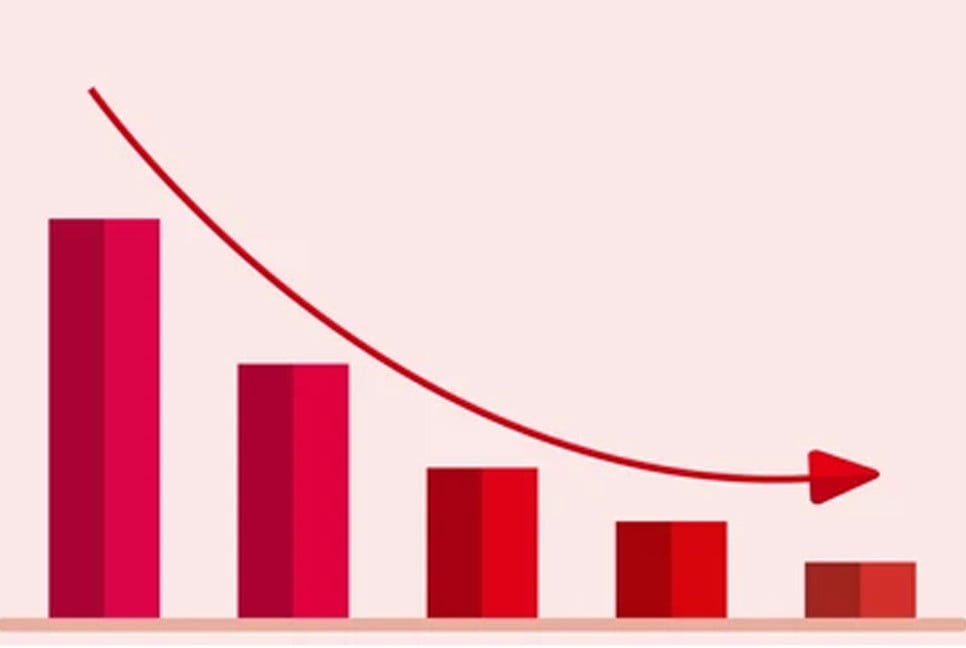

In the latest quarterly report, Bangladesh Bank (BB) has revealed a decline in the opening and settlement of letters of credit (LCs) during the first quarter of the current financial year, spanning July to September. The report indicates that the total number of LCs opened fell by approximately 7 percent compared to the same period last year, while LC settlements decreased by 2.5 percent.

Despite a slight uptick in LC activity noted in September, the overall trend for the first three months remains downward. Analysts attribute this decline primarily to the focus on importing raw materials, as businesses brace for future investments amid ongoing political instability.

BB report highlights that import LCs valued at $15.59 billion were opened, with settlements amounting to $16.21 billion in the July-September period. Industry stakeholders emphasize the importance of political stability for fostering new investments, which, in turn, could lead to an increase in imports and a stabilization of the overall economy.

According to the report, capital machinery imports fell by more than 41 percent during the July-September period. Capital machinery worth $380 million imported in three months. Capital machinery worth Tk 65 crore was imported during July-September 2023. Settlements fell by 25 percent during the same period.

In the first three months of the current financial year, 490 million dollars of debt was settled; Which was 650 million dollars in the same period of the previous financial year.

Apart from this, in the first three months of the current fiscal year, the LC opening for the import of consumer goods has decreased by 17.50 percent. During this period, consumer goods worth $1.37 billion were imported. Imports during the same period a year ago were $1.66 billion. Imports of intermediate goods decreased about 13.25 percent.

In the first three months of this financial year, the goods worth $1.14 billion have been imported. Imports during the same period of the previous year were $1.32 billion. Similarly, the import of petroleum products has decreased by 7.25 percent.

Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank, said, “Inflation has increased and people have less money. Purchasing power is decreasing. Extreme poverty rates are increasing. Demand in the domestic economy is also declining. Naturally, those who produce will not produce as before. If production decreases, imports will also decrease. Which are affecting LC opening rate.”

“Even after the arrival of the present government, there was an additional arrears of 2.5 billion dollars. They have now been settled. Due to which the settlement of LC has increased,” he added.

Toufic Ahmad Choudhury, former Director General of the Bangladesh Institute of Bank Management (BIBM), said, “The factory is not running properly. Many factories were burnt down. New factories are not being built. Demand has decreased. So why do you bring capital equipment?”

He also said, “Political stability is now essential. If this is confirmed, the traders will return to work. Manufacturers will start production. The affected companies will try to turn around.”

The data of the report said that the rate of LC opening and settlement increased in September but overall decreased in the first three months of the current fiscal. During July-September, the import of industrial raw materials was worth 5.72 billion dollars. Imports during the same period of the previous year were 5.29 billion dollars. Last September, LC opened at $5.57 billion; Which was $5.20 billion in the same period of 2023.

In September of this year, the import settlement was $5.87 billion; Which was $4.72 billion in September of the previous year. Which is $1.15 billion or 24 percent more compared to the previous year.

(Translated by Tanvir Raihan)