Allegations have been raised to many wealthy persons and businessmen of the country of siphoning off the money through hundee to rich countries like Singapore and Dubai (United Arab Emirates).

After the outbreak of Covid 19, there was a flurry of Bangladeshi businessmen and wealthy persons’ taking ‘gold visa’ of United Arab Emirates (UAE). The facility of the visa included staying in that country for 10 years and investing in the various sector including real estate, along with transferring money and opening bank account in any form.

Due to the strict rules and regulations regarding money transfers in countries like Canada and Australia, it has been very hard to siphoning off the money. So, many of them returned to Dubai, and some to Singapore and Malaysia. Many of the leading businessmen of Bangladesh invested there. However, the questions rose strongly over the ways of their transferring money. The small culprits behind hundee business were arrested, but the big fishes behind it are still at large.

The analysts and experts on this matter said it’s needed to be alert about the big fishes with a view to keep the economy of the country in normal stage. The authorities concerned have to find out how they become so ‘free-flowing’ in foreign land.

Few months ago, various governmental agencies of the country became alert over investment of controversial businessman PK Halder. How he invested such a big amount of money is still a mystery to them.

In his confession, PK Halder said his loan was Tk 1100 crore, while the rest 3,000 crore belong to others.

He said he would return his money if he can come back to the country and give information to the government about rest of the money and parties involved with the transaction of it.

However, all of these ‘tasks’ is yet to be completed.

Different governmental agencies are keeping an eye over these kinds of investment in countries like Singapore and Malaysia. Investigation over buying asset in those countries was done, but the money hasn’t been returned.

Investment and money laundering in UAE has now become the main concern of the governmental agencies. Not only big businessmen and politicians, mid-level business-owners and politicians are also making Dubai as their haven. Besides investing in real estate sector, they’re also buying various business and other organizations in Dubai.

According to the report of Dubai based media Teller Report and Emarat Al Aiyum, from the period of Covid 19 outbreak to the February 2022, the amount of Bangladeshi investment in real estate of Dubai is 123 million of Dirham. After the Covid-19 outbreak, it was the largest investment in the country by foreign individuals. It surpassed the Dutch investment as the amount of investment from Netherlands people was 117.6 million of Dirham, which was in second place in terms of amount of money invested. Even, Swiss people are behind Bangladesh in terms of investment.

The economists of the country think the government of Bangladesh has to be much more alert on the matter. If the money that has been laundered to Dubai and Singapore doesn’t return to the country, the economy won’t return to normal condition.

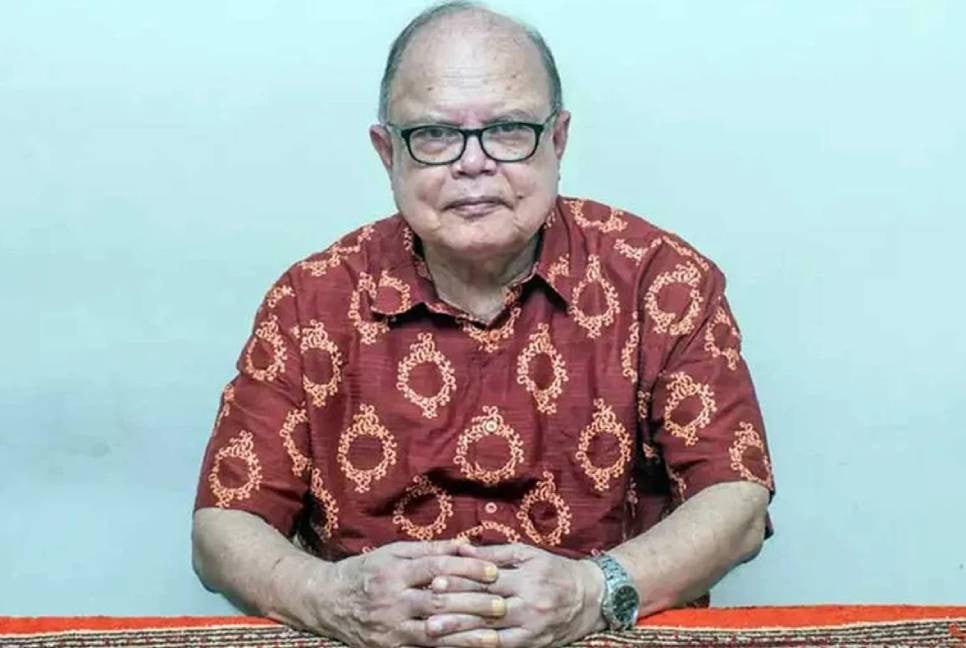

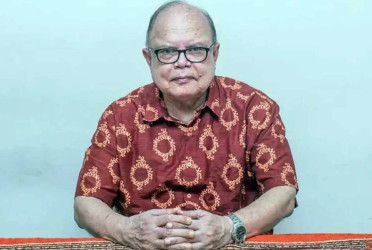

Former Bangladesh Bank Governor Salehuddin Ahmed told to The Bangladesh Pratidin, “Observing the overall situation, the people of the country are losing their trust on the economy system and the government as a whole. They’re not getting social and financial security and assurance regarding it. Due to the presence of proper monitoring system, the incidents of money laundering are increasing. The condition won’t be improved until sufficient monitoring is ensured.”

@The story published on print and online versions of The Bangladesh Pratidin on November 7, 2022 and rewritten in English by Lutful Hoque