Gas production in the country has been continuously declining, which has led to an increase in LNG imports. However, due to the dollar crisis, import bills are not being paid regularly. As a solution, the government plans to take a loan with World Bank support in the next fiscal year (2025-26) to finance LNG imports.

The government plans to take a loan of $350 million or 4,270 crore BDT. This information has been revealed by the Ministry of Energy and Mineral Resources and the Bangladesh Petroleum Corporation (Petrobangla).

Officials have stated that the loan process has begun with technical assistance from the World Bank, which will act as the guarantor. The Energy Department will negotiate with interested banks based on their proposals.

Chevron, the largest gas producer in the country has an outstanding bill of over $150 million. The LNG bill arrears have now exceeded $200 million. Due to increasing arrears, foreign companies are becoming hesitant to supply LNG. Petrobangla officials believe that if loan assistance is received, the situation may improve.

At its peak, the country produced 270 crore cubic feet of gas per day. However, production has been declining since 2018. To compensate for the shortfall, the previous fascist Awami League government shifted towards LNG imports but did not focus on new gas exploration or increasing domestic production.

On 2024, gas production was between 200-210 crore cubic feet per day, but it has now dropped below 190 crore cubic feet per day. Currently, 95 crore cubic feet is being supplied from imported LNG.

Previously, the government has taken short-term loans from the International Islamic Trade Finance Corporation (ITFC) to purchase LNG.

Similar to the gas bill crisis, the electricity bill cannot be paid due to the dollar shortage. Meanwhile, the target for LNG imports has been increased. For the remaining four months of the current fiscal year, the power and energy sectors need $5billion, which has already been communicated to the Ministry of Finance. Due to difficulties in clearing outstanding bills, loans are now being taken from multinational banks.

According to sources from the Energy Department, $200 million will be taken to purchase LNG under long-term contracts, and $50 million will be used to purchase LNG from the open market. This $250 million loan will be received in stages according to the letter of credit for LNG purchases.

The remaining $100 million will be used to pay off outstanding bills, with the World Bank acting as the guarantor and receiving a commission. Additionally, multinational banks will charge interest. The Energy Department will consider the bank proposals that offer the most favorable terms, considering both the commission and interest.

Mohammad Saiful Islam, Secretary of Energy and Mineral Resources Division stated that due to outstanding bills, good companies are reluctant to supply LNG. To meet the demand, LNG imports must be increased. Therefore, the government is taking a loan with the World Bank’s assistance.

He mentioned that by taking the loan through an open competition, the interest rate will not be high. Additionally, long-term contracts will be extended to reduce the cost of LNG purchases. Discussions are ongoing with Brunei and Saudi Aramco.

Experts say that by relying on LNG imports instead of focusing on gas exploration and production, the previous government placed the sector at risk. Taking a loan to address the immediate crisis is an easy solution, but experts believe this loan strategy will not provide a long-term solution. It will create new challenges.

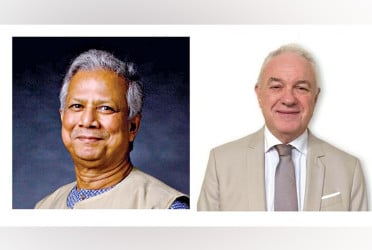

Khondaker Golam Moazzem, Research Director at the private research organization Center for Policy Dialogue (CPD), said that paying off debt with interest-based loans will not solve the problem but will instead create new debt. The process of paying bills through loans is a vicious cycle, and LNG dependence has exacerbated this cycle. In the future, securing loans may become challenging.

Bd-pratidin English/ Afia