In a significant move toward digitalization, the National Board of Revenue (NBR) has made online tax return filing mandatory for government officials in the tax zones of Dhaka, Narayanganj, and Gazipur city corporations.

The tax authority has announced that all bankers, officials from mobile network operators, and five multinational corporations including Unilever Bangladesh Ltd, British American Tobacco Bangladesh Company Ltd, Marico Bangladesh Ltd, Berger Paints Bangladesh, and Bata Shoe Company (Bangladesh) PLC, must file their returns electronically for the current assessment year.

“We want to establish a contactless NBR. Therefore, there is no alternative to digitalization in our drive toward creating a harassment-free tax environment,” said a senior official of the NBR.

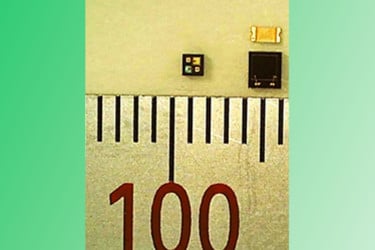

This decision comes after individual taxpayers exceeded 100,000 in filing tax returns since NBR re-launched its online portal for submissions earlier last month to enhance user experience.

Last year, the NBR received 500,000 online tax returns and aims to double that to 1 million this year.

NBR plans to bring all salaried individuals in both the public and private sectors under compulsory online return filing.

“Digitalization is essential for ensuring transparency. We are enhancing the capacity of our online system to accommodate all tax returns,” the official added.

This online platform allows taxpayers to prepare and file their income and wealth statements digitally. They can also pay taxes using cards, the internet, and mobile financial services.

Now, taxpayers can access copies of their submitted returns, acknowledgment receipts, income tax receipts, and print their Taxpayer Identification Number (TIN) online.

Bangladesh has more than one crore registered taxpayers; however, the tax administration received just 44 lakh tax returns for the 2023-24 assessment year.

Bd-pratidin English/ARK