Bangladesh Bank Governor Dr Ahsan H Mansur has said several banks, which were on the brink of bankruptcy, are now making significant strides in recovery due to strengthened regulatory measures and improved management practices, reports UNB.

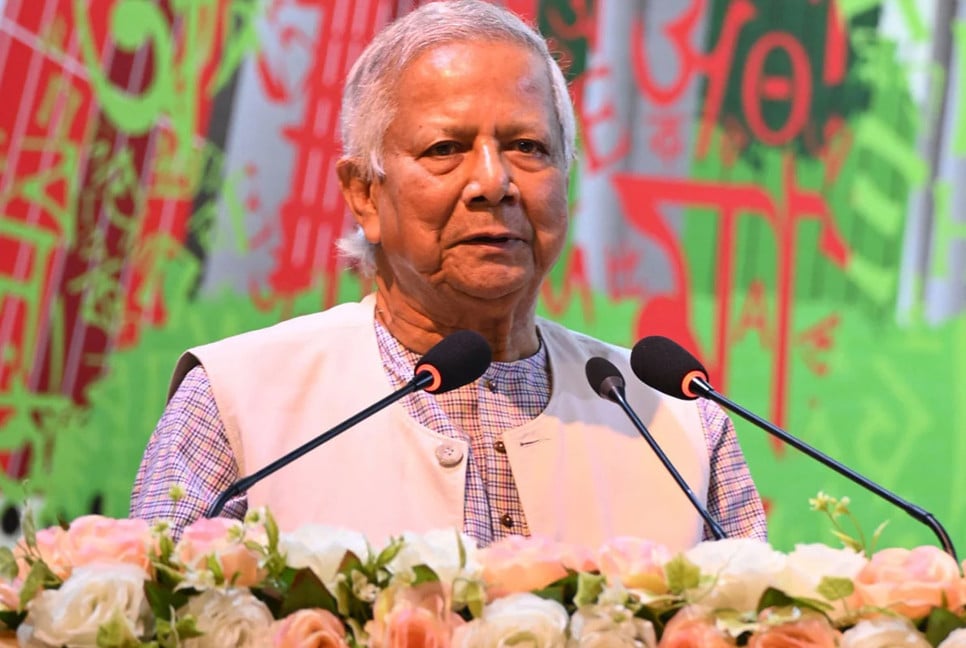

“Banks are not private or family entities; they belong to everyone. Depositors are the true owners of banks. Among the 10 banks that were on the brink of bankruptcy, many have managed to bounce back,” Dr Mansur said while speaking at the inauguration of Islami Bank Bangladesh PLC’s 400th branch in Ghatail, Tangail, on Saturday.

The Governor also addressed issues of money laundering, assuring that efforts are underway to retrieve assets from those who have fled abroad with illicit funds.

About inflation, Dr Mansur said, “Inflation remains high, but we are working to bring it down. By June next year, we aim to stabilise the rate to a more acceptable level.”

Islami Bank

Praising Islami Bank’s achievements, Dr Mansur said, “Islami Bank is the leading bank in the country. It holds the trust of millions, and its progress is vital for the nation’s economy. Within the last five months, Islami Bank has substantially improved its position, attracting Tk 7,000 crore in new deposits and maintaining its top position in remittance collection. This bank will not look back.”

The Governor expressed optimism about reinstating foreign investors, emphasising that Islami Bank has the potential to grow tenfold and reclaim its status as an international institution.

The inauguration ceremony, presided over by Islami Bank Chairman Obaid Ullah Al Masud, highlighted the bank’s expansive network, with 400 branches, 265 sub-branches, over 2,800 agent outlets, and more than 3,000 ATMs and CRM machines across the country.

Islami Bank Bangladesh PLC continues to set a benchmark in the banking sector, driving rural and urban economic growth while upholding its commitment to Shariah-based and welfare-oriented banking.

Bd-Pratidin English/ Afsar Munna