Under the disguise of mobile banking service Bkash and Rocket, the two companies are doing business in hundi by putting up signboards in many countries including Singapore, Malaysia, Dubai and the Middle East, as a result of which dollars are not coming into the country as remittance.

Due to the dollar crisis, businessmen have claimed that the country's trade and industry are at a standstill. Investments in bonds are also sluggish. Expatriate bonds are not being renewed.

Participants said that three levels of investment facilities are needed with an additional 1 per cent incentive along with the conventional 2.5 per cent to increase investment in bonds. Only then can the hundi be reduced. Besides, arrest and exemplary punishment should be given to those involved in hundi. Anti-Corruption Commission-ACC investigation and intelligence surveillance abroad is essential.

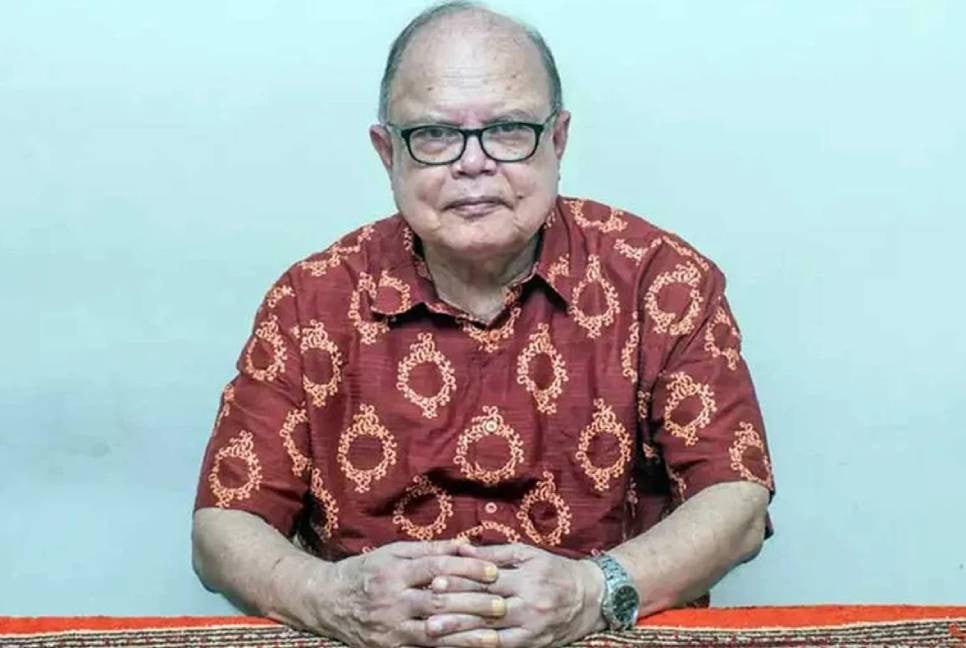

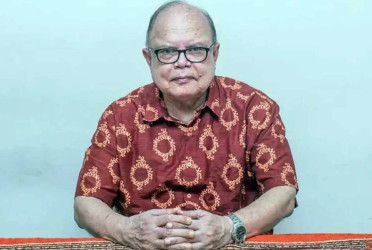

Salehuddin Ahmed, former governor of Bangladesh Bank told Bangladesh Pratidin, “First of all, the value of the dollar should be left to the market. Once an acceptable price is fixed, many things will become normal. However, monitoring should be done so that no one takes advantage of the open market rates to make excessive profits.”

“If the expatriate bond is not renewed, the dollar will go abroad again. Investment limits on expatriate bonds must be lifted at this time of dollar crisis,” he added.

Md. Jashim Uddin, President FBCCI has told Bangladesh Pratidin, “We have to come out of the conventional banking system. Do not follow the previous rules. Foreign exchange reserves increase due to investment in bonds. The matter should be considered in the ongoing situation.”

“Remittance incentives should be increased to reduce hundi. Increasing incentives will increase remittances through banking channels. 10 to 20 per cent incentive is being given for exports. There is only 2.5 per cent in remittances,” he added.

“Apart from this, exchanges of views can be held with expatriates at the initiative of exchange houses of Bangladeshi banks in remittance sending countries. Singapore, Malaysia, England, Saudi Arabia, Dubai should listen to the problems of expatriates and take initiatives to solve them. Above all, sending remittances should be made easier,” he also said.

The participants of some of the leading banks of the country said the money of expatriates is coming in hundi. As a result, foreign exchange reserves are decreasing. On the one hand, Bangladesh is deprived of foreign currency US dollars, on the other hand, money laundering from the country is increasing.

Hundi business is going openly in the name of Bkash and Rocket from Singapore, Malaysia, Dubai and Middle East countries. Strict intelligence surveillance abroad is necessary to stop these.

According to participants, expatriates cannot buy bonds above Rs 1 crore. Again the bond is not being renewed. If the purchase limit or ceiling of expatriate bonds Is increased from 1 crore to 5 to 10 crore, there would have been a huge response.

Again, if the incentive is given at the rate of 2.5 per cent, an additional incentive of 1 per cent will increase the reserve. This 1 per cent incentive will benefit both the government and the expatriate when the expatriates return home.

Participants also said that reserves have also been depleted as many have not reinvested. Dollar bonds must be withdrawn. If the remittance does not come, the risk will increase in the banking sector.

Dr. Ahsan H. Mansur, Policy Research Institute-PRI executive director has told Bangladesh Pratidin, “Limiting investment in expatriate bonds is a futile measure. It could have done so when the reserves were $48 billion. In this time of dollar crisis, investment of 1 crore in expatriate bonds is not much.”

“Investment in expatriate bonds should be renewed as soon as possible. Because, if the money is returned, the reserve will be under pressure. The dollar rate should be the same for import-export and repatriation income. A dollar is a dollar. Give more to some, give less to some, it cannot be. Wage Earners Bonds need to be popularized, “he said.

“There is no question of mobile financial service companies bringing money from abroad. They can neither bring money into the country nor send ii,” he added.

Syed Mahbubur Rahman, former Chairman of Association of Bankers, Bangladesh (ABB) and Managing Director (MD) of Mutual Trust Bank has told Bangladesh Pratidin, If we pay the interest of expatriate bonds, our expenses will increase now.”

“We also need remittance. Expats need to be looked at too. The whole thing should be well looked at and how to do it. Expatriate bonds were a good source of foreign exchange. Which is what we need right now. We have to see whether a balance can be made or not - so that investment also comes and costs do not increase. Something like that has to be done,” he added.

Sources said even with big investments in Singapore-Malaysia, various government agencies are keeping an eye on some people. An investigation into the purchase of assets in Singapore, Malaysia which has not returned any money. However, there is more discussion around the United Arab Emirates (UAE).

Not only big, but many middle-level businessmen and politicians are based in Dubai.

UAE’s local media claimed Bangladeshis have invested 123 million dirhams in Dubai's housing sector until last February after the covid epidemic. This is the highest investment by citizens of any foreign country in the country in one and a half years of covid. Bangladeshi investors have outcome Netherlands, Switzerland, China and Germany’s investors.

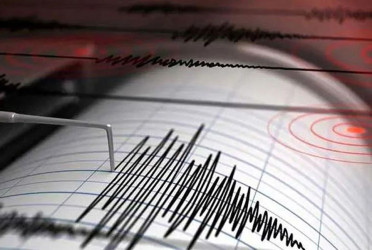

According to the data of Bangladesh Bank, the gross foreign currency reserve in the country is 34.3 billion US dollars. After subtracting $8 billion from this, what remains is the amount of net reserves.

Foreign exchange reserves are the most affected by the continued dollar crisis. Dollar is being released by breaking the reserve to control the market. Still the price is not going down.

As a result banks are not able to open LC on time. It is disrupting the import-export trade.

The biggest impact of the dollar crisis is now on the energy sector. Due to increase in fuel prices, prices of all kinds of goods have increased uncontrollably. The cost of people's living is increasing by leaps and bounds.

@The article published on print and online versions of The Bangladesh Pratidin on November 14, 2022 and rewriten in English by Tanvir Raihan