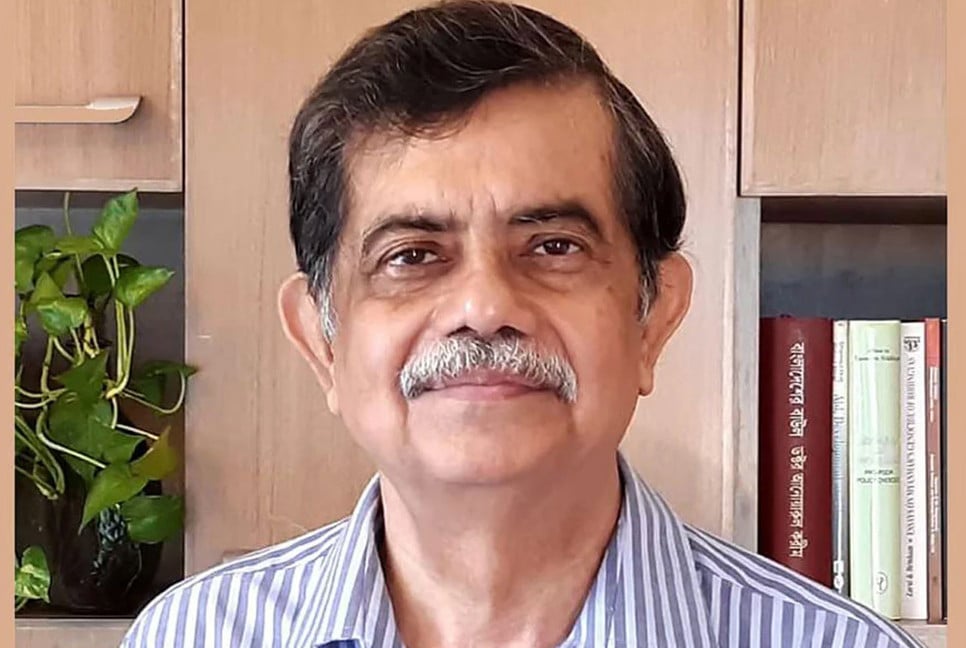

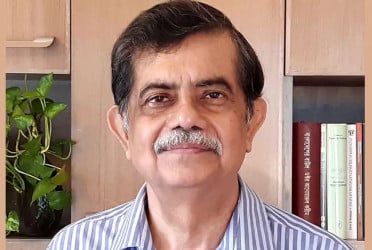

Iqbal Ahmed OBE is accused of money laundering in the guise of product exports and amassing illegal wealth in the United Kingdom (UK) with the laundered money. This controversial businessman was known as a close friend of Sheikh Hasina and Sheikh Rehana during the fascist Awami League regime. Iqbal established NRB Bank based on political considerations under the patronage of the autocratic Sheikh Hasina. He had been permanently expelled from the British Bangladesh Chamber of Commerce and Industry due to corruption in 2015. Bangladesh Bank has reconstituted NRB Bank’s board placing Iqbal Ahmed as a director despite his past corruption. This incident has created a lack of confidence among customers about the bank's future.

According to the sources, Bangladesh Bank has reconstituted the board of the NRB Bank to free this fourth-generation bank from the control of fugitive Awami League leaders and restore good governance. Former chairman Iqbal Ahmed OBE has been appointed director in the new board. Former Grameen Bank board member Ferdous Ara Begum, former Bangladesh Bank executive director Shaikh Md Salim, former Mercantile Bank MD Quamrul Islam Chowdhury, former Prime Bank DMD Sk Matiur Rahman, North South University professor Dr Sharif Nurul Ahkam, and accountant A K M Mizanur Rahman have been appointed as independent directors of the fresh board.

People concerned in the banking sector don’t want to see looting in the banking sector through Iqbal and like-minded people in the new Bangladesh after the July Revolution. They questioned why a controversial person like Iqbal, who became wealthy in the guise of frozen fish exports, has been placed in a top banking position. What is his source of power? They demanded an immediate investigation into the sources of wealth of Iqbal Ahmed and his two brothers -- Kamal Ahmed and Bilal Ahmed and their justice.

As per the investigation, Iqbal Ahmed, Kamal Ahmed, and Bilal Ahmed are all founding shareholders of NRB Bank. As of March 17, 2025, they hold 3.80 percent, 1.51 percent, and 2.13 percent of shares, respectively. The trio has also joint investments in Seamark (BD) Ltd., IBCO Ltd., IBCO Enterprise, IBCO Food Industries Ltd., Manru International, and Manru Shopping City.

They own multiple companies in the UK, including Seamark PLC, IBCO Holdings, MAI Investment Holdings, Vermilion Group Ltd., Flying Unicorn, Openshaw Holdings Ltd., IBCO Ltd., UK Bangladesh Catalysts of Commerce and Industry (UKBCCI), and New East Manchester Ltd. These companies deal in real estate, investments, and financial transactions. A significant amount has also been invested in these companies in the name of Sheikh Rehana and other members of the Sheikh family. Apart from these, Iqbal Ahmed has properties in London and other European countries. He owned nearly two dozen luxury houses and properties in London.

Sources said that over the past decade, Iqbal Ahmed actively participated in various programmes of Awami League. He had secured a strong position in political and social circles. His Facebook profile was filled with numerous pictures with Sheikh Hasina, which branded him as a ‘trusted associate’ of Hasina. However, after Hasina fled to India on August 5, these pictures have been removed from his Facebook profile.

Sources added that Iqbal Ahmed OBE was among the top 20 donors of Sheikh Hasina and Sheikh Rehana. He allegedly laundered thousands of crores of Taka abroad during the fallen regime in the guise of his business organization Seamark Group. Additionally, OBE acted as a money laundering carrier for top Awami League ministers and lawmakers. Seamark Group’s main business is fish export. Iqbal was involved with electronics and gold smuggling using his company.

On February 18 this year, NRB Bank issued a legal notice to Iqbal Ahmed and his brothers -- Kamal Ahmed and Bilal Ahmed for withdrawing excessive rent (out of agreement) payments from the bank. The notice said that an additional Tk 4.51 crore received as rent will have to be returned immediately. Otherwise, legal action will be taken against them. Barrister Helal Uddin, who served the legal notice, said that despite sending the notice, there has been no response from the accused.

Iqbal Ahmed has done many unimaginable things using power. At the British Bangladesh Chamber of Commerce, he misappropriated £2 lakh through irregularities. Chamber leaders filed a case against Iqbal, and he lost the case. A British court fined Iqbal £5 lakh and expelled him from the chamber. Earlier, OBE, a secret donor to the British Conservative Party, caused controversy by demanding reimbursement of a £12 thousand donation he had given to the party.

According to a report by the UK-based Daily Mail, this donor was accused of using party funds for his lavish lifestyle, sparking criticism in British politics. This raised serious concerns about financial transparency in political funding which comes from the the tax given by the people. This incident sparked a new debate about party's internal financial policies and ethics. Local media and civil society demanded strict regulation and accountability in the financing of political parties.

Meanwhile, allegations of money laundering against OBE have created a stir in the international arena. The Financial Action Task Force (FATF) has recently recommended swift legal proceedings against OBE to help remove Bangladesh from the ‘grey list’.

Transparency International Bangladesh (TIB) Executive Director Dr Iftekharuzzaman said that if there are specific allegations of money laundering and bank fraud against someone, appointing him as a bank chairman undermines the credibility of Bangladesh Bank. In this case, he should be investigated, and action should be taken against him. Banking sector reforms are underway. Appointing a controversial figure to a top bank position contradicts these efforts, he added.

This correspondent has failed to contact Iqbal Ahmed OBE after several attempts for his comment on corruption allegations. Contacted, NRB Bank Secretary Rezaul Karim declined to comment and suggested contacting the public relations department of the bank. The bank’s Head of Public Relations Salahuddin Murad was contacted but could not be reached.

Source: Kaler Kantho

bd-pratidin/GR