Loan defaulters staying in the country and abroad are being listed, than strict disciplinary action will be taken against them.

Law enforcement agencies including the Bangladesh Financial Intelligence Unit (BFIU) and the Anti-Corruption Commission (ACC) have already started the work of preparing the list.

Sources said that thousands of crores taka have been laundered in other countries in the name of loans from the country's banks in a few years. Punitive action was never taken against those involved in these incidents.

The government wants to ensure the prosecution of people's money looting and smugglers before the next national elections. As a part of that, it is known that action is being taken against the fugitives in the country and abroad for money laundering.

Analysts said that political will is needed to take action against those who stay in the country and those who laundered money from banks. Execution of punishment by trial.

According to the central bank, at the end of the October-December quarter of last year, the amount of defaulted loans in the country's banking sector stood at 1 lakh 20 thousand 657 crores taka. Out of this, the loan amount of the top defaulters is 16 thousand 587 crore 92 lakh taka.

Instead of paying the money to the bank, the loan defaulters are living a luxurious life in the country and abroad.

Many have built a second home in Malaysia. Some are living in Thailand, United Kingdom, USA and Canada. Sources said that effective measures are being taken now to ensure that money is not laundered from the country again before the next parliamentary elections.

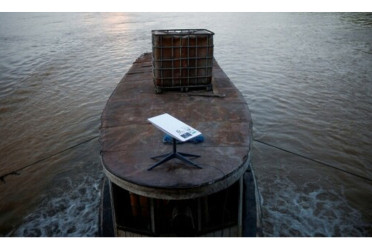

Bangladesh Bank (BB) is also doing strict monitoring to prevent money laundering in banking channels under the guise of import and export.

Bangladesh is third among all the countries participating in the Malaysia My Second Home (MM2H) program to build a second home in Malaysia. A total of 4 thousand 135 Bangladeshis have participated in the MM2H project till 2018. In the meantime, 250 Bangladeshis have bought houses in Malaysia.

Bangladeshis are third only to Chinese and UK nationals when it comes to buying houses in Malaysia. The residential area of Bangladeshis in Canada is known as Begumpara. Apart from this, many have migrated to Thailand, United Kingdom and United States.

Two and a half years ago, the government's action on those staying in the country and abroad by money laundering has started.

On November 18, 2020, at the meet the press event organized by Dhaka Reporters Unity (DRU), Foreign Minister AK Abdul Momen said about money launderers, we are collecting information about money laundering abroad. However, the same situation is not only in Canada, but also in Malaysia.

“But getting information is very difficult. Before the upcoming national elections, the government has taken the initiative to list the people who killed the money of the bank and take action. Meanwhile, law enforcement agencies including Bangladesh Financial Intelligence Unit (BFIU) and Anti-Corruption Commission have started working,” he said.

After the Hallmark scam, another hotly debated incident in the banking sector was the Bismillah Group loan scam. The group took a loan of Tk 1,200 crore from six banks and defaulted on it. Rather, the group's MD Khawaja Sulaiman Anwar fled abroad overnight without paying the loan.

In 2012 and 2013, Bismillah Group took a loan of about Tk 1,200 crore by showing fake documents.

Later, the entire amount was laundered abroad through fake LCs. There are several cases in the name of Bismillah Group. As a result, most of its top executives, including Khawaja Sulaiman, are on the run abroad. Among them, Bismillah Group MD Khawaja Sulaiman Anwar and Chairman Noreen Habib along with some of the group's officials are now living in Dubai. There they are running a luxury hotel business.

ACC secretary Mahbub Hossain told Bangladesh Pratidin, “Anti-corruption commission is taking necessary action after receiving complaints of money laundering.”

Analyzing the accounts of money deposited by Bangladeshis in Swiss banks, it has been found that money laundering from Bangladesh increases before every parliamentary election. The 11th National Parliament election was held in December 2018. At the end of that year, the amount of deposits of Bangladeshis in Swiss banks stood at 5 thousand 868 crores taka. Which is about 1 thousand 300 crore taka more than the previous year.

At the end of 2017, the amount of deposits was 4 thousand 572 crores. Similarly, during the 2014 parliamentary election year, Tk 2,633 crore taka was laundered.

At the end of 2013, the amount of money deposited by Bangladeshis in Swiss banks was 4 thousand 807 crores taka. At the end of 2012, the amount of deposits was 2 thousand 174 crores taka.

According to the report published on June 16 last year, Bangladeshis have deposited money equivalent to about 3 thousand crore taka in Swiss banks in one year. And the amount of money deposited till 2021 is 8 thousand 275 crores taka. Which is the highest ever. In 2020, it was 5 thousand 347 crores taka.

Salehuddin Ahmed, Former Governor of Bangladesh Bank said, “Political will is needed to prevent money laundering of loans taken from banks. The Judiciary should set an example by punishing one or two of the traffickers, so that others will be afraid.”

“Even if one company in a group defaults, another company in the same group is getting loans. If one institution in the group defaults, any other institution has to stop lending. The insurance benefits of the defaulting company should be cancelled,” he added.

@The report was published in Bengali on print and online versions of The Bangladesh Pratidin on May 03 and rewritten in English by Tanvir Raihan