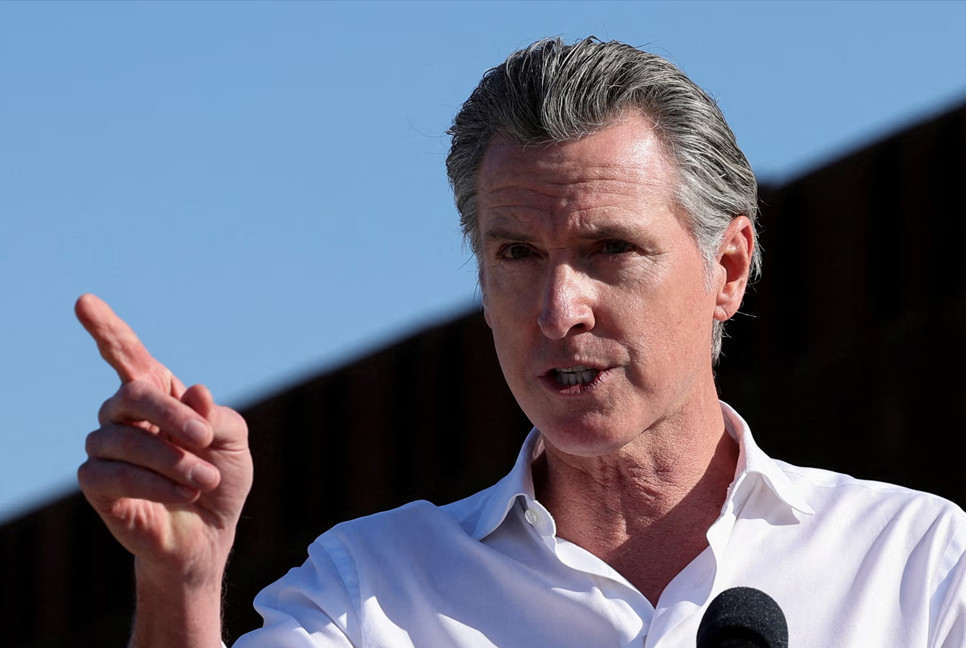

Md Abdur Rahman Khan, chairman of National Board of Revenue (NBR), on Tuesday said the government will gradually reduce tax exemptions and may eventually abolish the system.

He made the statement while speaking at a pre-budget meeting at the NBR conference room. He said: “We do not want to incur further tax expenditures. It is time to move away from the culture of tax exemptions.”

Representatives from the Institute of Cost and Management Accountants of Bangladesh (ICMAB), Institute of Chartered Accountants of Bangladesh (ICAB), Institute of Chartered Secretaries of Bangladesh (ICSB), Bangladesh Tax Lawyers’ Association (BTLA), Bangladesh VAT Professional Forum, and the Retired Tax Officers Welfare Association attended the meeting.

He urged all stakeholders to refrain from advocating for tax exemptions.

“Income tax is applicable when there is a profit. No one goes bankrupt by paying income tax, as it is just a portion of their earnings,” he said.

The NBR chief criticized the mindset of seeking tax exemptions before starting a business, emphasizing that investment decisions should be based on economic viability, geographical advantages, and potential returns rather than tax relief.

“There is no reason to fear income tax. The perception that industries should only be established if tax exemptions are granted is incorrect. The key factor should be whether the investment yields reasonable returns,” he added.

Regarding foreign-funded government projects, Abdur Rahman Khan said structural changes in agreements are necessary to ensure tax collection.

“If changes are not made, we will continue missing out on tax revenues,” he said, adding that contracts should explicitly mention that tax payments are the responsibility of the contractor.

He stressed the need for careful vetting of agreements to prevent tax evasion.

“A significant amount of tax evasion is happening in this sector, and a broad discussion is needed to address the issue,” he said.

Bd-Pratidin English/ AM