Hong Kong and Singapore are at the forefront of Asia’s push to become cryptocurrency hubs, capitalising on a global resurgence in the sector, fueled in part by support from US presidential frontrunner Donald Trump.

Bitcoin recently surged to nearly $110,000, with other cryptocurrencies also rallying on Trump’s pro-crypto stance. With forecasts pointing to further gains, governments are eager to position themselves as key players in the market.

Hong Kong regulators said Wednesday that the city must tap into “global liquidity” and outlined plans to expand crypto offerings, including derivative trading and margin financing. “The one word we must always consider is liquidity,” said Eric Yip, executive director at the Securities and Futures Commission (SFC), speaking at an industry conference in the city.

“How do you bring liquidity to this market—hence commercial value, hence ecosystem?” Yip asked.

The collapse of FTX in 2022 wiped out around $8 billion in customer funds, later recovered, but the episode led regulators worldwide to push for stricter oversight. While crypto has moved away from its freewheeling, anti-establishment roots, officials now seek a balance between investor protection and business-friendly policies.

“There was much more scrutiny two or three years ago, right after FTX,” said Hong Fang, president of crypto exchange OKX. “Regulators want to ensure proper due diligence.”

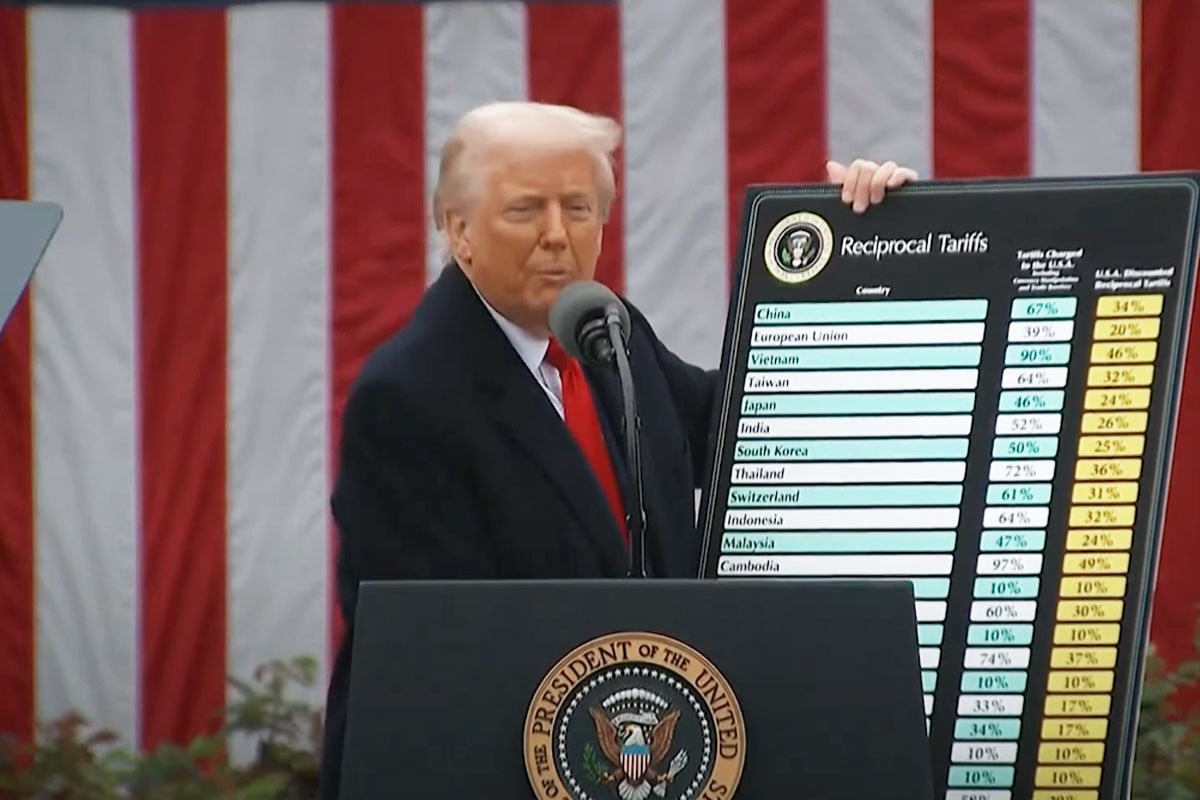

Governments across Asia are reassessing their approach. Malaysia and Thailand are exploring policy shifts, while Japan, South Korea, and Cambodia have taken gradual steps. However, Hong Kong and Singapore—along with Dubai—have solidified their leadership, particularly during a period when US regulators under President Joe Biden took a sceptical stance on crypto.

Trump’s recent executive order pledged to make the US the “crypto capital of the planet” by providing “regulatory clarity and certainty” to support blockchain and digital asset innovation. Animoca Brands’ group president Evan Auyang called this shift a “game changer” that will influence regulators worldwide.

Singapore’s Monetary Authority has already granted “Major Payment Institution” licences for digital payment tokens to 30 companies, including OKX. The city-state has led in regulating digital assets, launching initiatives such as Project Guardian in 2022, which brought together regulators and global banks to explore asset tokenisation.

“Singapore engaged early with central banks, regulatory bodies, and international standards-setting institutions,” said Leong Sing Chiong from the Monetary Authority of Singapore.

Hong Kong, meanwhile, has taken a different route, granting “Virtual Asset Trading Platform” licences to 10 companies. The city is “number two... behind Singapore” in crypto regulation, Auyang said. Despite fewer exchanges, Hong Kong saw a surge in trading activity last year. In the first half of 2024, its centralised exchanges received $26.6 billion—almost triple the previous year’s total and nearly double Singapore’s $13.5 billion.

Hong Kong overhauled its legal framework for crypto exchanges in mid-2023, placing the SFC in charge of vetting and licensing. While China banned crypto in 2021, exchanges in Hong Kong are prohibited from serving mainland clients. Yet, Animoca’s executive chairperson Yat Siu said the city’s pro-crypto policies have Beijing’s “blessing” and benefit from Hong Kong’s role as China’s financial gateway.

Beyond exchanges, Hong Kong’s regulators plan to expand oversight to areas such as custody services, staking, and over-the-counter trading. “Hong Kong isn’t sitting back and saying, ‘Look at the US, we’ll just wait and see,’” Siu said. “It actually spurs it more into action.”

However, implementing these policies has proven complex. “Anybody applying for an exchange licence must commit to a rigorous governance regime,” said Hong Kong regulatory lawyer Jonathan Crompton. “It’s not for the faint-hearted.”

Over the past two years, firms have struggled to recruit specialised compliance staff, and the SFC’s vetting team remains understaffed. The regulator’s website lists eight pending licence applications, while 13 companies have withdrawn.

“The SFC has been stuck between a rock and a hard place,” Crompton told AFP. “Some complain that regulation is too slow, while others say it doesn’t provide enough protection.”

Source: AFP/The Sun (MY)

Bd-pratidin English/ Jisan