Due to Russia-Ukraine war, dollar crisis in the country has deepened which devalued taka by 25 per cent.

Strict controls of the import sector and vigorous efforts to increase exports have not been able to increase the supply of dollars. This has resulted in a huge gap between demand and supply. As a result, the price of each dollar rose from 88 taka to 125 taka against taka within a few months.

Dollar was sold at tk 105 to 107 in the bank sector on Tuesday. But in the open market the price was Tk 115 to Tk 117.

Last year, Bangladesh Bank sold dollars almost every day, increasing the supply of dollars for several consecutive months. However, the situation didn’t change.

According to Bangladesh Bank, the value of the taka has depreciated by more than 25 per cent in a span of one year. And as the highest rate of commercial banks, taka has been devalued by 35.20 per cent.

On the other hand, taka has depreciated by 37 per cent in terms of the dollar price in the open markets. Although, the government has taken various strategies to maintain the value of taka. As part of this, the newly announced monetary policy has also increased the interest rates on consumer loans.

At the same time, the cap on interest rates on bank loans and deposits has been lifted. The import sector is being tightly controlled for another six months to reduce dollar spending. At the same time, the prices of gas and electricity have been increased.

Analysts said that the increase in gas-electricity and fuel prices has a multifaceted impact on people's lives. As a result, the transportation fare increases first. And rising transport fares have a negative impact on all aspects of life, fueling inflationary pressures. In the last two months, the inflationary pressure has decreased slightly, but it is still above 8 per cent.

The prices of daily necessities, food products, cosmetics including powders and bar soaps have more than doubled. There is no item in the medicine market that has not gone up in price.

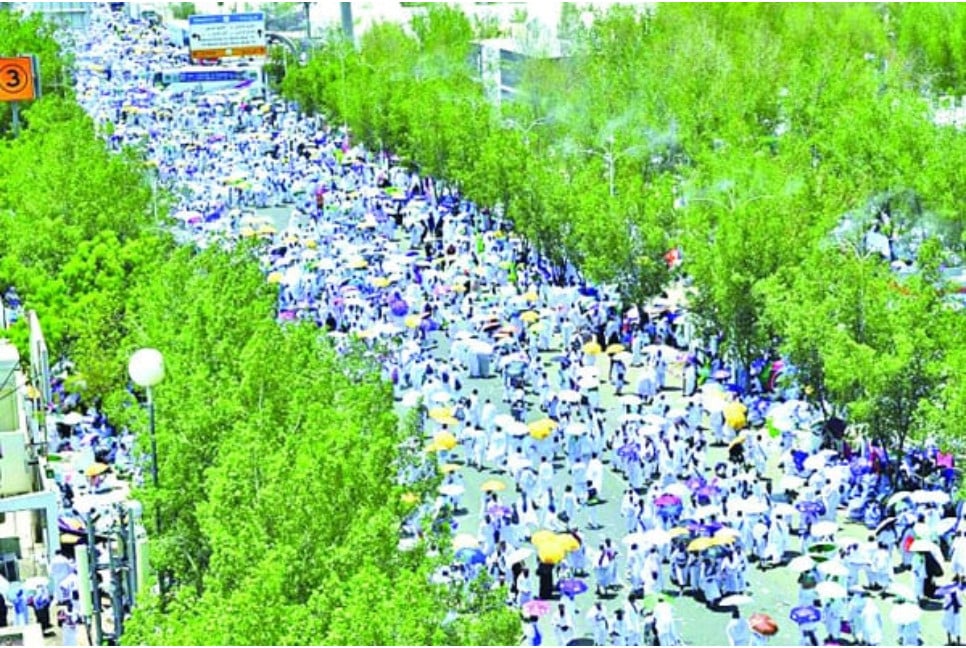

Apart from this, the month of Ramadan is coming throughout March and April. During fasting and Eid, people's expenses is naturally longer than other times.

For this, Dr. Salehuddin Ahmed former governor of Bangladesh Bank fears that the inflation pressure will increase in the coming days.

“The government has been giving repeated instructions for austerity, while the prices of various services are being increased to increase the daily consumption. The prices of food products and other items are as high as before,” he said.

“The price of a kg of flour has now doubled from what it was a year ago. There is no initiative to reduce it in the announced monetary policy. However, the consumer loan interest rate has been increased. This may have a small positive impact if consumer debt is reduced slightly. But to reduce inflation, first of all, the cost of living must be reduced.”

Otherwise, the value of money will continue to fall, which will cause a serious negative impact on the country's economy, he said.

According to Bangladesh Bank, a review of the last 10 years of data showed that the value of taka rose slightly in 2020 and 2021 due to low demand for dollars due to covid and high foreign exchange earnings.

However, at other times the value of the dollar has increased. The value of taka has fallen. Most of them were between less than 1 per cent and 2 per cent.

In 2017 alone, the value of the taka fell by a quarter of 5 per cent. And in the outgoing (2022) year, the value of taka fell at a record rate of 25 per cent, which is the official estimate.

According to various private research organizations, the value of taka = has decreased by 35 to 37 per cent.

@The report was published on print and online versions of The Bangladesh Pratidin on January 25 and rewritten in English by Tanvir Raihan.