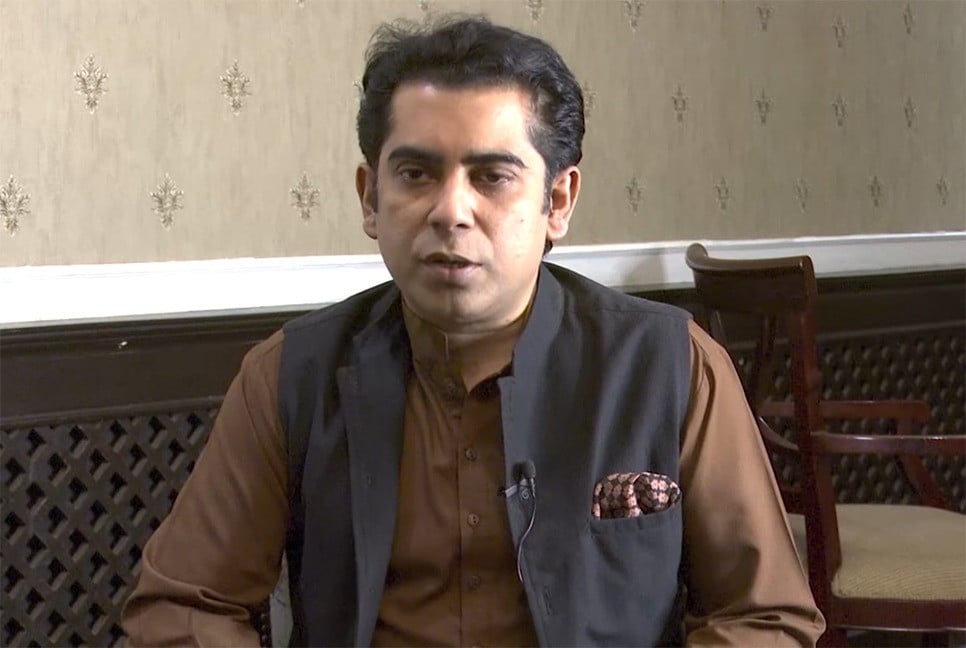

Salman F Rahman, a prominent figure in Bangladesh's business landscape and advisor to the ousted prime minister Sheikh Hasina, has come under fire for alleged practices surrounding debt defaults. Critics label him the "founder of debt default" as his Beximco Group reportedly holds over 36,865 crore taka in loans across various banks and financial institutions, with significant exposure to state-owned Janata Bank.

Salman is accused of employing strategies to evade repayment, leading to the Bangladesh Bank's introduction of new rules for rescheduling defaulted loans. His influence has raised concerns about the stability of the banking sector, with state resources reportedly at risk.

The past 15 years have seen Salman linked to numerous controversies, including his involvement in stock market manipulations that siphoned off around 6,000 crore taka. Recently, the Bangladesh Securities and Exchange Commission (BSEC) imposed fines totaling 428.52 crore taka on nine individuals and organizations for their roles in the manipulation of Beximco shares.

The previous Awami League government left the country's stock market and banking sector in turmoil. Economic analysts think that former Prime Minister Sheikh Hasina's private industry and investment adviser is one of the responsible for this situation. Salman F Rahman's Beximco Group took a huge loan from Janata Bank and the government put the bank at risk. The amount of his loan is more than nine times the paid up capital of the bank.

At the end of June this year, Beximco Group's loan from Janata Bank stood at Tk 25,000 crore, which is 950 per cent of the bank's paid-up capital, which is beyond central bank's single borrower limit. In the case of Salman F Rahman's Beximco Group, the state-owned Janata Bank's non-implementation of the single loan limit rule has jeopardized the bank's financial situation. 72 percent of Beximco Group's crowdfunding loans defaulted.

Not only Janata Bank, the father of the defaulter, Salman F Rahman, has taken out thousands of crores of Tk in the name of loan from a total of 7 public and private banks. According to related sources, Salman F Rahman's non-payment strategy started in 2014. This adviser to the Prime Minister demanded to pay the 5 thousand crore tk taken from the state-owned Sonali, Rupali, Agrani, Janata and private National, Exim and AB Banks as per his wish.

On August 5 of that year, he applied to the Governor of the Central Bank and asked for 12 years to repay the loan. Salman F. Rahman was approved the provision of suspending the obligation to pay installments for two and a half years and reducing the interest rate to 10 percent.

In a petition to the governor in 2014, Beximco Group Vice Chairman Salman F Rahman blamed “various restrictions on politically motivated loans from 2001 to 2008, bank loan repayments of Tk 800 crore in the previous three years and the economic disaster caused by prolonged blockades and shutdowns in 2013-14.” Tk 5 thousand 245 crores of loans applied for rescheduling on urgent basis

In this context, Bangladesh Bank subsequently issued a new large loan rescheduling policy on January 29, 2015.

According to that policy, banks can file a case against the borrowers if they fail to repay the loan. Later, Sonali Bank rescheduled Beximco's Tk 1,700 crore loan at 10 percent interest for 12 years under the policy. Which is much lower than the market based interest rate. At that time the loan interest rate was 13-14 percent.

Apart from this, Beximco was supposed to pay Tk 57 crore 40 lakh to Sonali Bank from September 2016 after a grace period of one year. In December 2017, the borrower was obligated to pay six installments, but Beximco paid only two installments.

As a result, even after defaulting in late December 2017, Sonali Bank did not cancel the facility and did not file a case against Beximco. On the contrary, in March 2018, the debt of Beximco Group was rescheduled again under the influence of Salman F. Rahman.

According to the central bank policy, minimum 10 percent down payment of the defaulted loan is mandatory for rescheduling the loan, but Beximco did not have to make any down payment. Another example of non-repayment of bank loans is the Beximco Group's GMG Airlines loan.

In 2009, Beximco Group bought half the shares of GMG Airlines, the country's first private airline. In August 2016, Sonali Bank took the initiative to auction the properties of the group's vice chairman Salman F Rahman and his brother Sohel F Rahman, the group's chairman, due to non-payment of the company's debt. Later, the auction was stopped by the order of the High Court. In July this year, the central bank issued a notice to auction the mortgaged properties against the loan, and the GMG went to the High Court and sought a stay order. The airline, which has been grounded for years, has also had its accounts regularized due to court orders.

(The report was published on print and online versions of The Bangladesh Pratidin on October 04 and rewritten in English by Tanvir Raihan)