China Exim Bank want to finance in Chinese currency Yuan instead of US dollar in the projects ongoing in the country with the finance of China government. The bank has given this proposal to Bangladesh with a view to prevent the monopoly of dollar.

Bangladesh Bank also provided permission to open LC in Yuan last year to reduce the dependency on foreign currency. According the authorities concerned, this new system will minimize the cost of export and import between two countries.

Recently, Lee Qinji, deputy general manager of Export-Import Bank of China, in a letter sent to economic relations department (ERD) of ministry of finance, said with the abnormal increase of the interest rate of federal reserve, the exchange rate of dollars is also fluctuating abnormally. Hence, the project cost and exchange rate is carrying excessive risk for China and Bangladesh. The dollar deficit has created adverse situation for the cooperation between two countries. In this circumstance, the ever-rising cost of dollars may increase the interest rate in the projects run by finance of China government.

According to Lee Qinji, the Yuan gives cross border settlement facility and diversified finance in international trade and projects implementing with foreign finance in lesser cost, as Bank of China is enlisted in International Assets Reserve. So, this year Yuan is in the list of stable currencies. If Yuan is used, the transactions will be free from the risk of dollar rate fluctuation and high interest rate as well as will be protected from the pressure of dollar deficit.

In addition, the Chinese contractors working in ongoing projects prefer to transact in Yuan. If finance is possible in Yuan, the cost of exchange rate will be reduced which will minimize the project cost in the long run.

The deputy general manager of Exim Bank of China thinks if the initiative of the two countries become successful in this regard, then it will pave the way to make the projects successful as well.

According to Bangladesh's list of priority projects, there is huge potential for bilateral cooperation with financing of Chinese government. China has recently been developing an alternative payment system called the Cross-Border Inter-Bank Payment System (CIPS). Meanwhile, Bangladesh has recently decided to trade with China in Yuan due to a severe deficit of dollars resulted from the decrease in foreign exchange reserves.

On September 15 last year, Bangladesh Bank allowed authorized dealer banks to trade in Yuan alongside dollars for trade with China. As a result, Bangladeshi banks are able to open accounts in the Chinese currency Yuan to facilitate the transactions of local traders in letters of credit (LC) and with foreign branches of the banks.

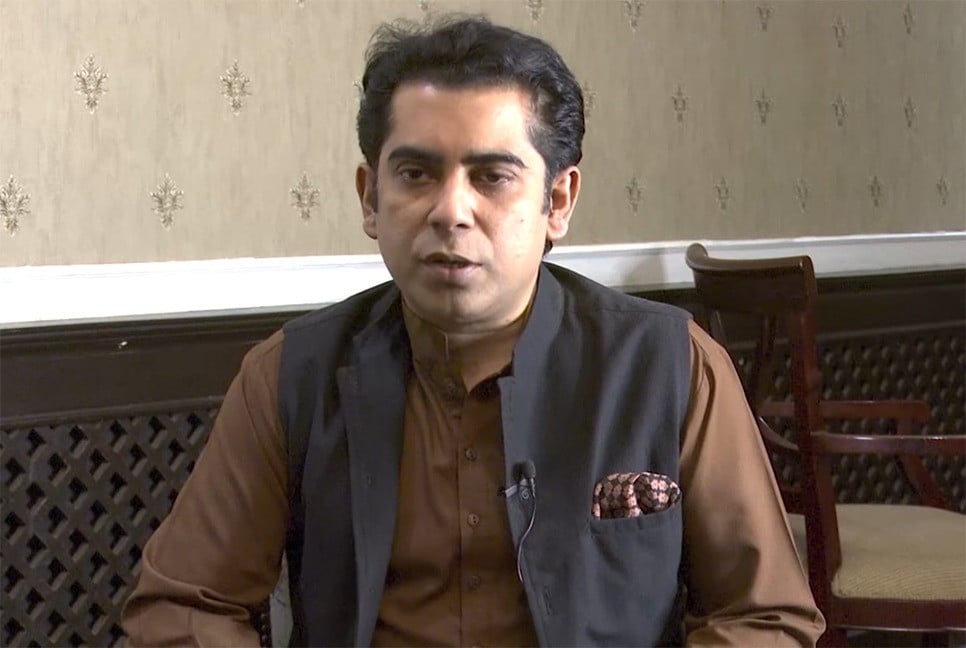

An official of Bangladesh Bank told The Bangladesh Pratidin that the government announced the Yuan as a convertible currency in a notification issued in March 2014. In this context, Syed Mahbubur Rahman, managing director of Mutual Trust Bank, said, “The use of different currencies in both trade and bank-transactions will bring diversity in foreign trade. Such a move would reduce over-reliance on a single foreign currency for opening and settling letters of credit (LC). Now, trade will be more affordable.”

In this regard, the former chief economist of the Dhaka office of the World Bank Gropu, Zahid Hossain told reporters, “Most of Bangladesh's foreign income comes in dollars. We may have an opportunity to profit if the Yuan appreciates against the dollar.”

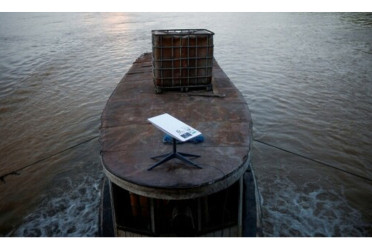

Bangladesh annually exports $1 billion worth of goods to China and imports $15 billion of goods. It should be noted that Chinese President Xi Jinping visited Bangladesh about six and a half years ago. During that visit, China promised to allocate 2 thousand 4 billion dollars for 27 projects related to the construction of various infrastructures including railway connection to Padma bridge, construction of tunnel under Karnaphuli river, communication infrastructure, information and communication technology. However, as of July this year, among the Chinese projects, loan agreements for eight projects have been signed. Although the cost of these projects is 7.8 billion dollars, 3.3 billion dollars have been discounted so far. That is, China has given only 14 percent of the promised amount. And out of 27 projects, about 30 percent of projects have progressed.

@The report was published in Bengali on print and online versions of The Bangladesh Pratidin on April 30 and rewritten in English by Lutful Hoque