Bangladesh Bank’s effort to control inflation is going on and they increase the policy interest rate thrice in three months. However, the businessmen are in fear of losing investment due to the increase in policy interest rate. According to them, the interest rate on personal debt will be increased, which in turn will escalate the cost of operating business. It’s not possible to control the market just by increasing policy interest rate. Special monitoring of market system and strong actions against syndicates are needed here.

According to the economists, it wiil take another 4 to 5 months to get the good outcome of increase in policy interest rate. Md Jashim Uddin, former president of FBCCI, the largest trade body of the top industrialists in the country, said to The Bangladesh Pratidin, “The low and middle income people are going through enormous struggle due to high inflation. According to BB governor the inflation will be reduced only by increasing interest rate. However, as a businessman I think the increase in policy interest rate won’t decrease the inflation. More than 80 percent of the country's economic activities are outside the banking system. 70 percent of people do not go to the bank. How will inflation be controlled if interest rates are raised there? On the other hand, if the interest rate increases, the price of commodities increases and as a result inflation escalates. We have to import raw materials, capital equipment, fuel etc. There will be no new investment.”

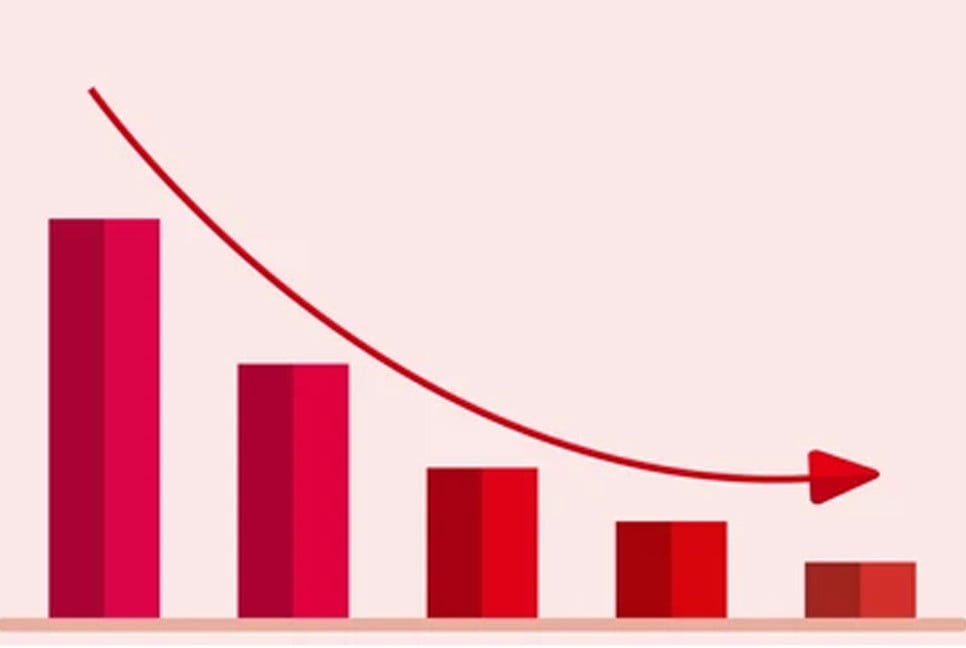

The interest rate at which commercial banks operating in the country take loans from Bangladesh Bank is called policy interest rate. At the beginning of the current financial year, this policy rate was 8.50 percent. It increased to 9 percent in August and 9.50 percent in September. Most recently, the policy rate rose to 10 percent in October. Next month it may increase by another 50 percent. The Governor of Bangladesh Bank has said several times that the policy interest rate will continue to increase to bring down inflation to 5 to 6 percent by June next year. Businessmen are looking at this decision of Bangladesh Bank negatively. They say that if the policy rate goes up, the loan interest rate in the private sector will go up, which will affect the economy.

In this regard, the president of BKMEA, the association of garments sector owners, Mohammad Hatem told The Bangladesh Pratidin, that now the loan interest rate is above 16 percent. The hike in policy rates a few days ago could raise loan interest rates up to 18 percent. No businessman can be expected to survive on 17 or 18 percent interest. As a result industries are destroyed, economy is destroyed, and businessmen will be ruined.

Economists say a rise in policy rates will slow new investment. No new employment will be created. However, they feel that there is no option to increase the policy interest rate to control high inflation. Chairman of Research and Policy Integration for Development Abdur Razzak said that the interim government should be given some time. If inflation can be brought down, if the reserves increase a little, then the interest rate will come back to a comfortable level. Then new investment will come.

According to the data of Bangladesh Bureau of Statistics, overall price inflation decreased to 9.92 percent in September this year. The rate of inflation was 10.49 percent in the previous month of August. And in July it was 11.66 percent. Similarly, food inflation has come down to 10.40 percent in September, which was 11.36 percent in August. And 14.10 percent in July. Inflation has come down on paper but there has been no impact on commodity prices in the market.

Dr. Abdur Razzak also said that the previous Awami League government did not take these policies seriously. They had approved huge budget even after high inflation was in the market. Overprinting money has fueled the extent of inflation.

Stating that overall inflation cannot be understood by looking at the prices of two products, he said that it will take another 5 to 6 months to understand how the current government's policies are working.

(Translated by Lutful Hoque)