The National Board of Revenue (NBR) must collect nearly Tk 2 lakh crore in the final quarter of FY2023-24 to meet IMF conditions tied to its $4.7 billion loan program.

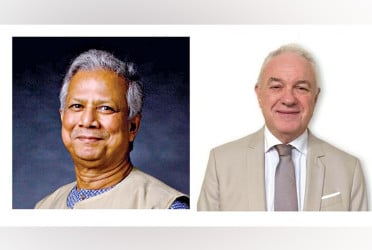

During a meeting with NBR officials in Dhaka on Sunday, the visiting IMF team, led by Mission Chief Chris Papageorgiou, called for raising the tax-to-GDP ratio to 7.9% by June, up from the current 7.4%.

To meet the target, total revenue collection must reach Tk 4.55 lakh crore — requiring a 19% growth year-on-year, though actual growth stood at only 1.7% as of February.

An NBR official described the expectations as “high, ambitious, and unrealistic.”

So far, the NBR has mobilized around Tk 2.52 lakh crore between July and March. The IMF also urged reducing tax exemptions and introducing a uniform VAT rate, though the government says reforms will be gradual.

The IMF mission, which runs until April 17, will assess whether Bangladesh qualifies for the release of two pending tranches. The mission has met with senior officials, including the finance adviser, finance secretary, and central bank governor.

The IMF revised its GDP growth projection for Bangladesh to 4% for FY24, up from 3.8% in December, though still below the government’s 5.25% target.

It expects growth to rebound to 6.5% in FY26. Inflation is now projected at 9% for FY25, down from 11%, while the government forecasts 8% for this fiscal year and 6.5% in FY26.

Finance Adviser Salehuddin Ahmed said the economy is currently stable and moving in the right direction.

Bd-pratidin English/ Jisan