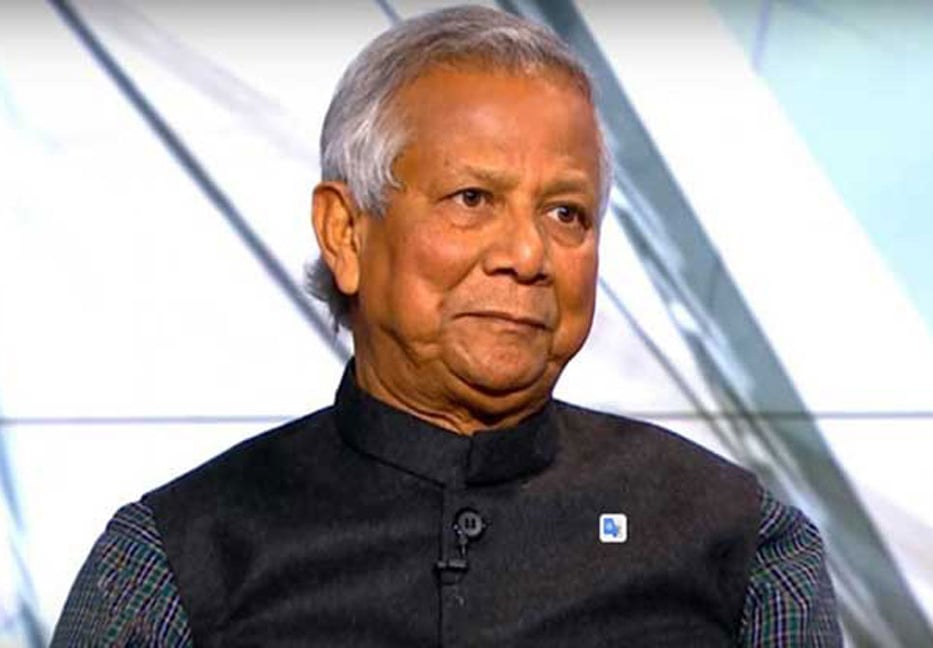

Incident of tax evasion of about Tk of thousand of crore was occurred just in Grameen Telecom, operating under Dr Yunus. Already details information was published on media over Dr Yunus’s siphoning off some thousands of crore in the name of social business from the non-profit organization Grameen Telecom. In addition, his heinous deal with the broker syndicate with a view to give bribe to some important persons of the country including Justice were aimed to take the verdict of the cases to his favor which was going on in the courts.

According to the ‘Money siphoning prevention Law,’ these acts are serious punishable crimes. Siphoning off money, corruption and other criminal activities of Dr Yunus were proved in documents. Now, his incredible crime of tax evasion has made everyone astonished. According to the vividness of tax evasion and newness of the crime, it will be signified as the biggest incident of tax evasion of the country.

In 1997, Dr Muhammad Yunus received the license of Grameen Telecom, i.e., Grameenphpone from the then Prime Minister Sheikh Hasina. Prior to taking license, he promised that he was going to take the license in order to change the fate of poor people living in the villages in the country. Besides, he made commitment that the motto of this organization would be to provide service to the poor people, not to accumulate profit. Despite his promise of taking accord to change the fate of poor people of the country, he did every possible thing to change his own fate by involving in corruption and criminal activities. Neglecting the interest of the country, he gave maximum share of Grameenphone to foreign company.

At present, Gramen Telecom is the owner of 34.20 percent of share of Grameenphone, by which Grameen Telecom receives dividend of Tk thousands of crore each year from Grameenphone. This non-profit company was formed according to section 28 of Company Law and it had no share capital and personal ownership. According to the law, there’s no chance of transferring its dividend to any person or institution. However, Dr Yunus has been siphoning off the dividend of Tk thousands of crore of Grameen Telecom after exchanging it through a few medium in the name of social business. According to the law of ‘Preventing siphoning off money’, this acts of Dr Yunus is serious and punishable crime.

Grameen Telecom has been disbursing 42.6% of its dividend income from Grameen Phone Limited to Grameen Kalyan, which is the violation of the provisions of Sections 28 and 29 of the Companies Act, 1994 even though Grameen Kalyan is not a shareholder of Grameen Phone Limited. As per law, the entire dividend income of Grameen Telecom has to be registered as its income and taxed accordingly at the applicable corporate rate for the relevant financial year. But a review of their audited accounts shows that they have paid almost half of their dividend income from Grameen Telecom to Grameen Kalyan only with Advance Income Tax (AIT) at the rate of 10-20%. But according to the law, the applicable corporate tax rate for them was from 35% to 37.5%.

The difference between this corporate rate and the dividend tax is tax evasion, because Grameen Kalyan is not entitled to receive the dividend income of Grameen Telecom as per existing law. If we add all the taxes that Grameen Telecom has evaded since its inception, it amounts to about Tk one thousand crore. This tax evasion account is only of Grameen Telecom. Other companies and institutions controlled by Dr. Yunus and his personal income tax have also been subject to widespread tax evasion over the years as a matter of course. If you calculate the tax evasion cases of other organizations controlled by Yunus, the amount will be huge.

During the 26 years of operation of Grameen Telecom, about one thousand crores of tax was evaded. In this long time, Dr. Yunus has been evading 15 to 25 percent of taxes every year. From 1997 to 2005 every year in Grameen Telecom, Yunus evaded 25% tax. At that time the tax was 35%, but only 10% paid. From 2006 to 2008 in this institution, Dr. Yunus evaded tax at 20% per annum. At that time the tax was 35%, but only 15% paid. From 2009 to 2022 15% tax evasion occurred every year in Grameen Telecom controlled by Dr. Yunus. At that time the tax was 35%, but only 20% paid.

It is worth noting, Dr. Yunus has filed several cases and writ petitions in the country's courts to cover up his tax evasion issues. The purpose of all these cases and writs is to tax evasion. Dr. Yunus's tax evasion has been documented in every tax related case. In the investigation conducted by the relevant state and regulatory authorities regarding the tax evasion of Dr. Yunus, it has been proved beyond doubt that Dr. Yunus himself and the entities he controls are involved in tax evasion under his direction.

Bd-pratidin English/Lutful Hoque