With Eid approaching, business owners find themselves under immense financial pressure, struggling to balance wages and bonuses amid declining economic conditions. Factory owners, particularly in the garment industry, are finding it increasingly difficult to manage wage payments for February and March, alongside Eid bonuses. The Ministry of Labor and Employment and the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) estimate that 50-60 factories are struggling with payments. Labor leaders, aware of the situation, remain firm in their demand for timely disbursements, pushing for full salary payments by the 20th of Ramadan and bonuses by the 25th.

Despite knowing the economic reality, labor leaders argue that factory owners use the festive season to extract additional government support while holding workers hostage. Many factories have already shut down due to political uncertainties, and production levels have dropped significantly. However, from the workers’ perspective, these financial challenges are irrelevant—wages and bonuses must be paid, no matter the circumstances.

In garment, construction, and other industries, owners are struggling to manage costs. Protests are escalating in industrial zones such as Gazipur, Savar, and Ashulia, where workers are demanding their rightful dues. Road blockades and work stoppages have become common, creating disruptions not only for businesses but also for the general public. Law enforcement agencies are attempting to mediate, ensuring that protests do not escalate into violence. The government is cautious, not wanting any unrest before Eid.

Business owners have sought government intervention, requesting financial assistance to manage the burden. However, despite their appeals, the government has remained largely silent. Many industries continue to suffer due to reduced orders and rising costs. Although the ready-made garment sector has seen some relief in export orders, many factories are struggling with cash flow problems, exacerbated by increased costs of raw materials and fuel shortages.

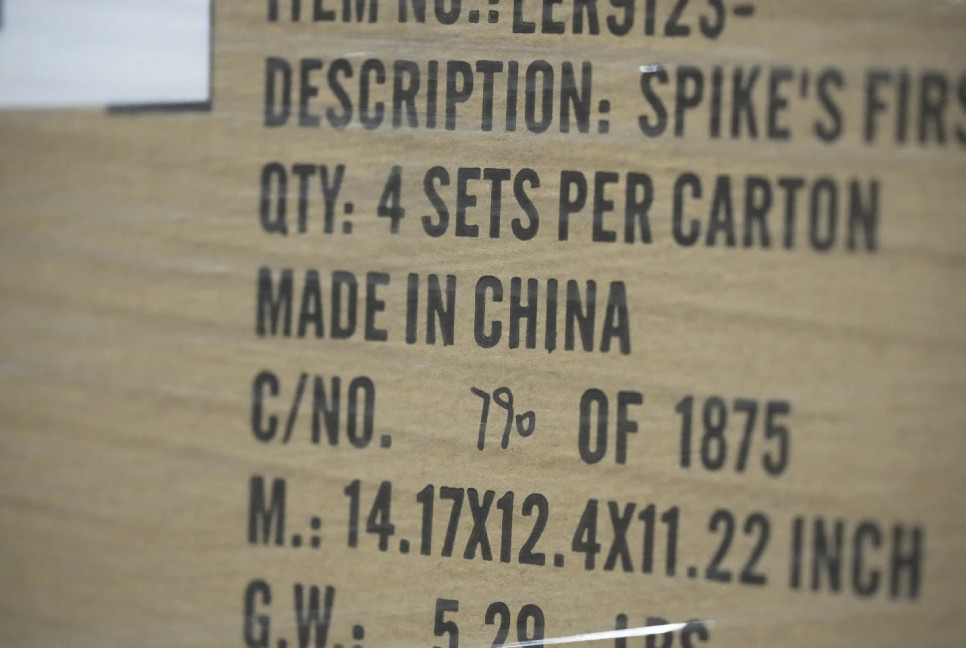

One of the most pressing issues is the energy crisis. Gas shortages continue to hinder production, with factory owners forced to pay up to Tk 30 per unit for uninterrupted supply. The lack of stable gas supply means that textile dyeing processes are suffering, causing bottlenecks across the garment industry. Many workers in dyeing, knitting, and printing sections are left idle, receiving salaries despite being unable to complete orders. Additionally, India’s aggressive yarn exports, backed by a 13-15% government incentive, have led to dumping in the Bangladesh market. Local yarn manufacturers are struggling to compete, leaving nearly $1.5 billion worth of products unsold ahead of Eid.

The jute sector is in an even worse condition. Around 200,000 workers are not receiving regular wages, further worsening the economic strain. Business leaders argue that sustaining the economy requires not just growth but also stability and protection for existing investments. If current investments remain under threat, there will be little incentive for new investors to step in.

Economic challenges are mounting across industries. Small and medium businesses reliant on bank loans are particularly affected, with high interest rates, unstable foreign exchange rates, and heavy taxation creating additional hurdles. The business community has long demanded lower loan interest rates, stable dollar pricing, and tax relief to regain financial stability. Yet, uninterrupted gas and electricity supply remains a distant hope, further increasing operational costs and reducing competitiveness in global markets.

Opening Letters of Credit (LCs) has also become a significant challenge. Many banks are reluctant to facilitate imports, creating further constraints on supply chains. Restrictions on setting up business offices abroad are another issue, as existing policies make international expansion more difficult. Business leaders urge the government to ease these policies, which would help increase investment and trade. They also stress the need for greater accountability and transparency within the financial sector, particularly within the central bank.

During a recent meeting with the National Board of Revenue (NBR) chairman Abdur Rahman, representatives from the textile, garment, and plastic industries raised concerns over VAT, import duties, and customs complications. They called for tax reductions and an end to bureaucratic harassment, particularly at customs. The NBR chairman acknowledged the challenges, stating that eliminating corruption within the system would not be easy. He advised business owners to resist bribery demands from officials but placed the burden on them to report any wrongdoing.

However, business leaders argue that their role is to invest and create jobs, not to police government institutions. They seek stability and assurance that their investments will be protected. Without a business-friendly environment, economic recovery will remain out of reach.

The ongoing economic uncertainty has direct political implications. A struggling economy weakens democracy, just as a weakened democracy disrupts economic stability. Without financial stability, political stability remains fragile. The interim government faces mounting challenges, including a weak financial sector, external debt obligations, and a revenue shortfall of Tk 1.5 lakh crore. Geopolitical instability and Bangladesh’s positioning in global trade further complicate matters.

As businesses struggle to cope with financial pressures, concerns grow over the country’s long-term economic prospects. The combination of rising costs, policy uncertainty, and declining investor confidence risks flattening the economy further. Without immediate intervention, both businesses and workers face an uncertain future post-Eid.

Author: Journalist-Columnist