Bangladesh will go for alternative currencies by taka to decrease dependency on the dollar. Many countries are now showing their interest to use own currency due to the Russia-Ukraine war and geo-political reasons. The topic is now widely discussed. Economists and bankers said a variety would come by using alternative currency.

The government is working to settle bilateral trade with various countries amid the ongoing dollar crisis due to the Russia-Ukraine war. India and Bangladesh have already agreed to complete trade with their currencies. The process is going on for a currency swap with Russia. Bangladesh is reviewing China’s proposal for a currency swap. Although Bangladeshi banks can open LCs and foreign bank accounts in Chinese Yuan from September 15 last year.

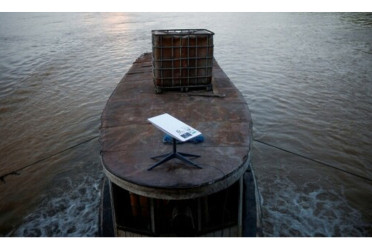

Bangladesh has recently approved a payment of $318 million for payment to Russia in the Chinese currency of yuan for the construction of the Rooppur Nuclear Power Plant.

The payment for a $12 billion loan Bangladesh obtained from Russia to develop a nuclear power plant in Rooppur, is expected to be routed through China's Cross-border Interbank Payment System (CIPS). Russia will get the payment through the CIPS system.

Now, Bangladesh is going to launch its currency trade with India which will allow the Indian and Bangladeshi currencies for the settlement of bills for exports and imports as an alternative to the dollar.

On April 11 last, a representative of the Reserve Bank of India and State Bank of India held a meeting with the managing directors of Sonali Bank and Eastern Bank. During the meeting, both parties discussed the use of the taka and rupee in trade and its payment system.

The meeting source said Sonali Bank and Eastern Bank will open a bank account at the State Bank of India and ICICI Bank to trade with India in their currency. Similarly, the State Bank of India and ICICI Bank will also open a bank accounts at Sonali Bank and Eastern Bank for the same purpose.

Officials of the Bangladesh Bank and concerned banks said approval of respective central banks is needed to open these accounts which are familiar with Nostro and Vostro accounts internationally.

Businesses have welcomed the initiative. Federation of Bangladesh Chambers of Commerce and Industries (FBCCI) Vice President Amin Helaly told Bangladesh Pratidin that currency swap would release pressure on foreign reserves and would expand the country’s trade and commerce. The country’s export in India has been increasing for the last two years and it will increase further for this payment system.

Eastern Bank Managing Director Ali Reza Iftekhar this correspondent that the initiative has been taken to trade with taka and rupee without any third currency.

“After getting approval from both country’s central banks, we will inform customers that from now on export and import could be done through taka and rupee. Interested businessmen then can open LCs at rupee which will save expenditure. On the other hand, it will reduce ongoing pressure on the dollar.”

It is mentionable that the country’s businessmen have been urging Bangladesh Bank to reduce dollar dependency since the Russia-Ukraine war begins.

Mutual Trust Bank Managing Director Syed Mahbubur Rahman said the currency swap system will bring variation in both the trade and banking system. It will also decrease the dependency on a single foreign currency to settle LCs.

Contacted, Bangladesh Bank Executive Director and Spokesperson Mezbaul Haque said Bangladesh has decided in principle to use taka and rupee for bilateral trade with India. Bangladeshi businesses can open LCs rupee.

@ The article was published on print and online versions of The Bangladesh Pratidin on April 20, 2023 and has been rewritten in English by Golam Rosul.