fortunate.

He also highlighted that international collaboration is being sought to implement vital reforms in Bangladesh's banking sector.

Regarding interest rates, Ahsan H. Mansur stated that if inflation decreases like the U.S., it will be possible to reduce interest rates in the country after six months as well.

On October 22, Bangladesh Bank announced an increase in the policy interest rate by 50 basis points, raising it from 9.50% to 10%, effective October 27.

Furthermore, to enhance liquidity management, the upper limit of the interest rate corridor for the Standing Lending Facility (SLF) has been adjusted from 11% to 11.50%, reflecting a 50 basis point increase.

Similarly, the lower limit for the Standing Deposit Facility (SDF) has also increased by 50 basis points, from 8% to 8.50%.

Starting next month, Bangladesh Bank will initiate internal asset valuations of the nation’s banks. Decisions regarding necessary financial assistance will be made based on the report's findings.

Additionally, the central bank has sought policy assistance from the U.S. government and the World Bank regarding the approaches to be adopted for economic development.

Bangladesh government representatives attended various meetings at the International Monetary Fund (IMF) annual meeting held at the organization’s headquarters in Washington, D.C. They showcased a roadmap for developing a prosperous new Bangladesh to donor agencies, including the United States.

The delegation presented the reforms aimed at restoring integrity in the country's financial sector, which is currently in a distressed state, including improvements in banking management.

Beginning in November, the asset evaluation process will commence with the involvement of international observers. A roadmap has been established to initiate this asset assessment.

Bd-Pratidin English/ARK