Food inflation fell to a 21-month low in February, providing a glimmer of hope for struggling consumers.

Moreover, overall inflation has also dropped compared to the previous month, according to a recent update by the Bangladesh Bureau of Statistics (BBS).

Apparently, the interim government's measures for regulating the market, easing import duties for essentials, and raising interest rates to curb inflation have been effective, said experts and economists.

However, many people are still struggling with an exorbitant cost of living stemming from a high non-food inflation rate and wage stagnation.

According to BBS, the food inflation rate in February was 9.24%, a significant drop from the previous month's 10.72%. The last time food inflation was below 10% was in March 2024.

The lowest food inflation rate was 8.84% in April 2023.

The overall inflation in the country also dropped to 9.32% in February from 9.94% in January. However, it is still way higher than the comfort level of most people, said experts.

This reduction in inflation marks the second time in four months that inflation has returned to single-digit levels, an encouraging trend for a population that has faced months of mounting financial pressure.

Food prices and economic recovery

According to experts, the recent decline in food inflation can be attributed to several factors, including the seasonal reduction in prices of winter vegetables and a stable rice market. These items, which make up a significant portion of the food basket, have seen price corrections in recent weeks, offering a respite to consumers.

Additionally, government interventions in regulating the market and easing import duties on essential commodities such as oil, onions, and eggs have helped stabilize prices.

Dr. Zahid Hussain, former lead economist at the World Bank's Dhaka Office, noted, "The drop in food inflation is certainly a relief, but non-food inflation has slightly risen. Despite the reduction in food inflation, the overall situation remains challenging for many."

Non-food inflation increased to 9.38% in February, up from 9.32% in January. This indicates that while food costs are easing, other expenses, such as housing, transportation, and healthcare, are still placing pressure on households.

The impact of inflation is not just a statistic but a reality for millions of Bangladeshis. For example, in February 2024, a family spending Tk100 on goods and services would need Tk109.32 to buy the same items a year later due to inflation. This means a significant rise in the cost of living, with people having to adjust their budgets, cut back on non-essential purchases, and, in many cases, take on debt to make ends meet.

Inflation and wage disparity

One of the primary concerns surrounding the inflation situation in Bangladesh is the gap between wage growth and the inflation rate. In the first two months of 2025, the average inflation rate was 9.63%, while wage growth during the same period was 8.10%.

In 2024, inflation averaged 10.33%, significantly higher than the wage growth of 7.94%. Over the past three years, inflation has consistently outpaced wage increases, leading to a reduction in the purchasing power of the average citizen.

In 2023, for instance, the inflation rate was 9.55%, while wages increased by just 7.43%. This growing disparity between wages and inflation has resulted in a real decline in household income, particularly for low-income families who are already living paycheck to paycheck.

The situation worsened in 2024 when food inflation alone reached 14.10%, a staggering 16-year high. This pushed many households into a financial crunch, especially for those whose wages have remained stagnant or have not kept pace with the rising cost of essential goods.

Government's role and response

The Bangladesh government has taken a series of steps to control inflation, including raising interest rates to curb excessive demand and stabilizing the currency. The National Board of Revenue (NBR) has also reduced taxes on key goods like oil and essential vegetables, aiming to ease the pressure on consumers.

Despite these measures, challenges remain. The inconsistency in government policy, with abrupt changes in VAT rates and other fiscal policies, has caused uncertainty in the market. Experts suggest that a more consistent and long-term policy approach is necessary to bring inflation under control.

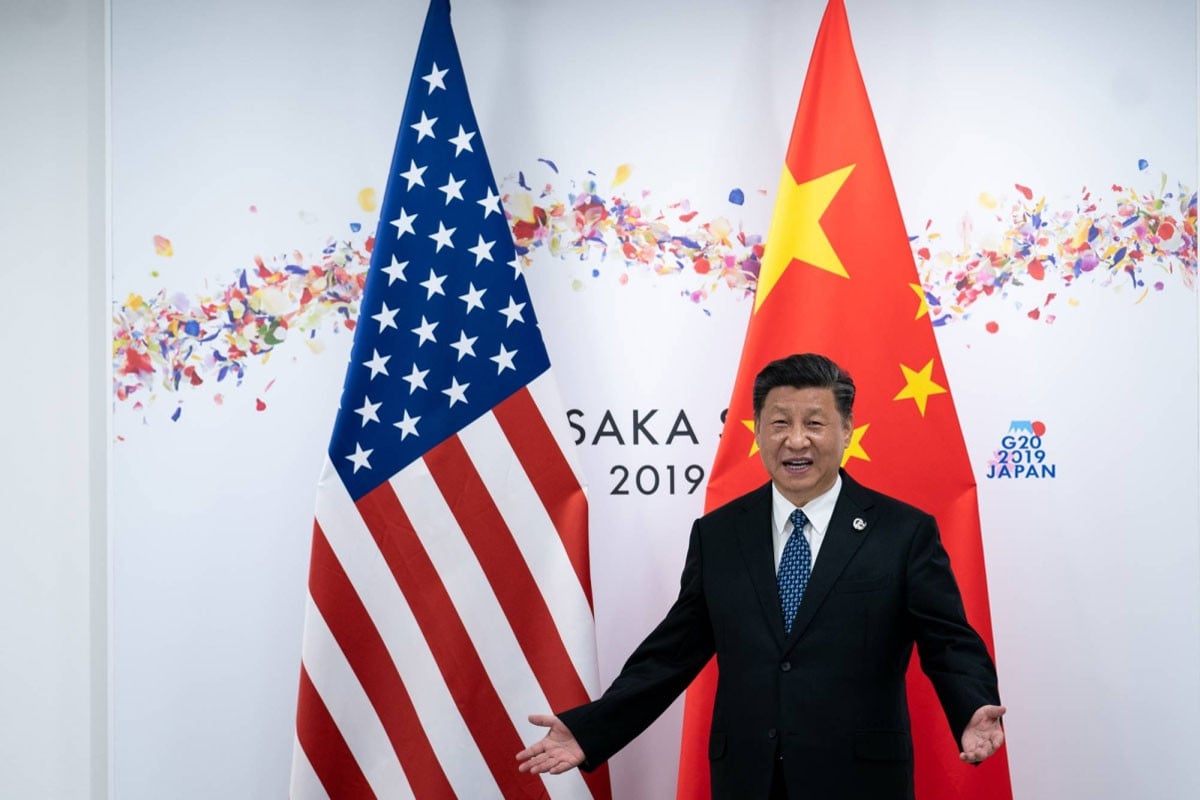

Zahid Hussain said, "While the government's efforts are commendable, there is a need for continuity in policy. Frequent changes, such as VAT hikes followed by cuts under public pressure, create confusion and prevent the market from stabilizing effectively."

Outlook for the future

As the country observes the month of Ramadan, the government has pledged further efforts to stabilize prices, especially of essential commodities. Finance Adviser Salehuddin Ahmed recently stated that it would take another two to three months for inflation to decrease significantly, with the expectation of an average inflation rate of 6%-7% by June.

The path to stabilizing inflation, however, is fraught with challenges. A continued global economic slowdown, rising fuel prices, and climate-related disruptions could all affect the prices of essential goods in the coming months. For now, the government remains focused on mitigating the effects of food price hikes, but structural reforms may be necessary to address the underlying issues of inflation.

The impact of inflation on low-income families

Shaila (45), a single mother living in a rural area, works as a schoolteacher and earns Tk20,000 a month. The food inflation rate hovering above 9% has affected her purchasing power severely. For example, before food inflation reached double digits, she typically spent Tk8,000 on groceries each month. Due to rising food prices, she has recently been spending an additional Tk800 to buy the same items.

Shaila also has two children, both of whom are in school. As education costs rise, she struggles to afford basic supplies for them. Previously, she could send them for extra tuition classes, but now, she is forced to cut back on such expenses. To make ends meet, she has reduced her family's travel expenses and has limited entertainment, often choosing to stay at home rather than engage in recreational activities.

Shaila's case is just one example of how inflation can squeeze the lives of ordinary people, especially those in lower-income brackets. For Shaila and many like her, inflation is not just an economic term but a daily struggle that affects her ability to provide for her children's future.

While food inflation has eased slightly, Bangladesh continues to face significant challenges with inflation. The reduction in food prices has offered some relief, but the rising non-food inflation, along with wage stagnation, presents a persistent problem. In the coming months, the government's measures to stabilize prices will be closely watched, as the real test will be in their long-term sustainability and their ability to address the broader issues that contribute to rising costs of living.

Finance Advisor Dr. Salehuddin Ahmed has highlighted the pressing need for new employment opportunities in Bangladesh, acknowledging the challenges posed by reduced income and economic disruptions. While he reassured the public that the overall economy is not in crisis, his emphasis on revitalizing business activities and stimulating growth in the SME sector shows a focused approach towards long-term economic stability. Dr. Ahmed's commitment to addressing unemployment through government initiatives reflects a positive direction, but the real test will lie in the implementation of these strategies and their ability to foster sustainable job creation.

Bd-pratidin English/ Jisan