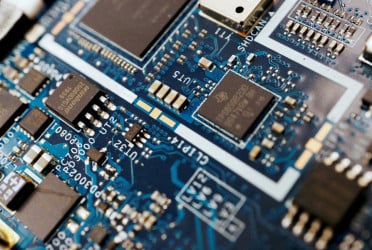

China's semiconductor sector is bracing for another four years of tension under Donald Trump's presidency. To navigate this challenging period, the industry is increasing its procurement of foreign chipmaking equipment, while actively seeking opportunities to recruit international talent and build new strategic partnerships.

One of the strategies being explored includes strengthening relationships with countries and companies that may be sidelined by the policies of the incoming U.S. president. Additionally, there is a renewed focus on achieving greater self-sufficiency. This insight comes from a review of over 30 articles and research reports published by Chinese chip firms, industry associations, and analysts following Trump's election victory.

During his first term, Donald Trump targeted major Chinese telecom companies like Huawei and ZTE, as well as chipmaker SMIC, by placing them on trade blacklists that restricted their access to essential U.S. hardware and software. In contrast, the Biden administration has adopted a broader approach, implementing extensive export controls aimed at cutting off China’s access to the most advanced chips produced by American companies.

Zhu Jing, deputy secretary-general of the Beijing Semiconductor Industry Association, called on Chinese chip companies Thursday to strengthen their international operations and expand into additional markets. He suggested that if global coordination among the U.S., Japan, and Europe to enforce sanctions against China weakens under Trump, there may be opportunities to resume certain chip imports.

In an article published on WeChat, Zhu Jing emphasized that companies should also intensify efforts to attract international talent. He warned that if the Trump administration revisits its previous stance and enacts policies that restrict Chinese students and professionals from working in the U.S., Chinese firms will need to adjust by hiring more overseas expertise.

"Trump's first term made us realize the importance of semiconductors and the necessity of localization, paving the way for China's semiconductor industry to become self-reliant," stated Jinan Lujing Semiconductor Co., a manufacturer of security chips and power devices, on its WeChat account.

The industry had braced for continued tensions with the U.S., regardless of whether Trump or his opponent Kamala Harris won the election. However, some had anticipated that the sector would face more enduring challenges under Harris’s leadership.

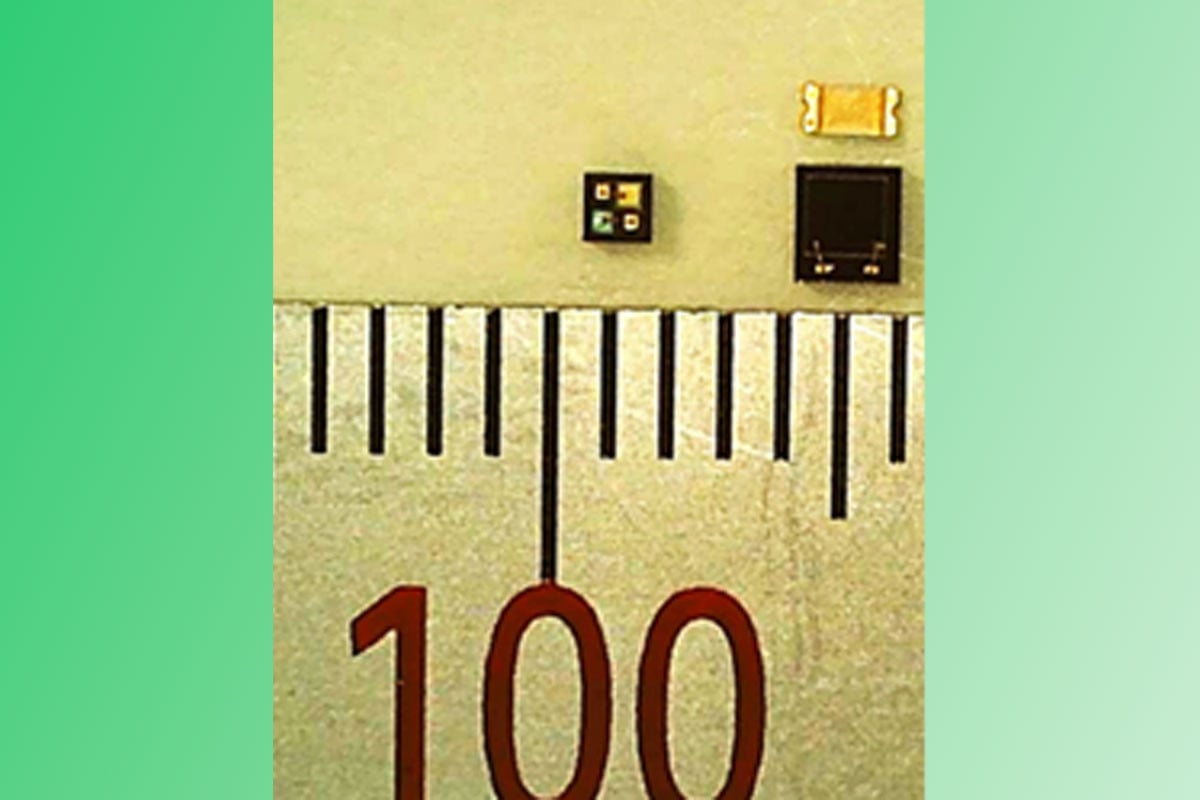

Better Equipped

China has significantly increased its imports of semiconductor equipment, with purchases rising by a third to $24.12 billion in the first nine months of this year, according to China Customs data. Of this total, $7.9 billion was spent on lithography machines essential for producing the most advanced chips, marking a 35.44% year-over-year increase. Most of these lithography machines, valued at $7 billion, were sourced from the Netherlands. However, ASML Holding (ASML.AS) halted shipments of its cutting-edge deep ultraviolet (DUV) machines to China this year, following new rules introduced by the Biden administration. The company has also been unable to deliver its extreme ultraviolet (EUV) machines to China since 2019.

Two industry sources told Reuters that Chinese companies had been aggressively ordering semiconductor equipment to shield themselves from potential fallout from the U.S. election. Due to the sensitive nature of the issue, the sources requested anonymity.

“Chinese tech companies, having been impacted by tariffs during the first Trump administration, have progressively expanded their production capacities to mitigate future risks,” said Nori Chiou, investment director at Singapore-based White Oak Capital Partners. “They are more prepared this time and feel more ready than with the 2018 trade war and the 2020 election.”,he added.

(Source: Reuters)

BD-Pratidin English/Mazdud